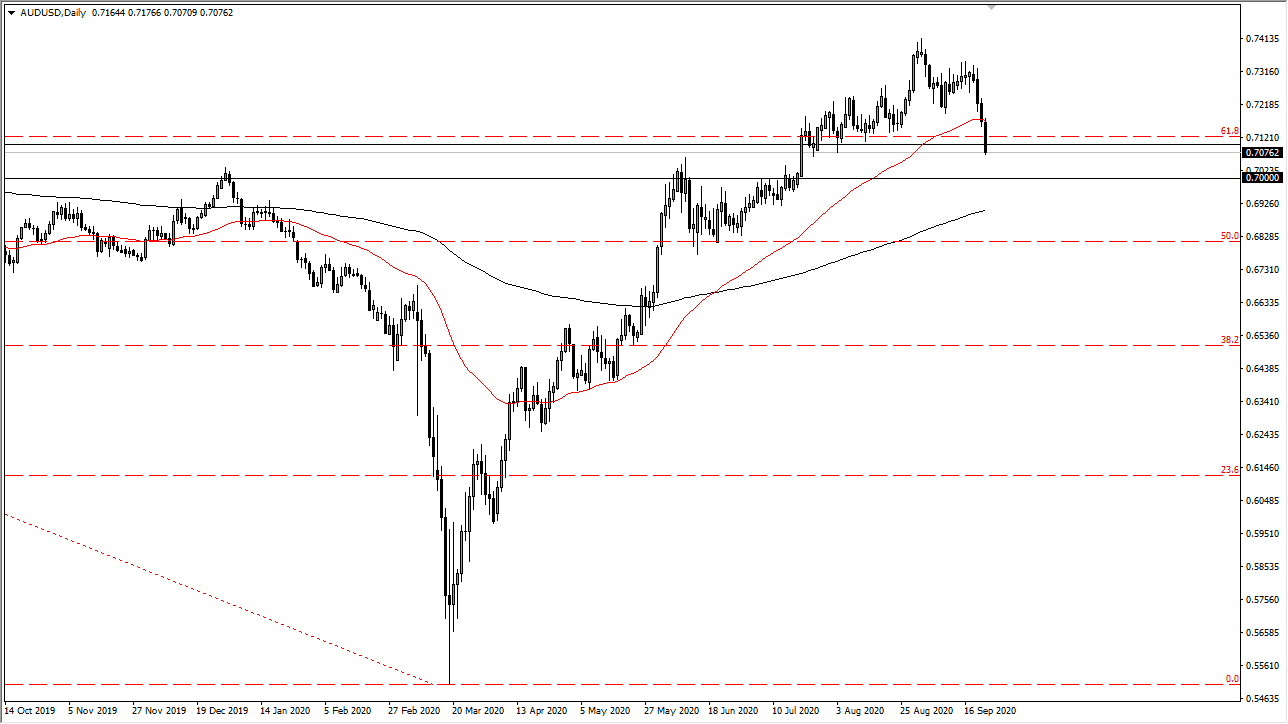

The Australian dollar has gotten hammered again during the trading session on Wednesdays slicing through the 0.71 handle. This is the beginning of that massive support barrier that I have been talking about and it is likely that we have a fight on our hands now. We have sliced cleanly through the 50 day EMA and therefore I think we continue to drop from here. After all, the US dollar is strengthening in general, and that of course has an effect over here.

However, the Australian dollar has the Chinese economy backing it as it is a proxy for that economy, so the Aussie has been “less bad” than other currencies against the US dollar. I think at this point, if you are looking to buy the US dollar you are probably better off buying it against other currencies. However, if the US dollar suddenly starts the selloff, this will be the first place I will be jumping toward, as the Australian dollar has been such a great performer against the greenback. That being said, it is likely that a turnaround is going to show itself in this market quite rapidly. In other words, if the US dollar falls apart then I am going to be buying the Australian dollar initially. After that, I may look at other currencies.

To the downside, the 0.70 level is the bottom of this overall support level, and if we were to break down below there, then it is likely that we could go down to the 200 day EMA. The 200 day EMA is of course an area where we could have buyers jump in as well. Nonetheless, when I look at the US Dollar Index, it is likely that the greenback will continue to strengthen overall. I have been shorting the EUR/USD pair during the day, as it has broken down. The Australian dollar still has plenty of support underneath, so there is no point in fighting what has been such a strong uptrend as other pairs have broken down. To the upside, if the market was to clear the 0.71 handle going higher, then it is likely that the market could go back towards the highs again. This is ultimately the best way to short the US dollar in general, but clearly right now is not the time to do it.