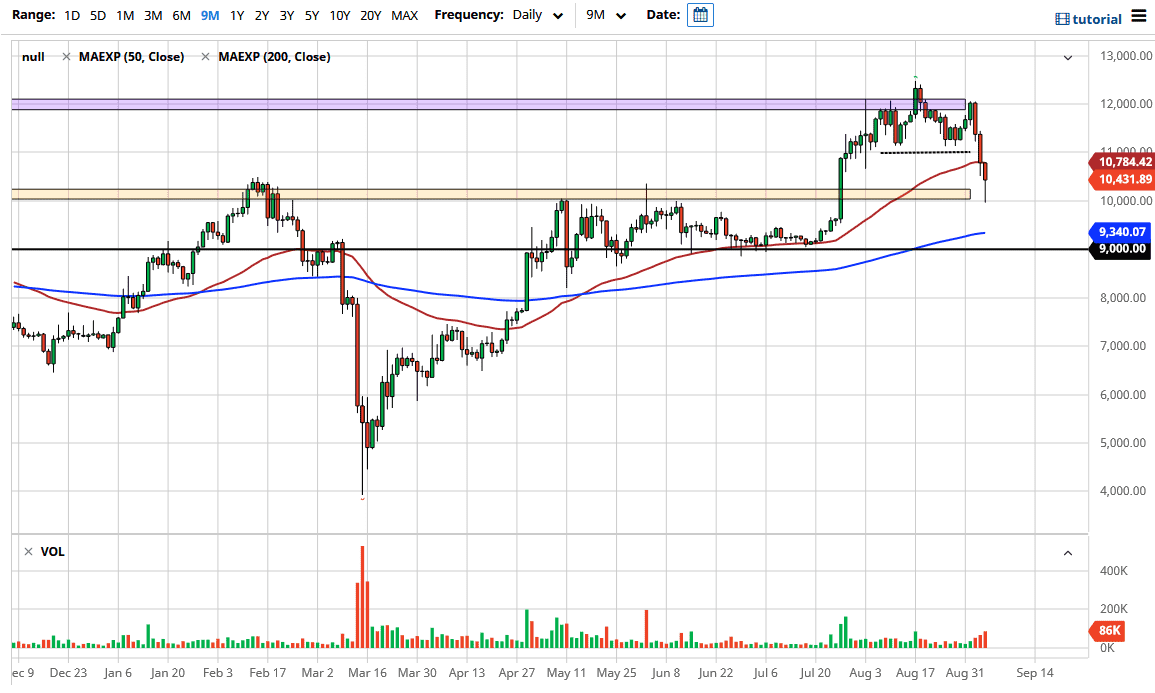

The bitcoin market fell rather hard during the trading session on Friday, as the job number came out and pushed the Bitcoin market lower to reach down towards the $10,000 level. The $10,000 level is a large, round, psychologically significant figure so it makes quite a bit of sense that the market did bounce from there. The fact that we bounced the way we did does suggest that there are buyers in this area looking to take advantage of the market being so cheap, and therefore I think it is only a matter of time before the market moves back to the upside. It will be interesting to see whether or not that continues to be the case, but right now I like the idea of looking at the $10,000 level as a major barrier to support the market.

I think given enough time, the market is likely to reach back towards the highs, especially as the structure is so supportive. Remember, Bitcoin does tend to be very volatile, so a $2000 pullback is at the end of the world, although it is roughly 15%. If you are looking for something that moves steadily and then suddenly is quite drastic, this is the market for you. To the upside, the $12,000 level of course is a major resistance barrier, so if we were to clear that then I think the market can truly take off to the upside.

To the downside, the 200 day EMA is coming into the picture at the $9300 level, so if we were to break down below there then we would test the $9000 level, which is massively supportive based upon a previous shot higher. If we were to break down below there, then the market could break down rather drastically as it would be a wipeout of the recent move higher. All things being equal, I like the idea of buying it on the dips, but I recognize also that we may have a couple of rough days still ahead of us. This will come down to risk appetite and whether or not people have a reason to move with lower against the US dollar. A break above the candlestick for the trading session on Friday would be a good sign, and probably have the market skipping over the $11,000 level at the first chance that it has.