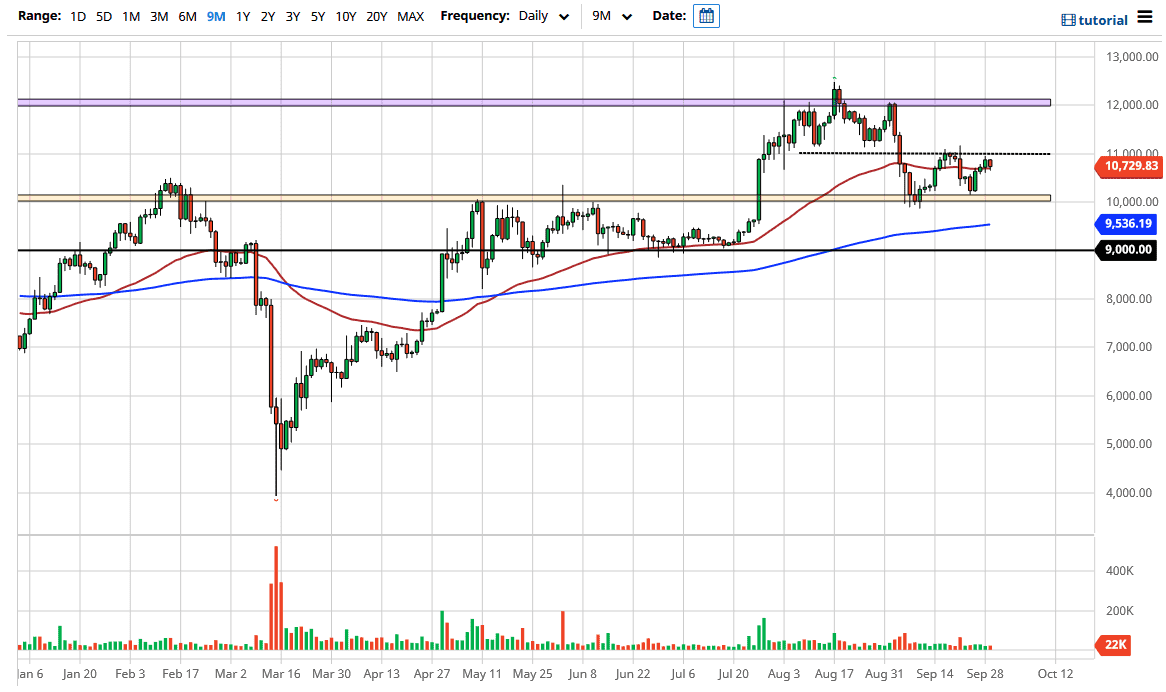

The Bitcoin market continues to oscillate in a relatively tight range, using the $11,000 level as resistance. As far as support is concerned, it is closer to the $10,000 level. Looking at the 50 day EMA right below the candlestick for the day also suggests that there is a certain amount of buying. Having said that, the market looks very noisy and I think it is only a matter of time before we have to make some type of decision. In the short term, the market is likely to go back and forth in this $1000 range, at least until we get some type of catalyst to get moving.

It is very interesting that the market is struggling a bit during the trading session on Tuesday even as the US dollar has lost some strength. Typically, if the US dollar falls, the Bitcoin market will rally as it is priced in the same US dollars. However, it was a bit of a divergence day on Tuesday. However, if we break above the $11,000 level, it is likely that this market could go looking towards the $12,000 level. There has been significant resistance in the past, and therefore I think that it will be interesting to see whether or not we can break through there.

If we were to break down below the $10,000 level underneath, then it opens up the possibility of a move down towards the 200 day EMA which is currently at the $9536 level, and below there probably go looking towards the $9000 level. Bitcoin does tend to move in $1000 increments, so it does make quite a bit of sense. Ultimately, I think that we are simply playing in these ranges for short-term moves, so you may have to look at hourly charts for a trade in the Bitcoin pair against the greenback.

One thing that you do need to keep in mind is that there seems to be a bit of a shift when it comes to risk appetite so it is possible that the Bitcoin market probably could be rather volatile. Having said that, I think one thing to keep in mind is that your position size is crucial to pay attention to as well. It will be noisy and choppy, but if you pay attention to the big figures, you can trade back and forth.