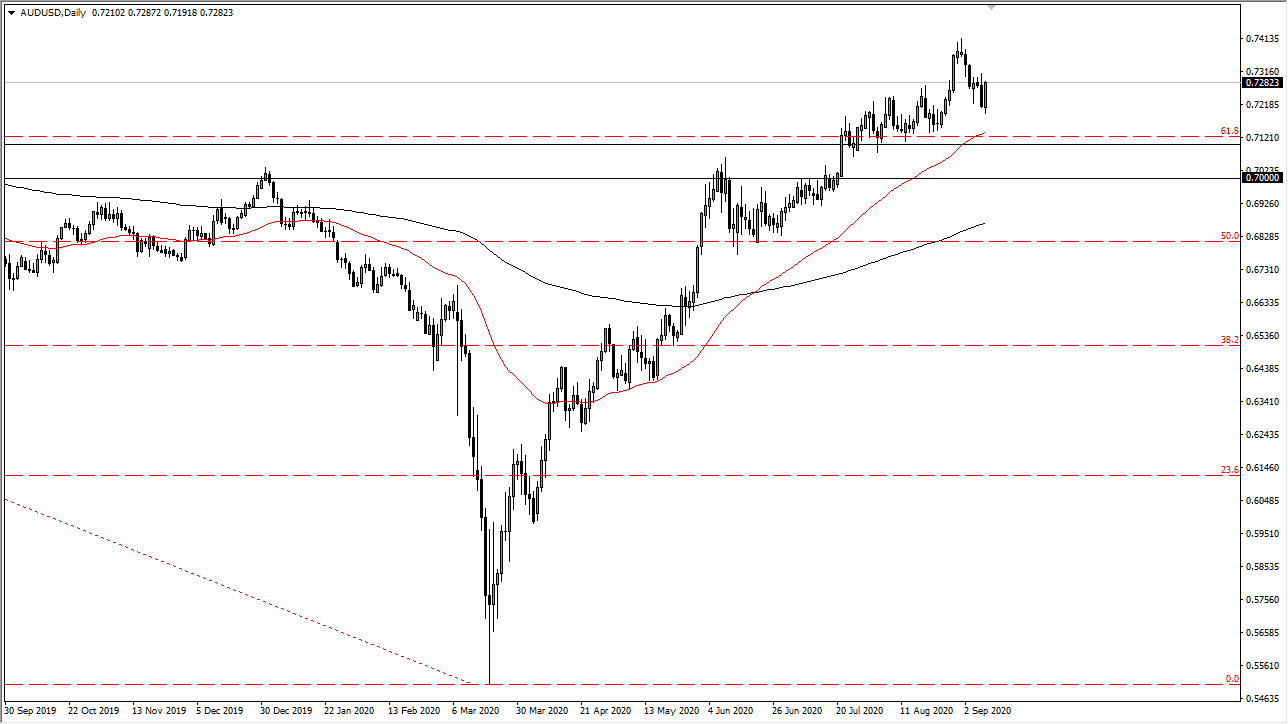

The Australian dollar initially fell during the trading session on Wednesday, reaching down towards the 0.72 level before rallying again. By showing the strength that it has, it looks as if the Aussie dollar is trying to recover and continue the longer-term trend. This would go more along the lines of a “risk-on rally” and falls right in line with the anti-US dollar scenario that we have seen as of late.

That being said, there are a lot of headwinds out there when it comes to risk appetite as well, so although it does look like the US dollar is going to lose strength from the longer-term perspective, the reality is that the market is very likely to be noisy in the midterm, and therefore you would need to be very cautious about your position size. To the downside, I believe that the 0.71 level offers a significant amount of support that extends down to the 0.70 level, and therefore it is not until we break down below there that I would even take notice of any type of selloff. After that, we have even more support to be shown near the 200 day EMA which is just above the 0.68 handle.

To the upside, if the Aussie can continue to break out, it is likely to go looking towards the 0.75 handle, followed by the 0.80 level. Keep in mind that the Australian dollar is levered to China and gold, so those are a couple of things that should be paid attention to as well if you are going to trade this pair. I like buying dips and have no interest in trying to short this market, lease not quite yet. Do not be wrong, we could see a massive run away from risk again, and that could send this market lower, but at this point, I think there are still buyers underneath waiting to get involved. Therefore, they will be looking at any pullback as a potential value area that they can take advantage of. The 50 day EMA is currently just above the 0.71 level, so that has a certain amount of influence as well. Expect a lot of volatility, but we still are very much in an uptrend as we have been in for quite some time.