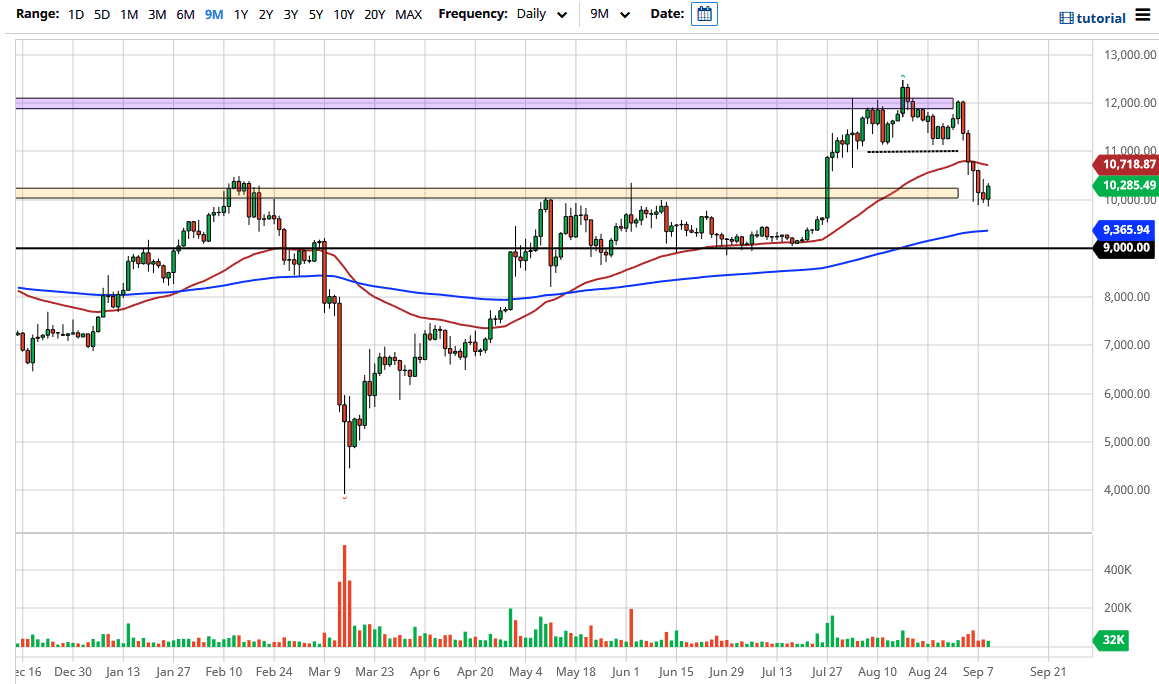

The Bitcoin market initially dipped below the $10,000 level during the trading session on Wednesday but has recovered enough to show signs of strength again. By doing so, the market looks very likely to try to go towards the 50 day EMA above, which is at the $10,718 level. Beyond that, we are looking at a potential move to the 11,000 level, followed by an even greater move to the $12000 level.

This will be driven almost solely based upon the value of the US dollar and whether or not it goes higher or lower. At this point in time, the market is likely to continue to favor anything, not the US dollar unless we get some type of major “risk-off” type of scenario. Looking at the stock markets we did see a nice recovery and it does look like we are trying to build up a little bit of confidence. This will likely translate into the Bitcoin market grinding sideways a little bit, and I also recognize that there is a massive amount of support extending all the way down to the $9000 handle. With that in mind, I like the idea of buying short-term dips, but I would not buy too much of the same time due to the fact that Bitcoin is so volatile.

At the $9365 level there is the 200 day EMA, which is just above that crucial $9000 level. I think that it is only a matter of time before the buyers will return in that area, so I am very likely to be interested in that area as well. I will be trading the Bitcoin market from the CFD markets because I can splice up my trades into multiple pieces. However, for those of you who are more longer-term inclined, the $9000 has to be your short-term "line in the sand." If we break down below there, it is very likely that Bitcoin will remain very negative, perhaps correcting quite drastically. The Bitcoin market continues to focus on the greenback, so therefore you can extrapolate some of the actions that you see the gold market right along with this chart. That being said, if you are a true believer you think that it points going to go much higher over the longer term, so this might be of value area.