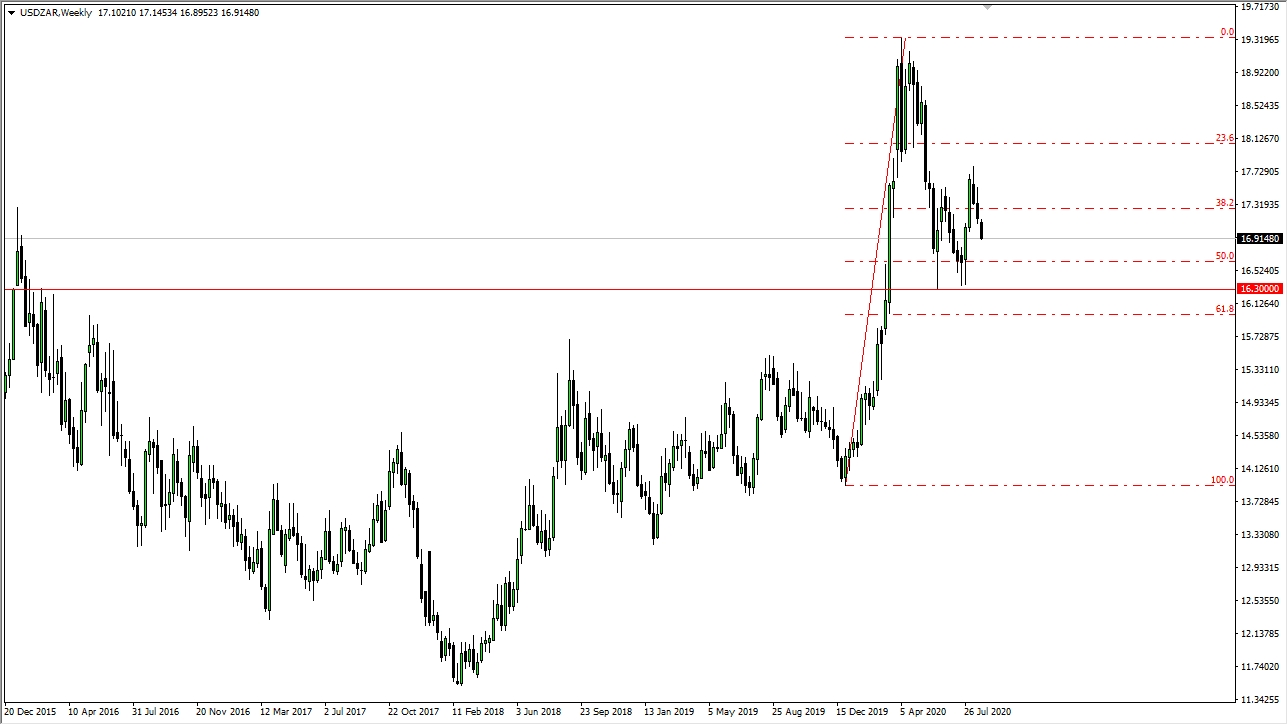

This is an interesting currency pair because we have a clear support level underneath that seems to be destined to be tested rather quickly. At this point, it looks like the 17.60 level continues offer significant resistance, while the 16.30 level will offer support. I believe that support also comes into play due to not only the last couple of candlestick there, but the 61.8% Fibonacci retracement level is shortly underneath there as well.

That being said, this is all about the US dollar and the emerging markets. The South African Rand is a proxy currency for risk appetite, so if overall risk appetite continues to get better, then this pair will not only reach down towards the 16.30 Rand level but will also break down further than that. Rallies at this point are to be sold, and I do not think that we will break above the 17.75 Rand level, but if we do then it is something to pay attention to. This is probably more or less going to be due to some type of major “risk off” type of scenario.

The South African Rand will more than likely move along with other emerging market currencies such as the Brazilian real, Indian rupee, and Pakistani rupee. It is only a matter of time before we see some type of bigger move, but right now I would not be surprised at all to see this market go back and forth between these two major levels, due to the fact that there are a lot of moving pieces. It is obvious that the 16.30 Rand level is an area of major support, so if it gets broken, that means that something good has happened.

At this point, we are paying attention to coronavirus figures around the world, and of course how the emerging markets are going dealing with that. Beyond that, consumption in the United States needs to pick up an order for emerging markets do better, as a lot of the imports come from emerging markets. Something that is worth paying attention to, albeit from a minor standpoint, is the fact that the South African Rand sometimes will move with gold, as South Africa exports so much of the metal. In general, I think we have a very choppy month ahead of us, but I suspect we are more than likely going to see a breakout to the downside if we see when it all.