Bitcoin initially tried to rally during the trading session on Monday, but then gave back the gains as there was so much strength in the US dollar. Remember, Bitcoin is essentially a currency, and as a result, you should look at this market as a Forex pair. Ultimately, you are trading BTC/USD and if the US dollar is strengthening, then it makes sense that Bitcoin would fall against it. Almost everything lost strength against the greenback, so it makes quite a bit of sense that you would see it here.

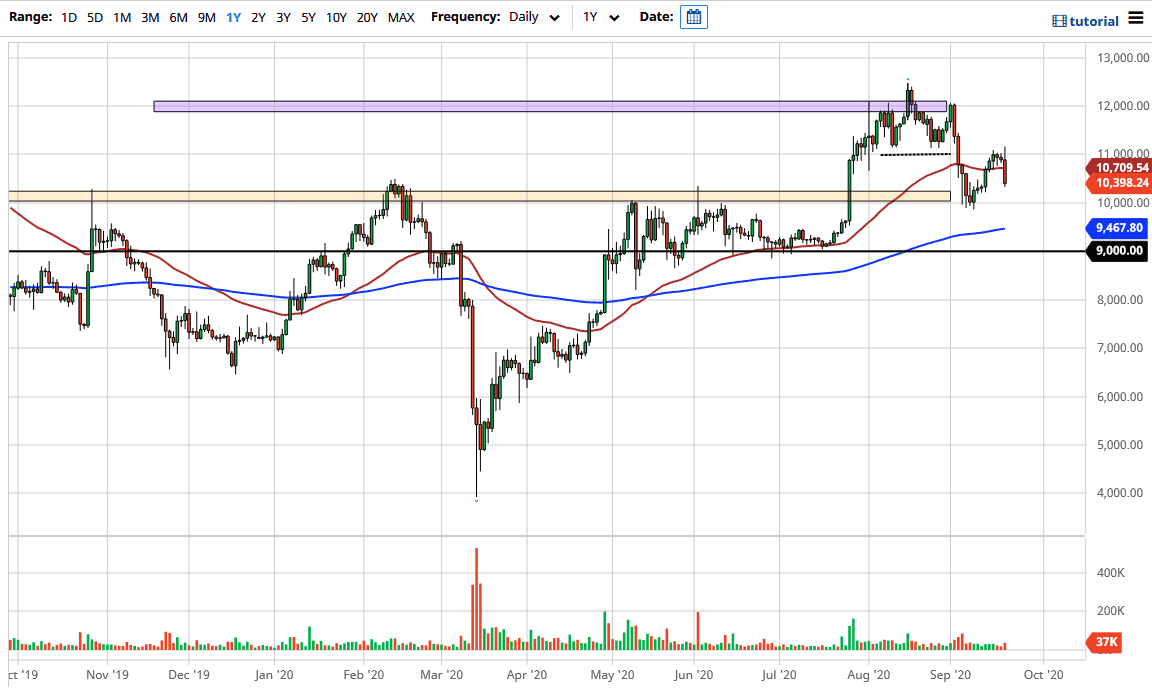

The $11,000 level has offered resistance a couple of times, as you can see over the last week or so. You can see that initially, the day started out relatively strong, but as the US dollar picked up strength around the world and people started to worry about risk appetite, they started dumping everything, including Bitcoin. As we break down below the 50 day EMA, which is currently at the $10,700 level, it is yet another bearish sign in this market. However, the $10,000 level underneath is a large, round, psychologically significant figure, and an area where we have seen recent support. The market looks soft at this point because we have broken down rather significantly during the day and wiped out at least four days if not five.

Underneath, the 200 day EMA is closer to the $9400 level, so it is likely that we may go visit that. We most certainly will if we break down below the $10,000 level, perhaps reaching down towards the $9000 level which has been extreme support recently. With that being the case, I do favor the downside, but I think we may have quite a bit of back-and-forth to go forward. However, if we were to turn around and break above the top of the candlestick for the Monday session it would be a very strong sign, and should start looking towards the $12,000 level. This was the recent highs, so I think it should be massive resistance. If we were to break above there obviously would change quite a bit but at this point in time, I think that it is going to be difficult to make happen. I think we are much more likely to break down below the $10,000 level, perhaps even down to the $9000 level after that.