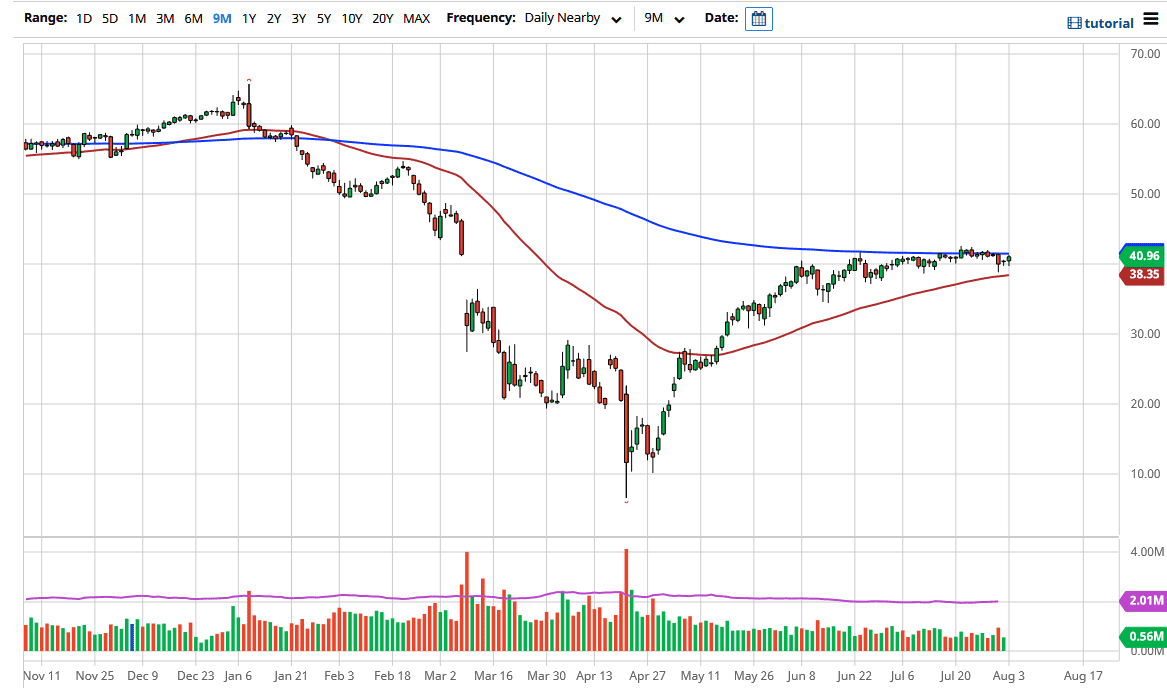

The West Texas Intermediate Crude Oil market pulled back just a bit during the trading session on Monday to kick off the week but found enough support near the $40 level to turn around and show signs of life again. Having said that, we are currently dancing around the 50 day EMA and the 200 day EMA, just as we have been doing for ages. It seems as if the market has more support the last couple of days though because we are starting to form wicks to the downside. Is this a signal to start buying? Not necessarily. However, what it does show is that there are plenty of buyers underneath.

When you look at the overall attitude of the market, it seems to be killing time, perhaps trying to figure out whether or not we are going to get some type of catalyst to finally move for more than a short-term scalp. Currently, we have to worry about a lot of different things going on at the same time, not the least of which has been the US dollar losing value. That of course causes crude oil to rise. After all, it takes more of those US dollars to buy a barrel of crude oil. Having said that, we also have to worry about whether or not there is enough demand out there to send this market higher. I do not know that there is, because we continue to see a lot of questions when it comes to that demand.

From a technical analysis standpoint, we are clearly stuck between a couple of major moving averages, so that does tend to attract a lot of attention. Ultimately, I think that this is a market that will eventually make an impulsive move, and when it does you will want to be part of it. In the meantime, only you can do is scalp this market back and forth because that is essentially all that is being offered here. One of the biggest mistakes that retail traders make is trying to force a trade that just is not there. At this point, there is not much to be done with crude oil but it does give us a little bit of a hint due to the fact that we have not been able to break down below the 50 day EMA, even though we have tried the last couple of days.