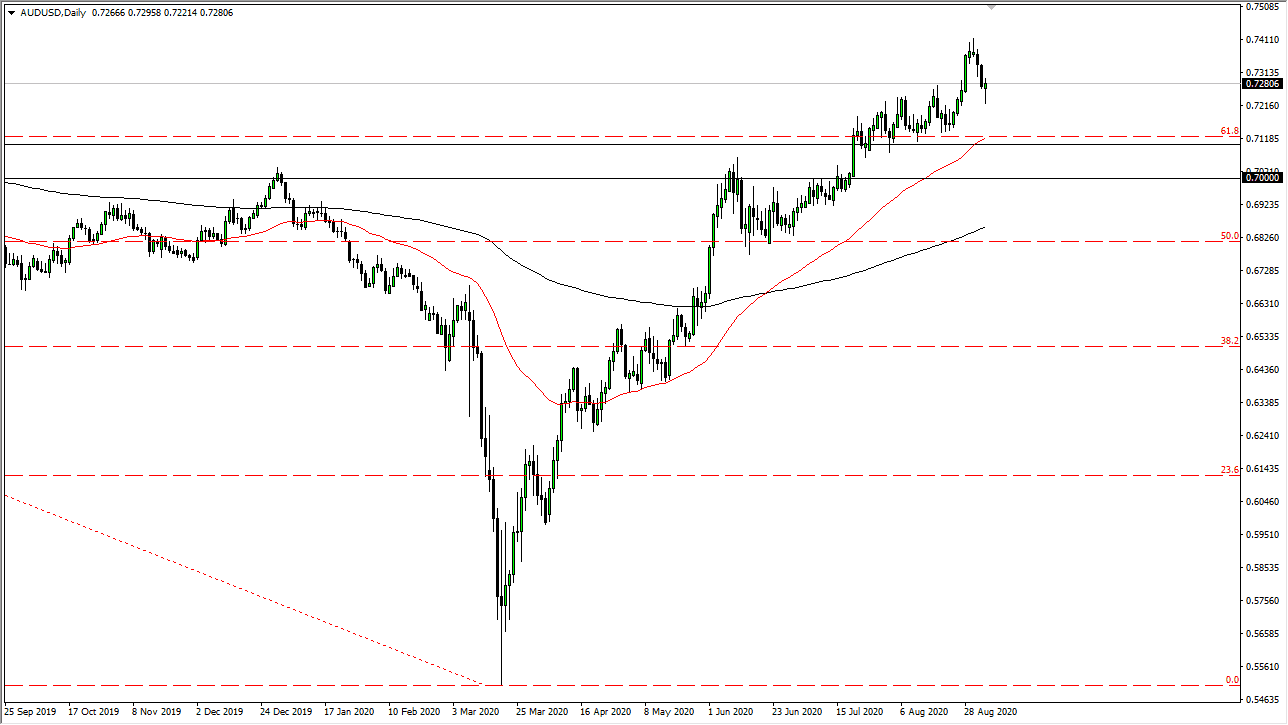

The Australian dollar has fallen a bit during the trading session on Friday, only to turn around and form a bit of a hammer. At this point, it looks like we will continue to see a lot of buying pressure on dips, as this area underneath continues to be one that people pay attention to. With that, I like the idea of buying dips, and I realize that it is only a matter of time before the market participants come back in and push this thing to the upside. I see a lot of support down at the 0.71 handle, which is not only massive support but has the 50 day EMA crossing through it.

Looking at the candlestick, it is a hammer and that attracts a lot of attention in and of itself. That being said, the markets are definitely very frail, as we have seen massive selling and risk appetite such as the NASDAQ 100 in the S&P 500. With that being the case, it does have an effect on the Australian dollar, simply because the Australian dollar is considered to be a “risk currency”, and that in and of itself will cause some issues. Ultimately, I think that the market goes looking towards the 0.74 level again, and then eventually the 0.75 handle. With that being said, I think that the US dollar could get a little bit of a boost in the short term as well, so I consider this market being supported all the way down to the 0.68 level. There are multiple areas that I would be willing to buy the Australian dollar, based upon a supportive looking candlestick.

The Friday session formed a hammer at the 0.72 level, which is the first one that I am talking about. After that, the 0.71 level begins a massive support level that extends down to the 0.70 level. After that, then we are looking at massive support at the 0.68 level due to the fact that the 200 day EMA is sitting in that general vicinity. As far as selling is concerned, once we break down below there then I think the entire uptrend would be over. Looking at this, I believe that this is still a “buy on the dips” type of market but keep in mind that there are a lot of headlines out there that could make things extraordinarily volatile.