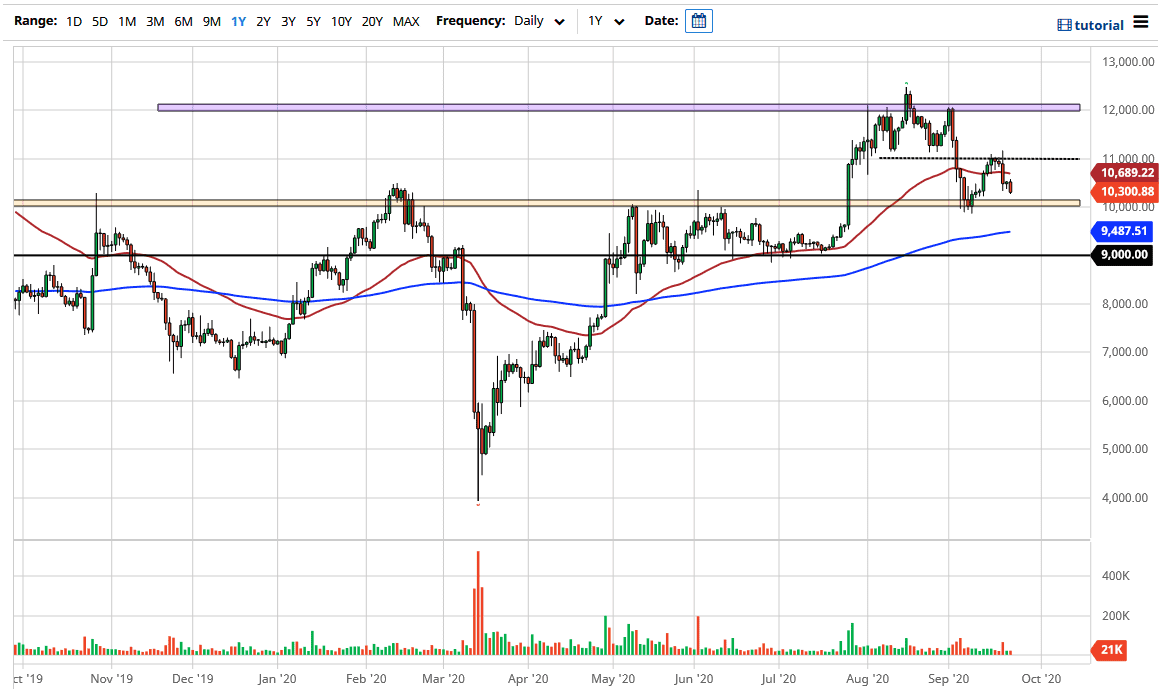

The Bitcoin market has fallen a bit during the trading session as we continue to see a lot of negativity. After all, this is being measured against US dollars which strengthened quite drastically during the trading session, and that of course has driven down Bitcoin in general. Having said all of that, the $10,000 level underneath is going to be important, as it is a large, round, psychologically significant figure. This is an area where we have also seen buying pressure before, and therefore it makes quite a bit of sense that we continue to see it play a certain amount of importance.

The candlestick is closing towards the bottom of the range of the day, so that of course is negative. However, it is not necessarily the biggest candlestick so I would not be overly concerned at this point. The $10,000 level course will offer support not only from a psychologically important sense, but the structural integrity has held several times not only as support but also as resistance previously.

The 200 day EMA sits underneath as well, so that is something that is worth paying attention to, as it is grinding higher and is also a major technical indicator the people will pay attention to. Because of this, I think that it is only a matter of time before the buyers return to Bitcoin, and therefore if the US dollar does turn around and start to sell off again, then it is likely that the Bitcoin market will be one of the first places that people jump in and start expressing an anti-US dollar position.

If we were to break down below the 200 day EMA, the next major support level was at the $9000 level. The $9000 level is the absolute end of the trend, so if we were to break down below there it is very likely that the overall trend is going to collapse. We are not anywhere near there right now, so I am not overly concerned but I do recognize that we may have a little bit of noise in this general vicinity, and therefore you will have to be cautious, and keep your position size relatively small until the market starts the work your favor. However, if we break down below the $9000 level, all bets are off, and we could go much lower.