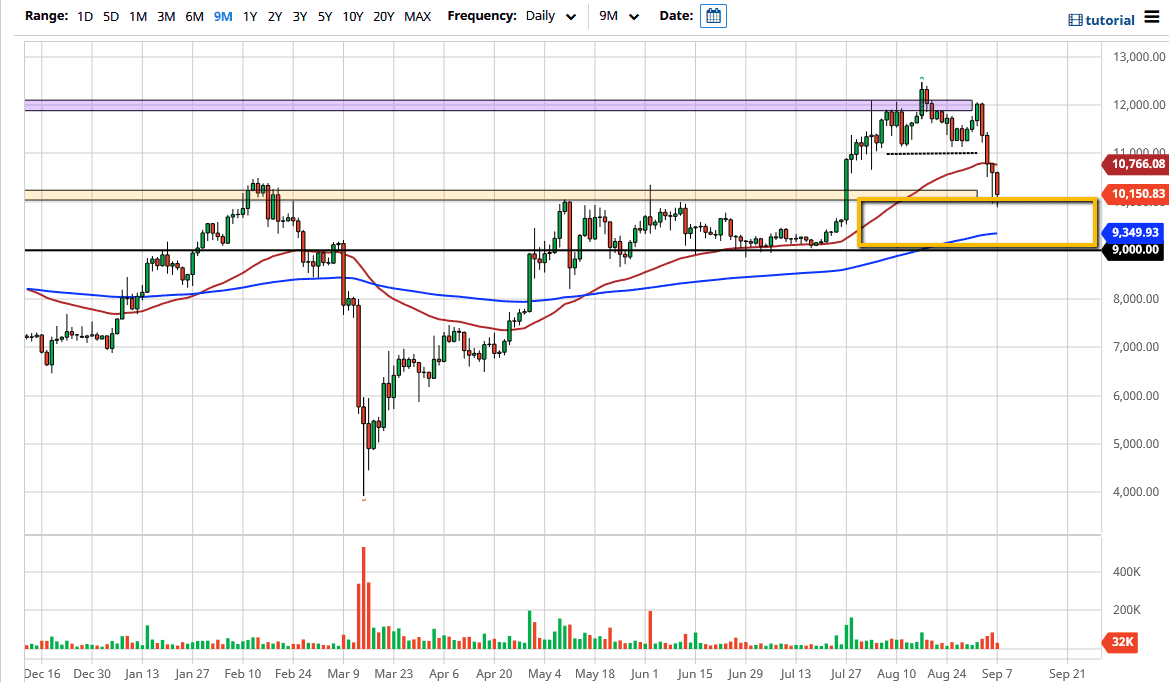

The Bitcoin market fell rather hard during the trading session on Monday as traders came back from the weekend, but you should keep in mind that it was also Labor Day in the United States, so a significant portion of the trading community simply was not there. It is worth noting that the $10,000 level has been tested again and it has in fact offered a certain amount of support. That being said, I believe that it is only a matter of time before this market continues to go higher, perhaps reaching towards the $11,000 level, followed by the $12,000 level.

It is worth noting that the $10,000 level is psychologically and structurally important, but it also begins a “band of support” down to the $9000 level. I think it is much more likely that we get a bounce from here than some type of major breakdown, but I also recognize that we are currently looking at a market that has been very beaten up over the last couple of days. Pay attention to the value of the US dollar, because it will have its influence over here as well, as the US dollar continues to drive where most currencies go, including Bitcoin.

All things being equal though, the Federal Reserve is still set to print a massive amount of currency, and I think that will continue to be the main driver in general when it comes to Bitcoin and pretty much anything else out there for that matter. “Buying on the dips” should continue to be the way most traders look at this as an opportunity, as the Bitcoin market has rallied so nicely over the last several months. This does not mean that we go straight up in the air, so even though we have had a $2000 drop, the reality is that Bitcoin is a very volatile market under the best of circumstances, although we do have long periods of time where it does nothing. The trend is still very much to the upside, so I do not have any interest in trying to get too cute here and short Bitcoin, so at this point I am likely to think more along the market moving towards the $12,000 level sooner rather than later. The Tuesday session will be rather crucial, so pay attention to whether or not it rallies. If it does, that could be the signal that we are ready to continue the overall trend.