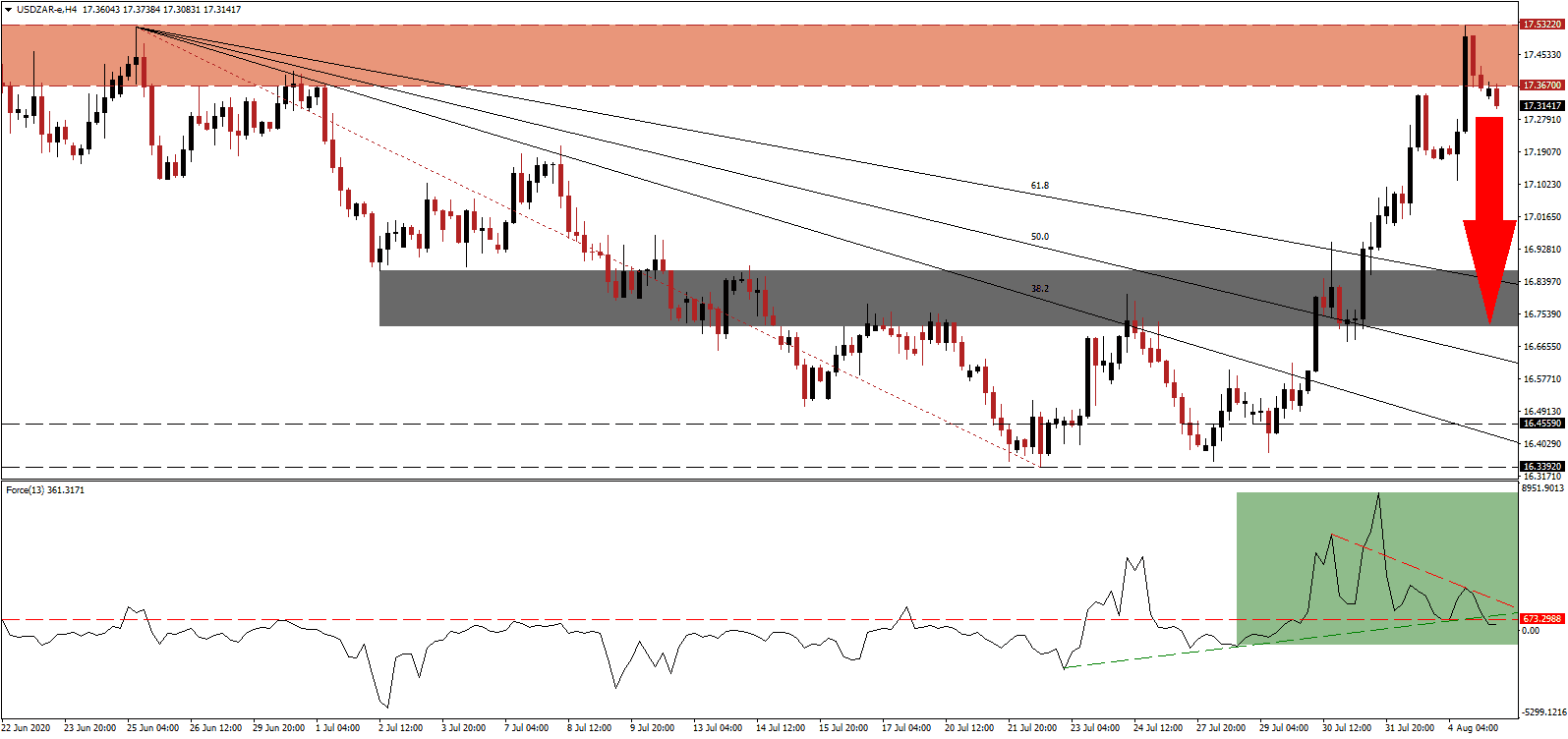

Lesetja Kganyago, the Governor of the South African Reserve Bank (SARB), reiterated the central bank would avoid monetary policies that failed throughout history. Calls to implement an aggressive quantitative easing program to support the Covid-19 struck economy increased, which are favored by developed economies and destroy the financial system over the long-term. South Africa is under a growing debt issue, especially after the $4.3 billion IMF loan. SARB did cut its benchmark interest rate, eased accounting and capital rules, and spiked its government debt purchased by 300%. The USD/ZAR embarked on a powerful breakout, but after reaching its resistance zone, bullish momentum collapsed.

The Force Index, a next-generation technical indicator, spiked together with price action but swiftly retreated while this currency pair pushed higher. A negative divergence formed suggesting a price action reversal is imminent. The descending resistance level pressured this technical indicator below its horizontal resistance level, as marked by the green rectangle. Bears, following the breakdown below its ascending support level, wait for a move into negative territory to regain complete control over the USD/ZAR.

A new analysis released by the Organisation for Economic Co-operation and Development (OECD) highlighted the present recession follows a decade of modest growth. The economy contracted for three-quarters before the Covid-19 related lockdown. The OECD forecasts a 2020 GDP contraction between 7.5% and 8.2%, followed by an expansion between 0.6% and 2.5% in 2020. After the USD/ZAR completed a breakdown below its resistance zone located between 17.3670 and 17.5322, as identified by the red rectangle, bearish pressures started to accumulate, while US Dollar weakness is on the rise.

South Africa faces a growing problem with government-sector wages, which continue to increase. The government suggested to index wages below inflation for three-years to counter inflationary pressures. One of the most pressing issues remains the energy infrastructure, blamed for the recession before the Covid-19 outbreak. Progress is being made, and SARB, for now, stays clear of long-term destructive monetary policy as practiced by the US Federal Reserve. The USD/ZAR is well-positioned to collapse into its short-term support zone located between 16.7183 and 16.8689, as marked by the grey rectangle. From there, the descending Fibonacci Retracement Fan sequence can guide price action farther to the downside. The next support zone awaits between 16.3392 and 16.4559.

USD/ZAR Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 17.3150

Take Profit @ 16.7150

Stop Loss @ 16.5150

Downside Potential: 6,000 pips

Upside Risk: 2,000 pips

Risk/Reward Ratio: 3.00

A breakout in the Force Index above its descending resistance level could lead to a second push higher. Given the deteriorating outlook for the US Dollar, driven by debt and a depressed labor market, the upside potential is limited to its next resistance zone between 17.8759 and 18.0115. Forex should consider any push higher from current levels as an excellent selling opportunity.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 17.6650

Take Profit @ 17.9650

Stop Loss @ 17.5150

Upside Potential: 3,000 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 2.00