Pressure on the South African government of President Cyril Ramaphosa is mounting to push through necessary long-term reforms. Confirmed Covid-19 infections will pass the 600,000 level this week, keeping Africa’s most industrialized nation at the number five spot globally. Three government departments signed a memorandum of understanding (MOU) to launch a planned R100 billion infrastructure fund, intended to become a pillar of job creation and economic growth through centralizing essential projects and approving them swiftly. Dominant bearish pressures in the USD/ZAR suggest a breakdown extension.

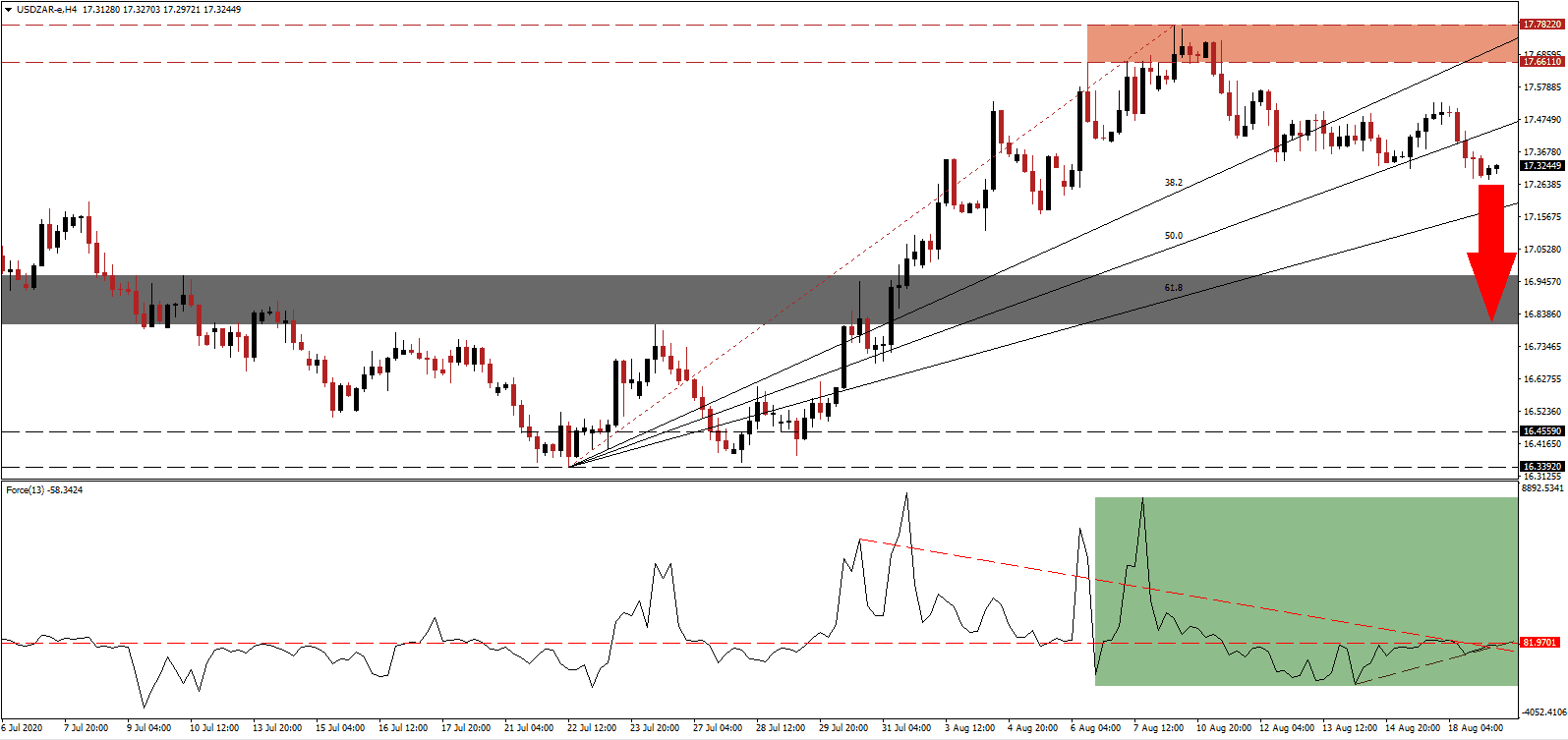

The Force Index, a next-generation technical indicator, maintains its position below its horizontal resistance level but inched above its descending resistance level, as marked by the green rectangle. A higher low resulted in an adjustment to the ascending support level, but downside pressures are intact, favored pushing this technical indicator into a reversal. Bears are in partial control of the USD/ZAR, awaiting a renewed contraction.

A recent survey conducted by PayCurve revealed the struggles of salaried employees across South Africa. Many seek secondary jobs, and almost 80% resort to expensive short-term loans to cover expenses. The bulk of respondents confirming financial difficulties were between 36 and 45 of age. A consumer debt cycle will reduce the spending power and add to a challenging recovery. The USD/ZAR, driven lower by US Dollar weakness, is well-positioned to extend its correction following the collapse below its resistance zone located between 17.6611 and 17.7822, as marked by the red rectangle.

South African banks are entering uncertain times, paving the rise for FinTech companies and micro-lending firms, better suited to the needs of South African consumers and small-to-medium sized enterprises (SMEs). The Covid-19 pandemic is forcing long-term changes, potentially ensuring a more efficient and modern economy moving forward, after a painful adjustment cycle. The breakdown in the USD/ZAR below its ascending 50.0 Fibonacci Retracement Fan Support Level, converting it into resistance, is favored to pressure price action into its short-term support zone located between 16.8051 and 16.9643, as identified by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 17.3250

Take Profit @ 16.8050

Stop Loss @ 17.4950

Downside Potential: 5,200 pips

Upside Risk: 1,700 pips

Risk/Reward Ratio: 3.06

Should the ascending support level inspire more upside in the Force Index, the USD/ZAR could attempt a brief reversal. Forex traders are recommended to sell any rallies due to the worsening outlook for the US economy. Retailers reported a drop in spending as the $600 per week government subsidy for the unemployed expired, adding to bearish progress. The upside potential remains limited to its present resistance zone.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 17.5700

Take Profit @ 17.6800

Stop Loss @ 17.4950

Upside Potential: 1,100 pips

Downside Risk: 750 pips

Risk/Reward Ratio: 1.47