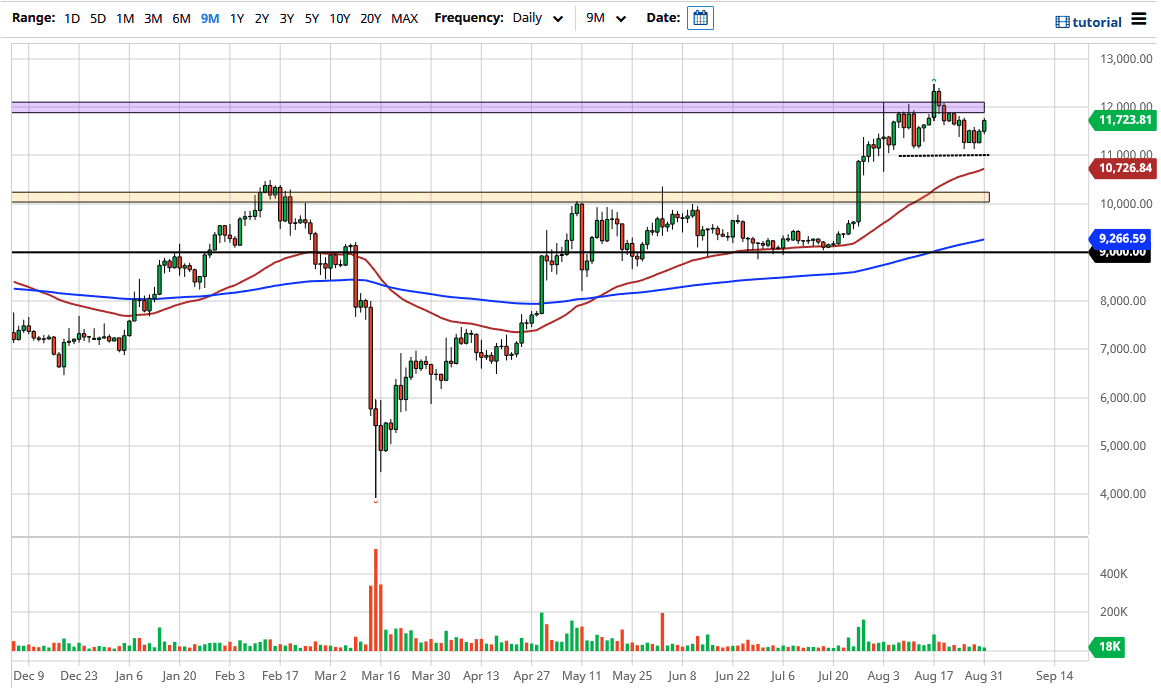

Ultimately, the market looks as if it is going to try to go looking towards the $12,000 level above, which is an area that has shown resistance previously and of course is a large, round, psychologically significant level that will attract a lot of attention. This is an area that I think there will be a lot of selling in the short term, but if we can break above the recent high, then it opens up the possibility of a move towards the $13,000 level after that.

I like the idea of buying short-term pullbacks, as it has continued to offer value. At this point, it looks as if the $11,000 level is going to offer significant support, as it has for several weeks. Furthermore, the 50 day EMA is starting to approach that level as well, so that gives is yet another reason to think that perhaps the market is going to continue going higher. With the devaluation of the US dollar, it makes quite a bit of sense that we will continue to see Bitcoin attract a certain amount of attention, as it is starting to trade quite a bit like a commodity. The large portion of the Bitcoin community that I talk to online does not like the idea that Bitcoin is essentially the same thing as gold, but at the end of the day it trades the same. In other words, the following US dollar is by far the biggest driver of price going higher.

If we were to turn around a break down below the $11,000 level, then it is possible that we could go down towards the $10,000 level which of course has a major psychological ramifications when it comes to the markets, especially as it had been so significantly resistive in the past. The 200 day EMA is starting to reach towards that area as well, so at that point it will only solidify the support. I like buying dips in this market because we will clearly see continued downward pressure in the greenback, probably lasting several months, if not years as the Federal Reserve has raised the bar for tightening monetary policy. Remember, this is a currency pair, namely BTC/USD, so you must think about central bank policy more than anything else.