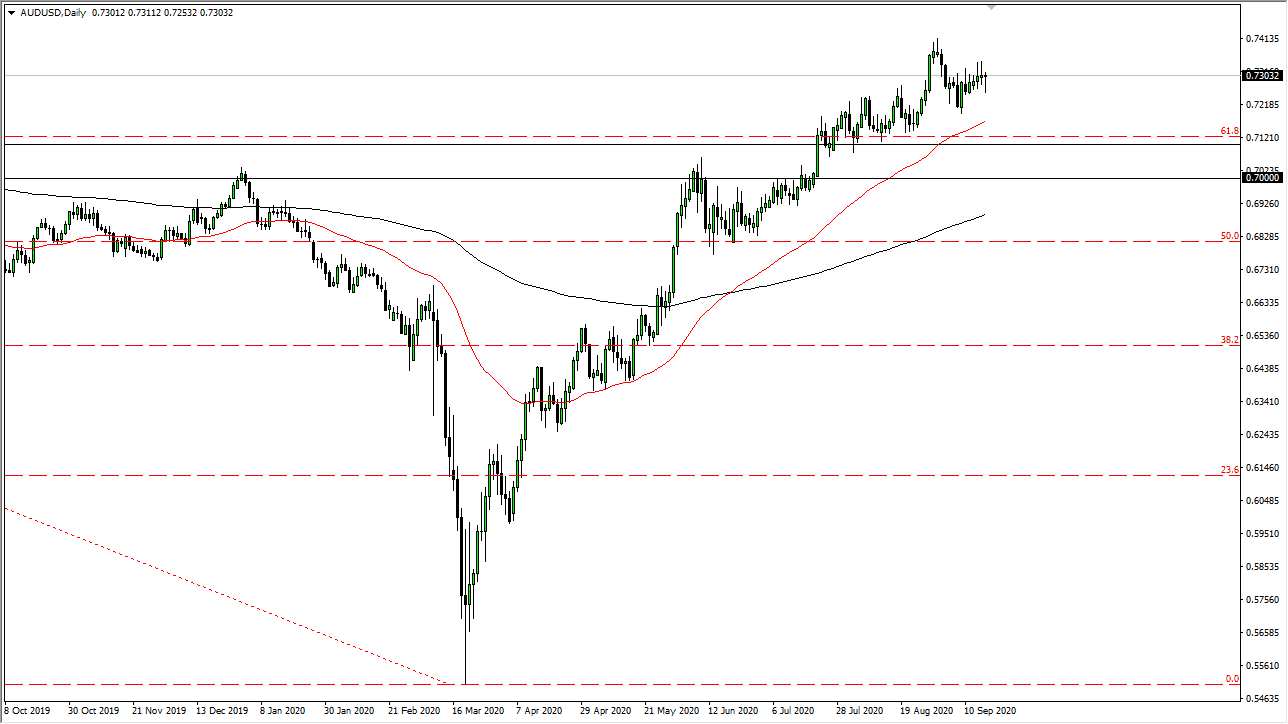

The Australian dollar initially fell during the trading session on Thursday, but then turned around to show signs of life again. The hammer of course is a strong candlestick, but it is preceded by a couple of shooting stars. This tells me that this market is probably going to continue to be very tight and choppy, because quite frankly there are a lot of questions when it comes to the global economy out there. I would suspect that one of the biggest things that is helping the Australian dollar right now is the fact that is so highly correlated to the Chinese economy which is doing fairly well.

The US dollar is strengthening in general though, so at this point in time it is likely that we will see a little bit of a wait around the neck when it comes to the Australian dollar, but I have no interest in shorting. After all, the 50 day EMA sits underneath and is rising, so what if you technical traders out there will be interested in this market. The 0.73 level is an area of interest, but then again, the 0.72 level underneath will be support as well.

Looking at the chart, you can also see quite a bit of support at the 0.71 handle, extending down to the 0.70 level. With all of that being said, there are multiple areas underneath that could catch any type of fall, so because of that I just do not have any interest in trying to fight the current. If I decide the by the US dollar and short another currency, then it will be the Australian dollar. After all, the Aussie has the benefit of China, but some other currency such as the British pound or the Euro do not. Because of this, even if this pair were to fall you probably see a lot more gains in favor of the greenback against other currencies. On the other hand, if the US dollar softens this will probably be the place to be as we have seen so much in the way of strength.

Looking at the overall attitude of the market, we have bounced drastically and a bit of grinding sideways and perhaps digestion of the recent gains should continue going forward, because quite frankly it is normal market behavior. Longer-term, I would not be surprised at all to see the Australian dollar reached the 0.75 handle.