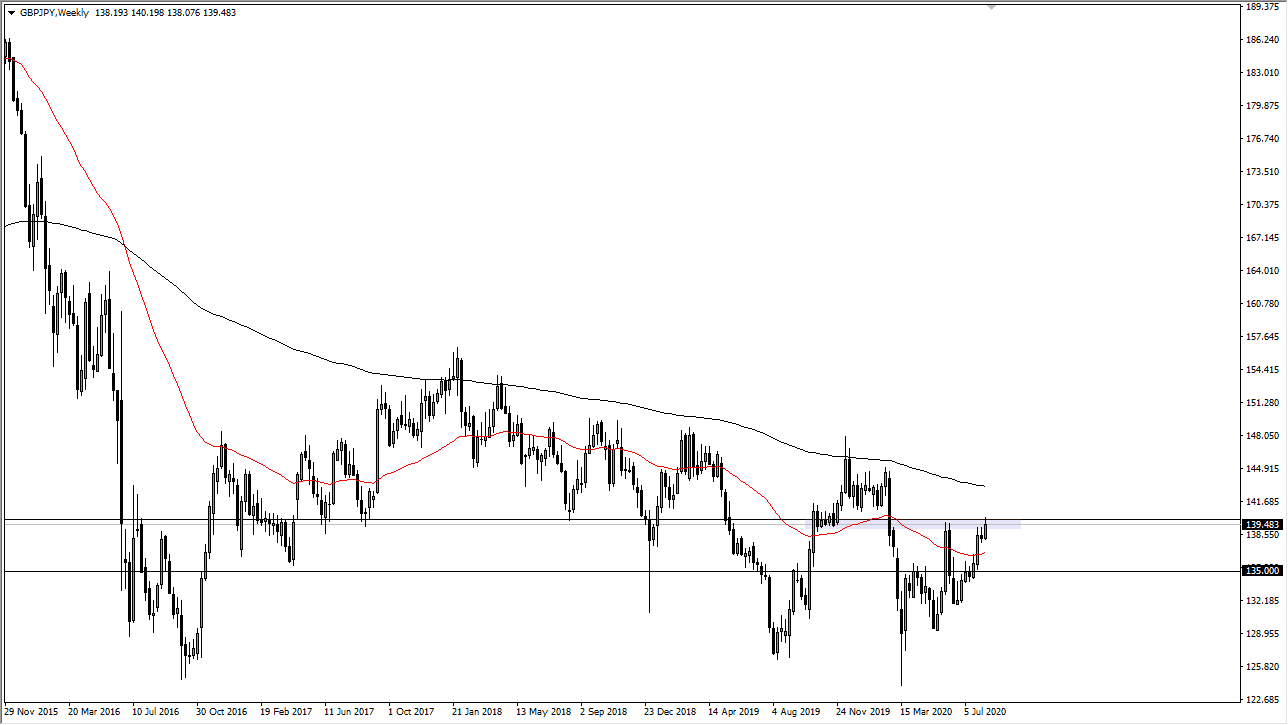

GBP/JPY

The British pound has rallied quite nicely against the Japanese yen during the course of the week, reaching towards the ¥140 level. At this point in time, we have pulled back a bit, but I think if we can break above that level on a daily close, then the market is likely to go looking towards the ¥144 level. In the meantime, I like the idea of buying pullbacks, as it gives you an opportunity to pick up value in a market that is doing everything it can to break out.

