South Africa continues to experience a gradual decrease in new daily Covid-19 infections, but the condition is far from positive. Over 600,000 cases with more than 13,000 casualties confirm dire statistics despite the best attempts to contain the pandemic. The economy was in a recession before the outbreak, financial resources depressed, the health system fragile, and politics mostly dysfunctional. President Cyril Ramaphosa accepted a controversial loan from the International Monetary Fund (IMF), which may have marked the low-point of the crisis for Africa’s most industrialized nation. More downside is expected in the USD/ZAR following a new double breakdown.

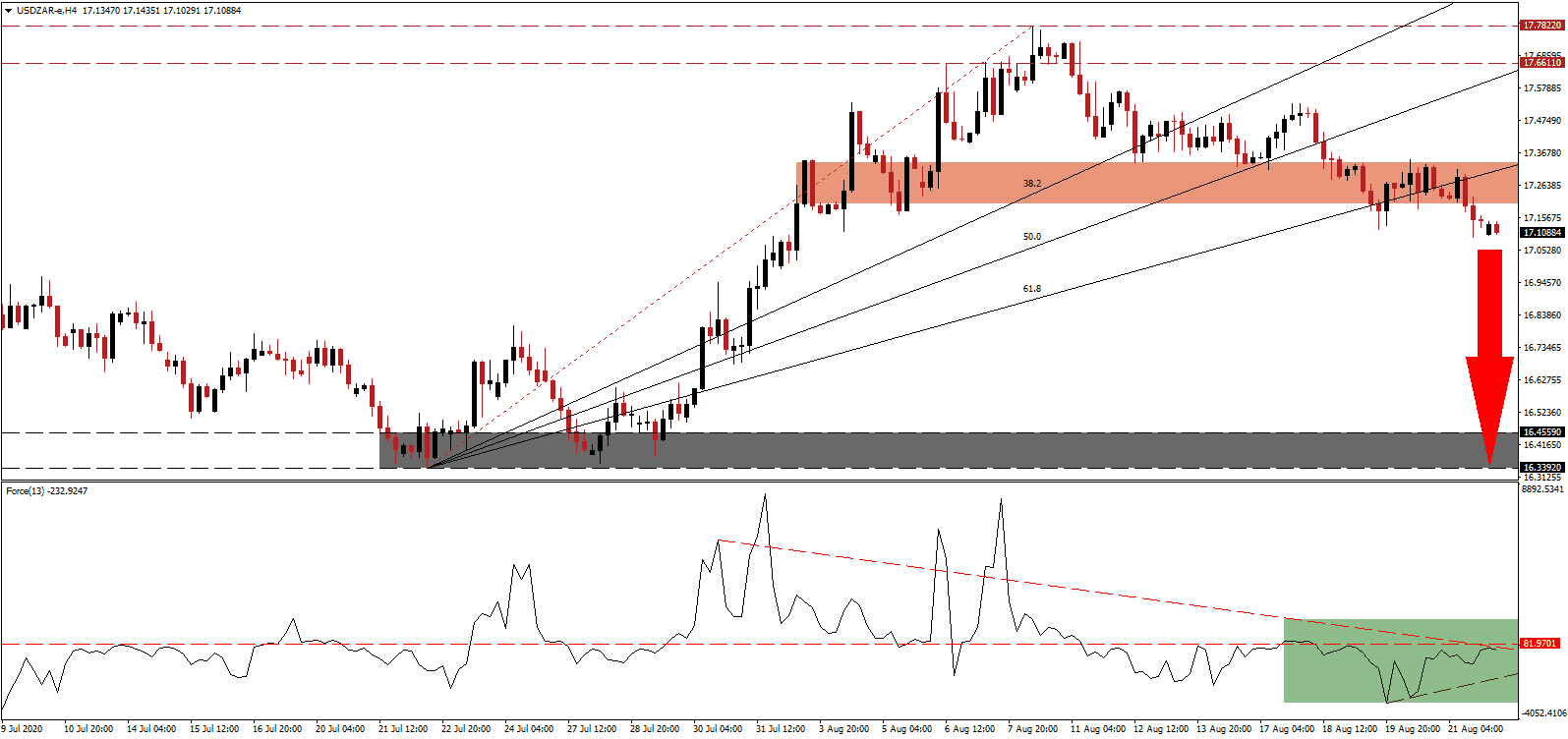

The Force Index, a next-generation technical indicator, recovered from its multi-week low but below its horizontal resistance level. Adding to downside momentum is its descending resistance level, as marked by the green rectangle. It is favored to pressure this technical indicator below its ascending support level, and deeper into negative territory, granting bears complete control over the USD/ZAR.

Due to the five-week lockdown, which has been gradually eased, partially due to lack of funding to extend it, second-quarter GDP estimates range between a plunge of 20.0% and a collapse of 53.0%. Glenda Gray, the Chief Executive Officer of the South African Medical Research Council, notes there is no middle path in the fight against the pandemic, pitting the loss of lives against the loss of livelihoods. The USD/ZAR gathered more bearish momentum following the collapse below its short-term resistance zone located between 17.2006 and 17.3370, as identified by the red rectangle.

While the Covid-19 pandemic has sparked the rush to reform the ailing South African economy, the business community cites a lack of leadership from the government. During last week’s National Economic Development and Labour Council (NEDLAC) meeting, companies presented over 900 slides of ideas and projects to kickstart the economy versus just 17 unorganized ones by the government, which is the most significant threat to the economy. After the USD/ZAR converted its ascending 61.8 Fibonacci Retracement Fan Support Level into resistance, the path is clear for a collapse into its support zone located between 16.3392 and 16.4559, as marked by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 17.1200

Take Profit @ 16.3400

Stop Loss @ 17.3700

Downside Potential: 7,800 pips

Upside Risk: 2,500 pips

Risk/Reward Ratio: 3.12

A sustained breakout in the Force Index above its descending resistance level may allow the USD/ZAR to embark on a temporary reversal. Given the intensifying bearish pressures on the US Dollar, Forex traders should consider any advance as a secondary selling opportunity. The upside potential is confined to its long-term resistance zone located between 17.6611 and 17.7822.

USD/ZAR Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 17.5000

Take Profit @ 17.6700

Stop Loss @ 17.3700

Upside Potential: 1,700 pips

Downside Risk: 1,300 pips

Risk/Reward Ratio: 1.31