Amidst a new downward momentum for the EUR/USD, the trading session on Thursday was the most declining for the pair, which collapsed to the 1.1737 support, the lowest level in a month before closing the week’s trading around the 1.1841 support. Recent performance has made forex traders wondering more of whether there has been a change of the course or just a correction? And the answer was the latter. The world's most famous currency pair has been struggling with the US dollar's recovery after markets understood the recent decision by the Federal Reserve Board on its policy objectives ahead of the presidential election.

The US Federal Reserve has indicated that it will not be possible to raise interest rates until 2023 - but also no action is imminent despite growing uncertainty about the outlook. The markets returned to buy the US dollar as a safe haven. Fed Chair Jerome Powell also indicated that policymakers would be wise to act by adding fiscal stimulus. On the other hand, it appears that Republicans and Democrats are making some progress toward agreeing on a new relief package. However, there are still no strong indications that the agreement is imminent, and politicians will likely have little incentive to make concessions before the elections. Therefore, failure to strengthen the economy may lead to further flows to the dollar.

Market uncertainty has returned with the resurgence of coronavirus cases, most notably in numbers rising rapidly in Spain, France, and even Germany and Austria - countries that dealt well with the Coronavirus in the beginning.

The balance sheet of the US Federal Reserve Board jumped by nearly $54 billion last week to $7.06 trillion, its biggest level since the end of June. It suggests that they buy approximately $20 billion a week of Treasuries and $10 billion a week in mortgage-backed securities. As others have noted, the US central bank now holds more Treasury bonds than other central banks combined, which also applies to the Bank of Japan and Japanese government bonds. Foreign officials also bought about $7 billion in Treasury bonds last week, which are held in custody in foreign central bank accounts. There is much talk in some circles about the intervention of Asian central banks in the foreign exchange market, and this appears from one point of view.

On the other hand, foreign central banks withdrew their holdings from the treasury during the chaos of March and April and gradually moved to rebuild. The average 10-year holdings in the federal guardianship account are $3 trillion. Separately, reports indicate that the US Federal Reserve will decide within the next two weeks whether to extend the maximum profits for large banks and buy back shares. But these are not, of course, common measures in Wall Street.

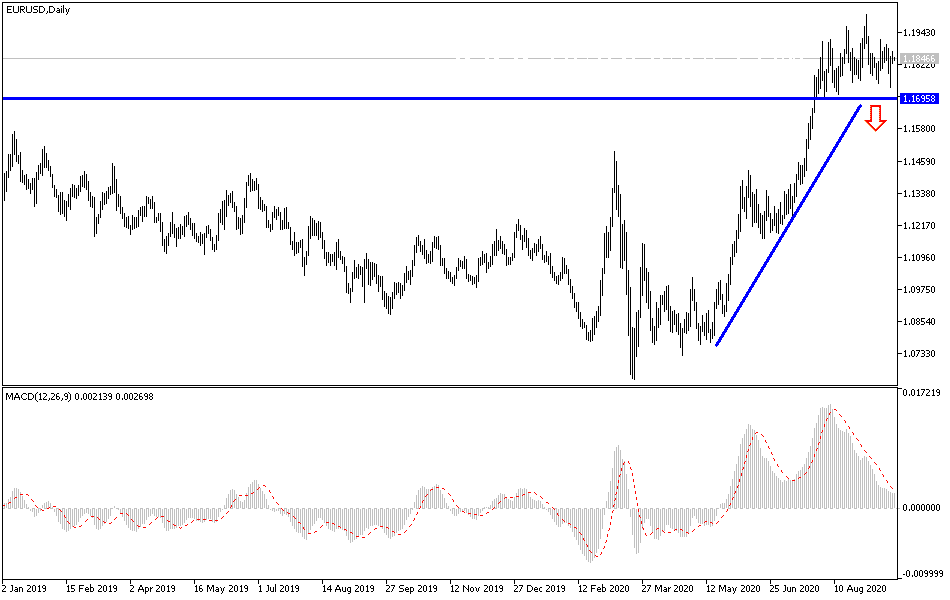

According to the technical analysis of the pair: The EUR/USD pair continues to suffer from the downward momentum on the four-hour chart, but it has overcome the simple 50, 100, and 200 moving averages. With the RSI steady around the 50 level, the picture is somewhat balanced. Some resistance awaits a daily high of 1.1860, followed by a swing high at 1.1920. The next peaks to watch for are 1.1965 and 1.2010. 1.1930 support is where the price touches the 50 SMA. It is followed by 1.1785, a swing low from early September, then 1.1760, and 1.1730, recent lows. The bulls are intent on overcoming the 1.2000 psychological resistance should the dollar pressure return.

Today there are no significant Eurozone releases. From the United States, there will be statements by US Federal Reserve Governor Jerome Powell.