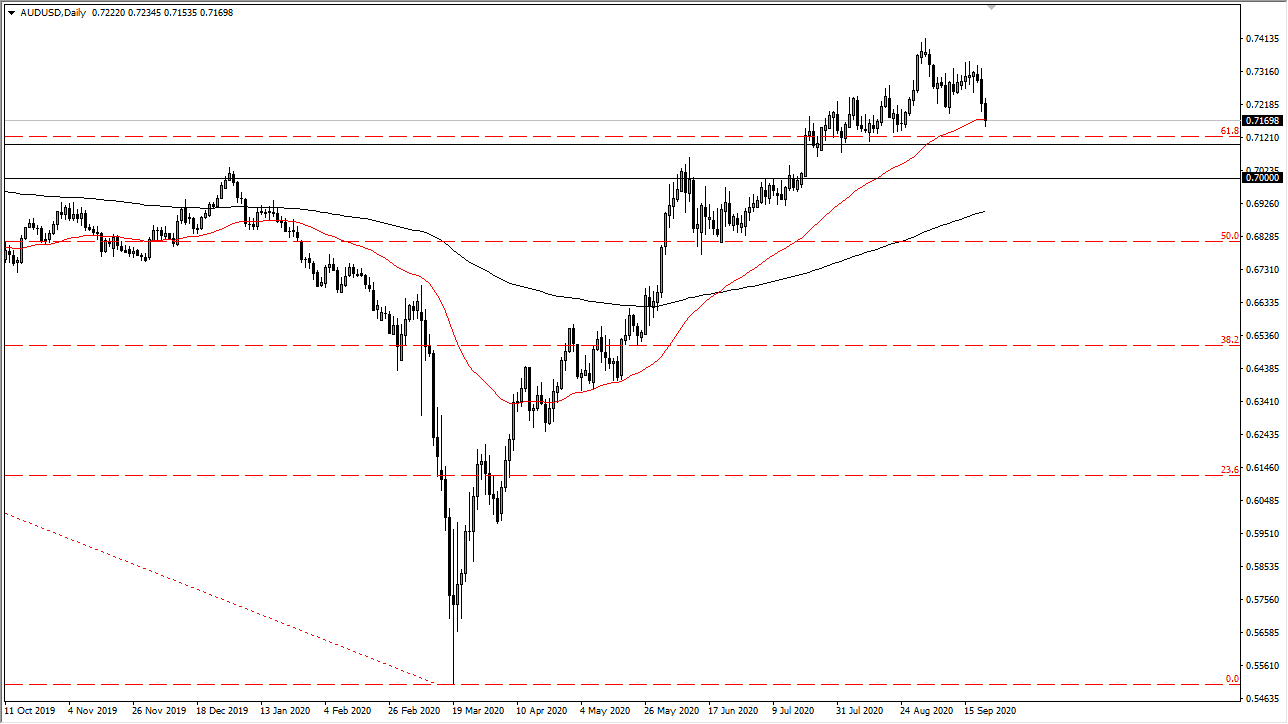

The Australian dollar has fallen a bit during the trading session on Tuesday, showing signs of exhaustion yet again as the market continues to see a lot of volatility and potential downward pressure. That being said, there is a significant amount of support underneath that could come into play. The first thing is the 50 day EMA that we are sitting on, and we have the 0.71 level underneath, extending down to the 0.70 level. Ultimately, this is a market that every time it pulls back there will be people interested in buying, but it does not necessarily mean that we cannot break down. Having said that, if we were to break down significantly and start looking towards the US dollar for safety, I will be looking to trade other markets.

The Australian dollar is far too strong to be shorting at this point, so if you are looking for a currency to short against the US dollar, you need to keep looking. Keep in mind that the Australian dollar has a significant correlation to what is going on in China, so that should be kept in the back of your mind. If the US dollar sells off, then it is likely that the Australian dollar will be one of the better performers against it. On the other hand, if the US dollar starts to strengthen, you will need to be shorting weaker currency such as the Euro, the Pound, etc.

Ultimately, it is not until we break down below the 200 day EMA that I would be selling this market, because it would be such a negative turn of events. With this being the case, the market is likely to see a lot of other pairs fall apart before this one does. You could see this market try to catch up, but it is difficult to imagine that it would lead the pack. With this, I am looking at this as a “buy only” type of scenario, or perhaps a market that I would be on the sidelines and overall. At this point, I believe that we are looking for signs of bullish pressure in order to get involved as the market has shown such stubborn bullish pressure.