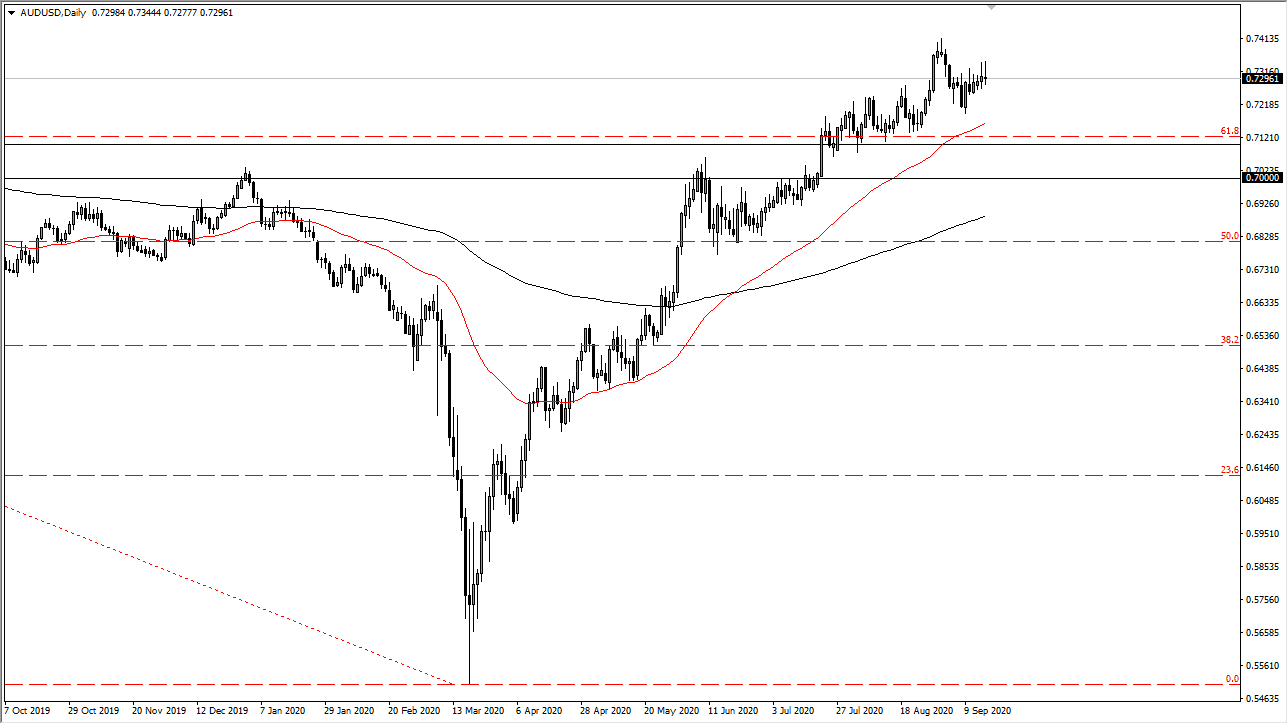

The Australian dollar continues to struggle at the 0.73 level, an area that has been resistant more than once. Ultimately, this is a market that showed a shooting star for the second day in a row, and therefore it shows just so much trouble we are in right now. The Australian dollar pulling back from here could send this market down towards the 0.71 handle, which is a major round figure due to the fact that we have seen the 50 day EMA breaking just above there, and there is a significant level down to the 0.70 level.

Pullbacks at this point in time should be a buying opportunity, and therefore it is likely that we will find value hunters given enough time. This is a market that has been very explosive to the upside for several months, and at this point, at the very least we need to do some type of consolidating as the market has been far too overextended. Ultimately, the US dollar is starting to show signs of strengthening in general, although the Australian dollar is supported by the Chinese economy and the fact that China is looking a bit healthier these days. If that is going to continue to be the case, then it is possible that the market will continue to buy the Australian dollar as it should continue to strengthen as commodities are bought by the Chinese.

At this point, even if we break down below the 0.70 level, it is not until we break down below the 0.68 level that I would start shorting this pair, because it has been so strong. To the upside, if we were to break above the recent highs, then obviously the Australian dollar would look bullish again, and we would probably go looking towards the 0.75 handle, followed by the 0.80 level over the longer term. In the short term, we get a pullback towards the 50 day EMA, but at that point, I would anticipate value hunters coming back into taking advantage of this. If you are looking to find a way to buy the US dollar, you probably need to do so against other currencies, not necessarily as the Aussie dollar as it is so strong. The choppy behavior will not be as profitable as the selling off of a short of the British pound might be in that scenario.