This is a market that has been trading right along with risk appetite in general, so I think it makes sense that with the massive selloff that we had seen a lot of risk appetite based assets get hammered during the trading session. For example, the NASDAQ 100 lost 5% during the bloodbath. Bitcoin got sold off in the fray, and it shows that Bitcoin continues to be more “institutionalized”, as it trades right along with the rest of the markets and not so much as an outlier anymore.

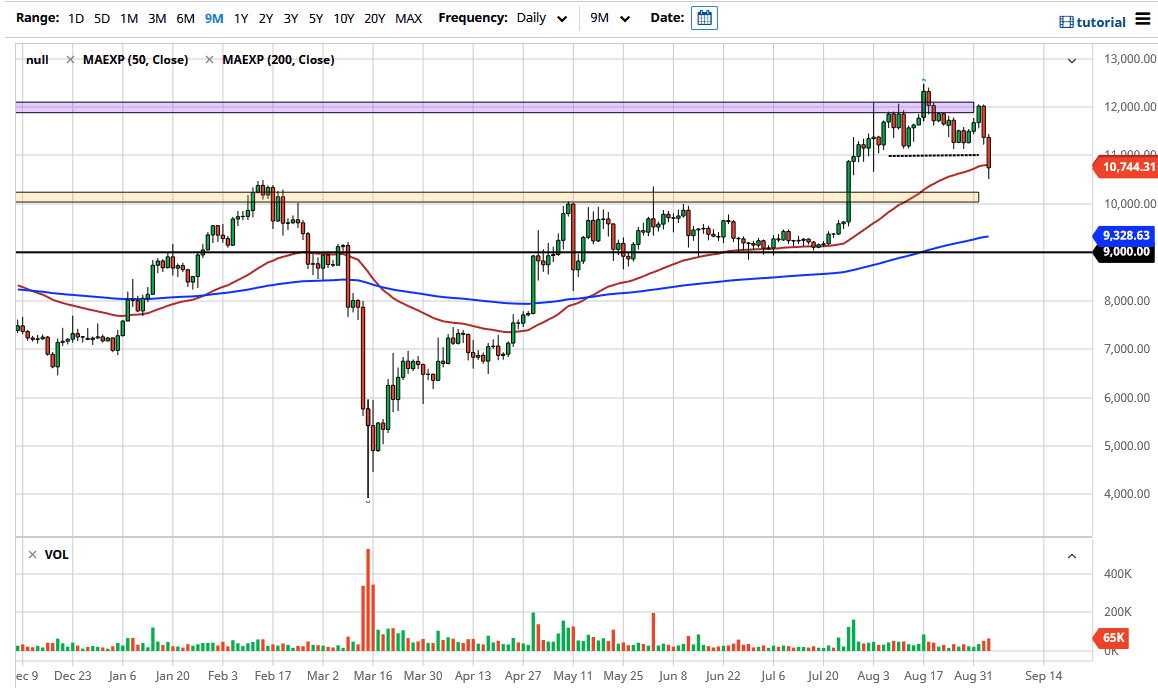

Now that we have broken down below the $11,000 level, it looks like we are likely to try to reach down towards the $10,000 level if we get any type of negativity. On the other hand, if we turn around and break out above the $11,000 level, then it is likely that we go looking towards the $12,000 level. At this point, we are still very much in an uptrend and it should be noted that the 50 day EMA is right in the middle so it is likely that the market will see a little bit of noise in this general vicinity. As long as we can stay above the $12,000 level, then it is likely that we will continue the uptrend overall.

When you look at the area that we just broke out of, you can make an argument for a head and shoulders pattern, which essentially measures for a move down to $10,000 anyway. That being the case, I like the idea of buying short-term pullbacks, but you would need to be very cautious about your position size as the volatility is probably going to increase, not shorting. Keep in mind that the jobs number comes out on Friday, and that will influence the US dollar. By extension, that is half of this currency pair, so obviously you have to pay attention to what is going on with that part of it. That being said, this is a very negative looking candlestick and I do think it makes quite a bit of sense that we drift a little bit lower heading into the Non-Farm Payroll figures come out at 830 in the morning New York time Friday.