The Australian dollar has initially tried to rally during the trading session on Thursday but gave back the gains as risk disappeared from the markets late in the day. It looks like we still have a lot of volatility and concern out there when it comes to global markets, and of course we continue to see this play itself out in multitude of markets, not just in the Australian dollar. That being said, the Australian dollar does typically move higher with stronger risk appetite, so that is something worth paying attention to.

By forming a bit of a shooting star it does suggest that perhaps we are not quite ready to continue the uptrend, and therefore the US dollar may strengthen against multiple currencies. It certainly has gained against the British pound during the day, as well as the Euro, albeit from the top of the initial surge higher after the ECB meeting. The Australian dollar does not work and live in a vacuum, so it had some influence over here as well.

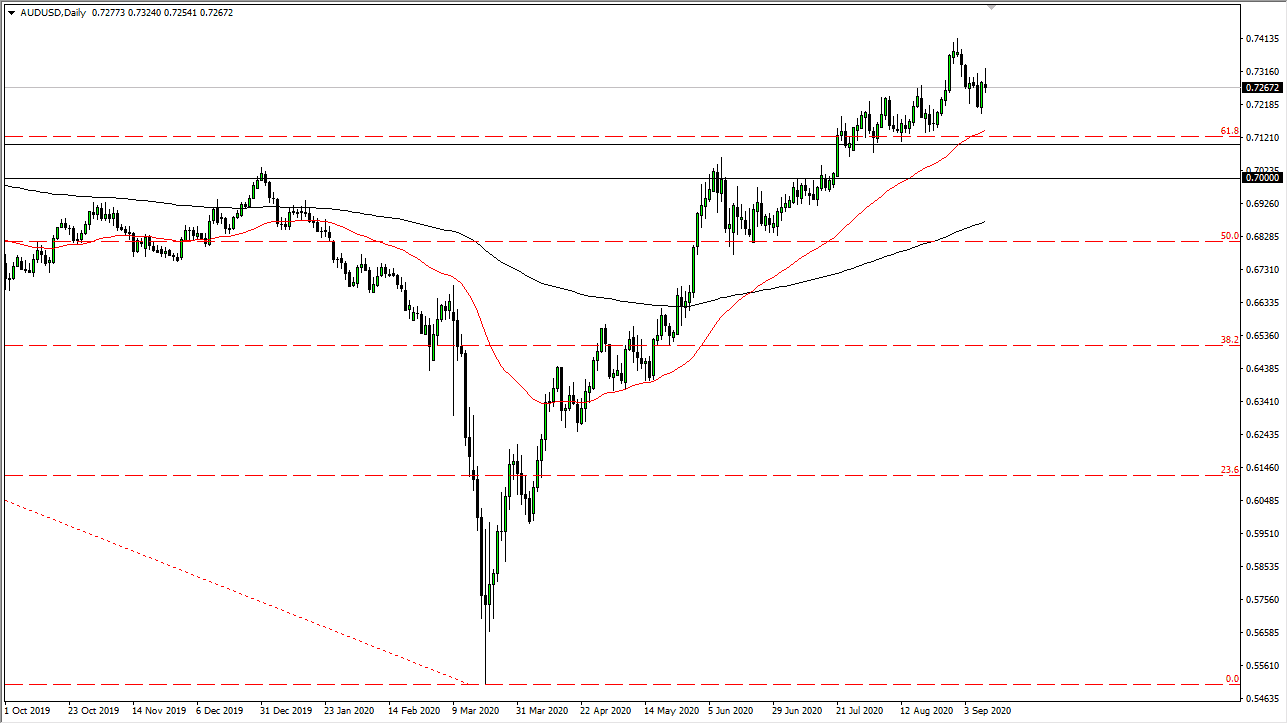

To the downside, I see the 0.71 level as offering support, not only due to the fact that it is structurally important and begins a 100 point support level down to the 0.70 level, but also the fact that the 50 day EMA has simply sliced through there as of late, and should attract attention if we reach down towards that area. There are a lot of concerns out there when it comes to global growth, and that could work against the value of the Aussie in general. However, the strength and the Chinese economy should reflect itself here as well, so the Aussie will continue to be somewhat bullish going forward. However, if we get a sudden unraveling when it comes to people willing to put money to work, the Australian dollar will get hammered as money flows into the US Treasury market. That will send this market lower, but it is not until we break down below the 200 day EMA, presently sitting at the 0.6850 level, that I would consider selling this market. Ultimately, I think buying dips will continue to be the best way to play this market, as we continue to see upward mobility as the Federal Reserve floods the market with greenbacks. Nonetheless, it does not mean that we are going to go straight up in the air.