The Bank of England has taken another step to prepare for possible negative interest rates. They will begin talks with the regulator in the fourth quarter to see how negative rates might operate. This caused the collapse of the GBP/USD currency pair to the 1.2865 support, and with the markets absorbing that signal, which was previously quoted, the pair returned to test the 1.3000 resistance but closed last week's trading around the 1.2922 level. With the announcement of the British Central Bank, pressure has increased on the Sterling, which is still facing a bleak outlook from Brexit. This is in addition to the strength of the second wave of the Corona pandemic, which threatens a new closure of the British economy. Such a measure - a lockdown to contain the outbreak - could severely impede the economic recovery at a time when the risks of Brexit are high and the market is already turning down in its outlook for the British pound due to the potential economic impact of a No-Deal Brexit after the transition period scheduled at the end of the year.

In general, it seems clear that if the Bank of England eases its monetary policy during its next meeting in November, it will not be ready to adopt negative interest rates, to which over the past month, they have expressed concerns about unintended negative consequences. Instead, the official interest rate is likely to be reduced symbolically from 10 basis points to zero, along with the appetite for more purchases.

Back to the Brexit file, the two sides - the European Union and Britain - have kept talking but with no concessions on European demands in trade talks and London backing down over the internal market bill, Brexit risks may still be a heavy burden on the pound. However, fear of the virus, investor appetite for risk, and dollar-related demand are also major factors. “The government continues to push ahead with its attempt to pass the internal market bill,” says Andrew Goodwin, UK chief economist at Oxford Economics. “Its objectives remain elusive, and the incident clearly damaged the trust between the UK and the European Union. But the road to a trade deal remains open if both sides choose to pursue it.”

On the economic side, the UK recorded a 0.8% increase in retail sales for August after a 3.7% increase in July. Despite the result, it is the fourth consecutive month in which sales have increased. Excluding gasoline, retail sales were up 0.6%. The government unveiled initiatives to encourage people to resume some of their usual activities. It should be noted that online purchases increased by 47%. There are two obstacles going forward. The first is a new outbreak of the virus, the second is the end of the vacation program, which is scheduled to end next month.

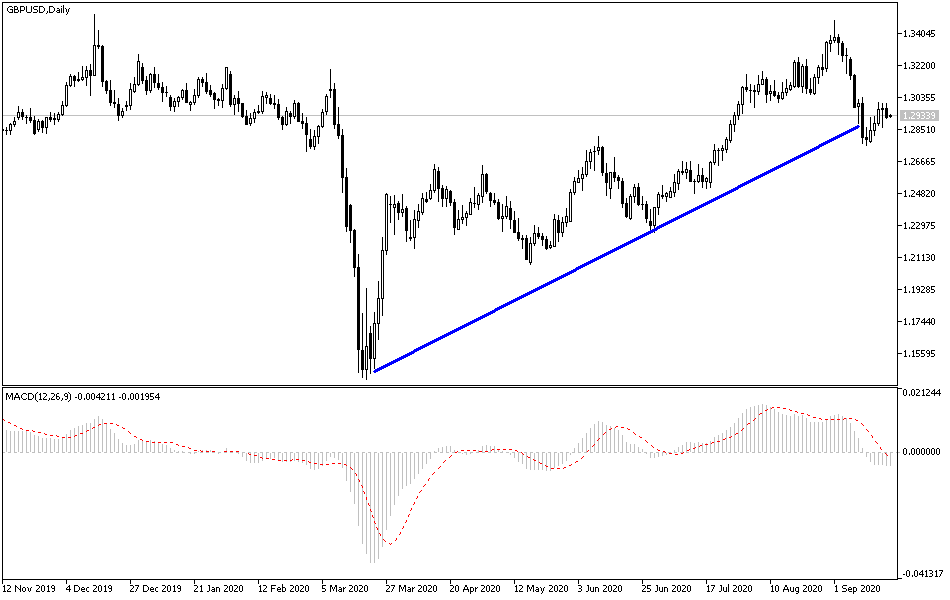

According to the technical analysis of the pair: Gains of the GBP/USD pair are still selling opportunities, as the pressure on the pound continues to increase, and the resistance levels at 1.3000, 1.3085, and 1.3175 will be targets for doing so. On the daily chart, the break of the general bullish trend is still in place, and therefore the bears move towards lower levels, and the next targets for them maybe 1.2880, 1.2800, and 1.2720, respectively. I still prefer to sell the pair from every upper level. The Sterling is not expecting any important British economic data today. The only focus will be on the content of US Federal Reserve Governor Jerome Powell's comments.