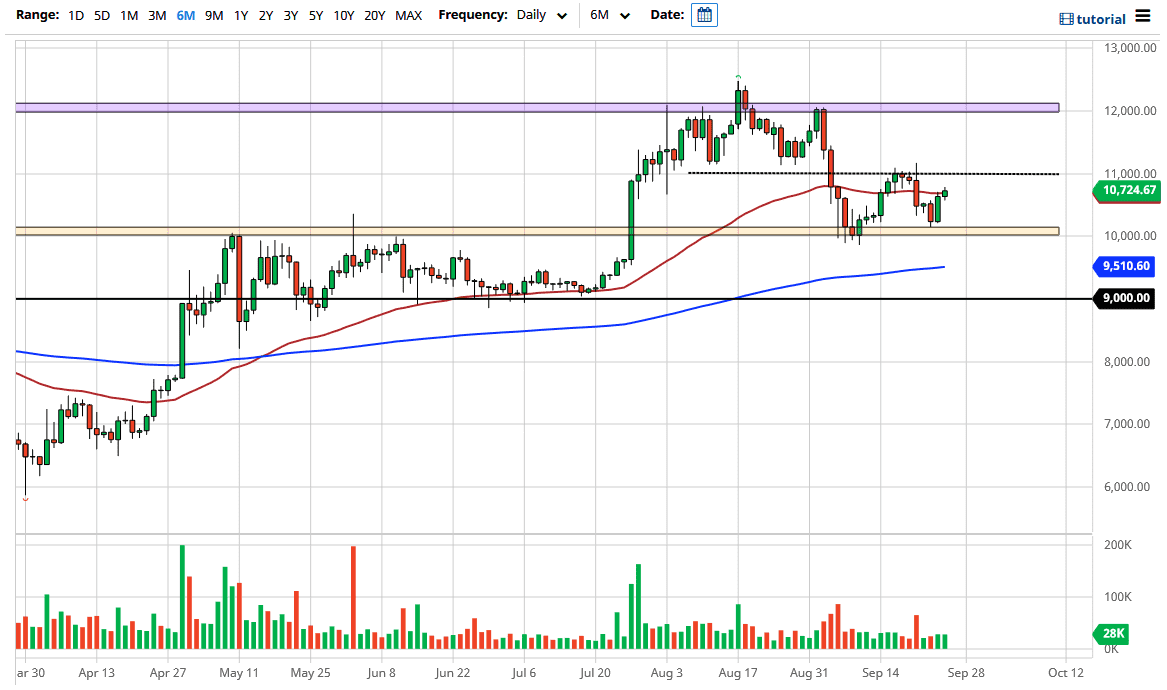

At this point in time, the market is likely to go looking towards the 11,000 level where we would see some selling pressure. That is an area that I think will cause some issues, but it should be thought of as short-term resistance. The bigger picture shows Bitcoin moving between the $10,000 level on the bottom and the $12,000 level on the top. As we are sitting at the 50 day EMA, it is something that should be paid attention to, but the 50 day EMA is essentially flat right now, so it suggests that the market is not quite ready to make a decision yet.

Overall, this will move based upon the US dollar. After all, a lot of Bitcoin traders forget this one important point: Bitcoin is priced in US dollars, at least the most common forms of it, and therefore becomes a Forex pair. I do not care what it is you think Bitcoin does, the reality is you are measuring relative value. That is what all markets are. This is why the US Dollar Index is so important, because of the US dollar is strengthening in general, it should all things being equal, work against the value of Bitcoin and unless there is something specific to Bitcoin that is going on.

All things being equal, I think we are going to go back and forth, and therefore short-term traders will probably continue to dominate the market. If you have the ability to trade with decent spreads, then you probably get the opportunity to move back and forth rather quickly. This suggests that you could make a little bit of money, especially over the weekend but at this point the $10,000 level looks to be rather significant support. Even if we were to break down below there, the 200 day EMA sits at the $9500 level, and then the $9000 level. If we were to break down below the $9000 level, the Bitcoin market will fall apart. Until then, one has to assume that we continue to step back and forth in these increments that I have marked on the chart, as Bitcoin typically will do. It is all about the US dollar at this point, despite the fact that most Bitcoin traders ignore that.