The West Texas Intermediate Crude Oil market has rallied a bit during the trading session on Monday to start off the week, but it looks as if we are still struggling a bit to break out to the upside. Ultimately, I think that happens and if we can clear the high from the previous week, that is what I am going to use as my signal to go long. If we do get this breakout, then I believe that the market is going to go looking towards the $49 level above. After all, that is an area where we have seen a lot of selling so it would make sense to see the markets target that area again.

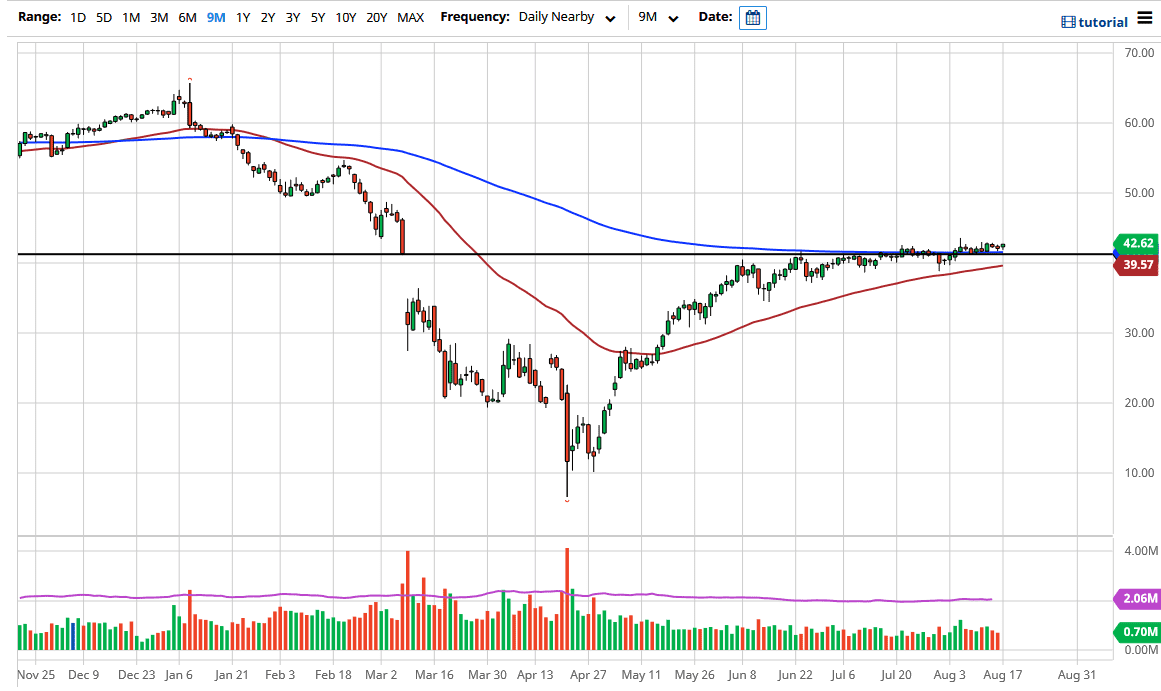

A pullback from current levels makes quite a bit of sense, but I think that will simply offer a nice short-term buying opportunity. The 200 day EMA sits just below and seems to be offering short-term support now that we are above there. The 200 day EMA is an area that will attract a lot of attention and is sitting on top of the short-term gap that we have now filled and blown beyond. The 50 day EMA currently sits at the $39.57 level, so I think that also offers support. Buying on short-term dips is how I have been playing this market for some time, but I have not been playing it for big moves. Ultimately, I think that we get a lot of choppy volatility, but it certainly seems as if the buyers are continuing to press the issue and therefore it is only a matter of time before we chip away at that resistance.

The following US dollar is a primary driver of price going higher, but we also have OPEC sticking to production cuts, something that is somewhat miraculous in and of itself as OPEC is notorious for failing at these things. The real question though is whether or not there is going to be enough demand, and that is an open question at this point. After all, economies around the world are going to continue to struggle, so that means that demand for oil will be somewhat weak. With all of this, I think the one thing you can count on is a lot of noisy trading in the short term.