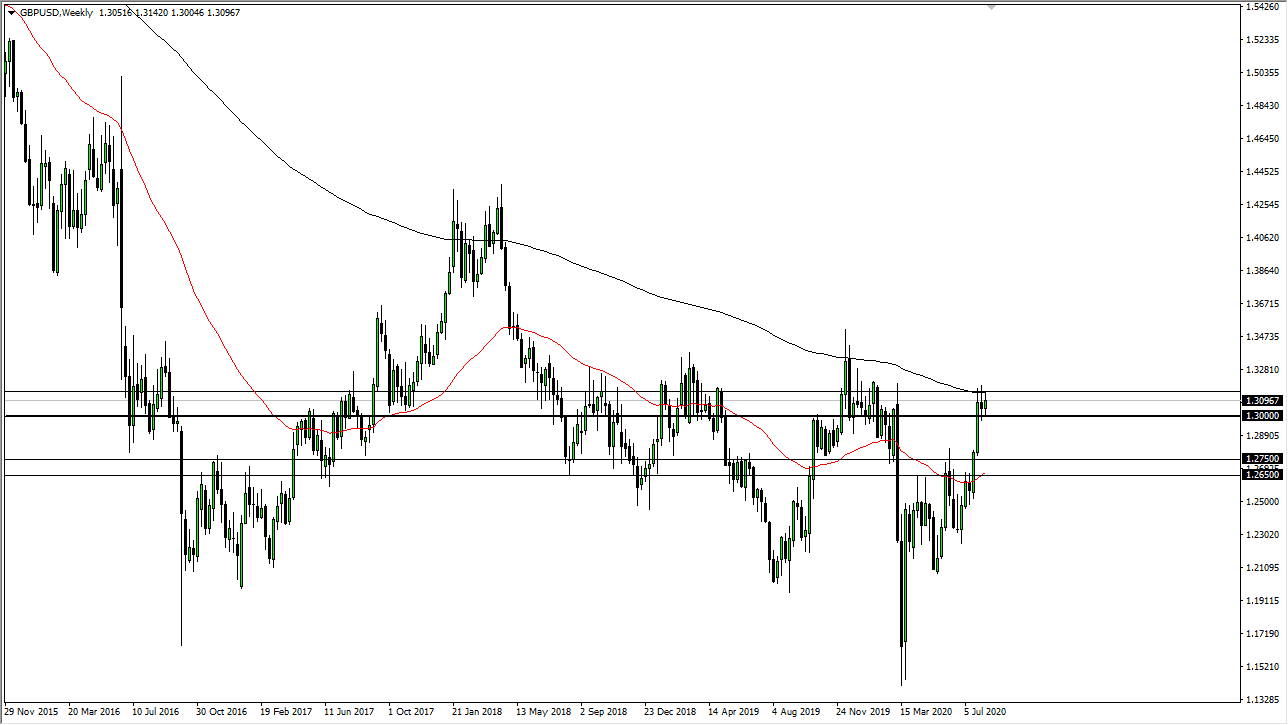

GBP/USD

The British pound has gone back and forth during the course of the week, as we continue to grind away in a relatively tight range. Ultimately, I think that the market could break out above the highs near 1.3150, opening up the move towards the 1.35 handle. Underneath, the 1.30 level continues to offer a lot of support, so with that being the case, I think that we will continue to see more of this back and forth. If we do break down below the 1.30 level, then it is likely we go towards the 1.2750 level underneath that. All things being equal though, I do prefer buying dips and believe that we will eventually break out to the upside.

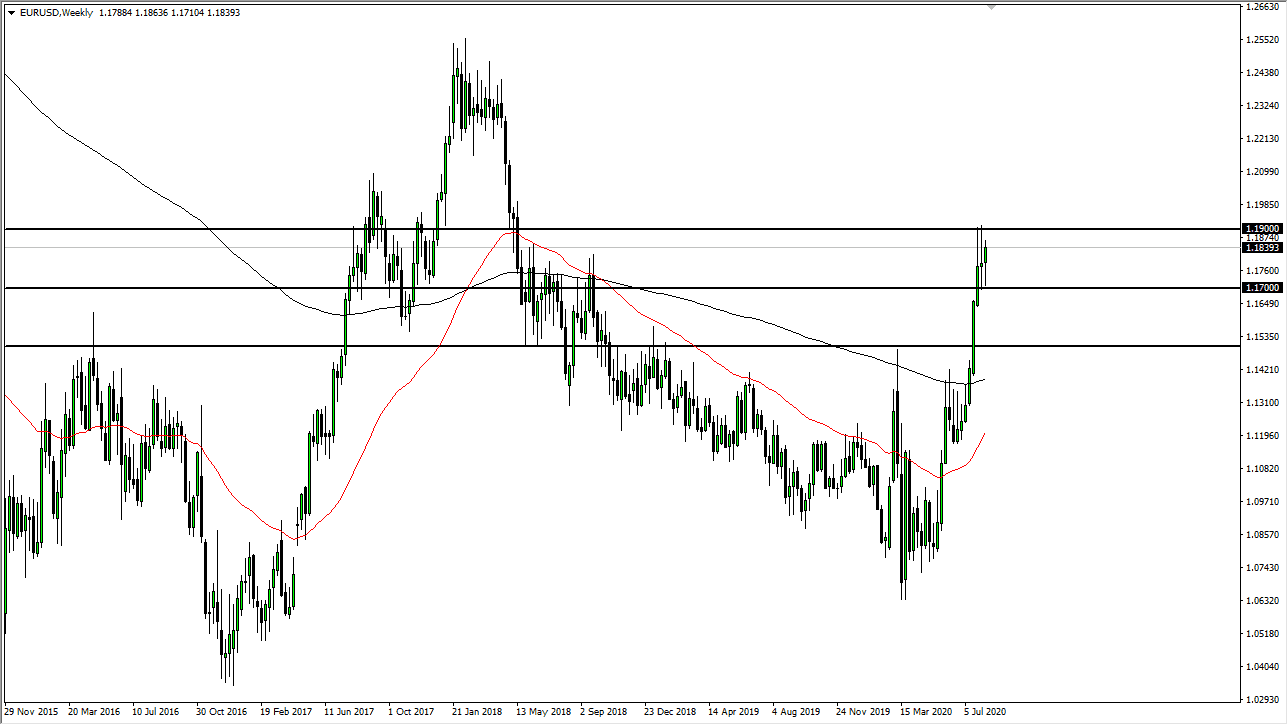

EUR/USD

The Euro initially fell during the week but found enough support at the 1.17 level to recover. At this point, I think we are going to continue to go back and forth between the 1.17 level on the bottom and the 1.19 level on the top. My base case scenario is that we go back and forth in this range, but if we break out, then I think we go to the 1.15 level on the downside or the 1.20 level on the upside. Expect a lot of choppiness but this could be yet another week like we have had over the last two.

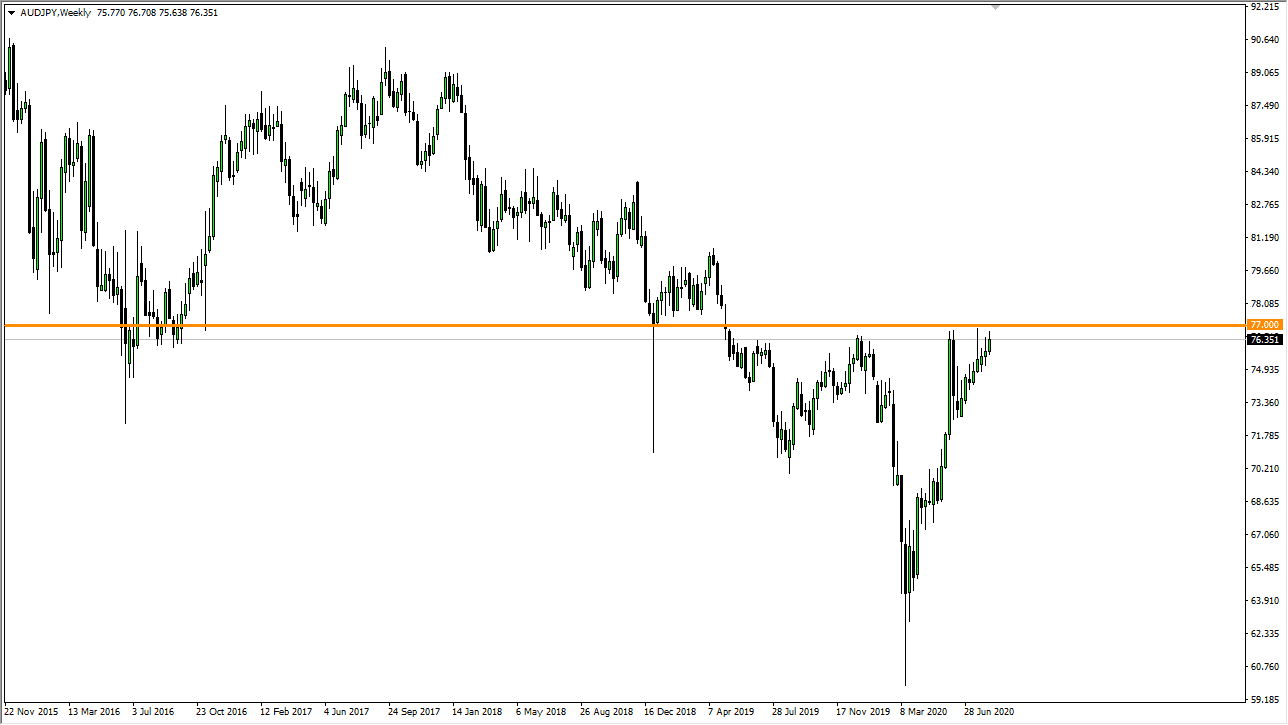

AUD/JPY

The Australian dollar continues to grind to the upside against the Japanese yen. It does look like we are trying to break out and if we can clear the ¥77 level, I believe it is only a matter of time before we go much higher, perhaps reaching towards the ¥80 level. It will be interesting to see how this plays out, but keep in mind that this pair tends to be highly sensitive to risk appetite. If we get more of a “risk-on rally” in stock markets, that could help this market as well.