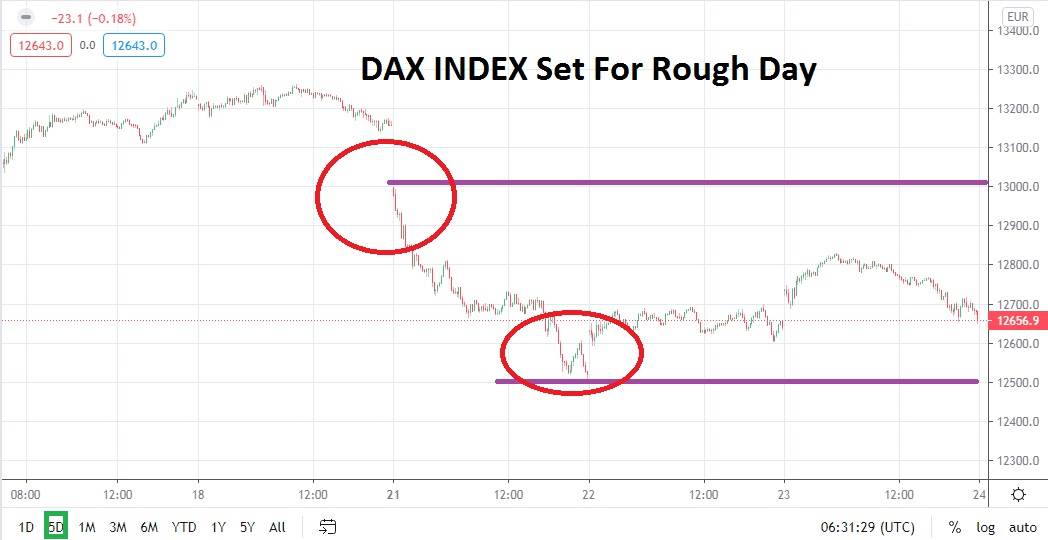

The DAX Index will face strong headwinds today as it battles negative sentiment which appears to be growing on global and US equity markets. The past month of trading for the German index has not been comfortable, yes the DAX Index did challenge highs this month, but it has stumbled the past few weeks and has seen a gradual loss of investor confidence emerge.

Traders have seen a negative opening on the DAX Index, and the 12450.00 level emerge as a likely battleground for support. While global indices have certainly been bullish during this year, the recent negative trading on indices is beginning to feel like a warning sign that a change of sentiment may be emerging. It is hard for investors to analyze real price values in equities within the current economic situation and because of central bank interventions bringing about the prevalence of ‘cheap’ money.

Speculators should count on dangerous and rough trading sessions ahead. The bull-run may not be over, but speculators should understand shadows are starting to grow that could produce more cautious situations which might affect market moves. The US presidential election is beginning to loom psychologically on stock markets. With an unknown outcome, investors cannot be blamed for starting to wonder about what will ensue economically if there is a major change in the White House administration.

The DAX Index feels the effects of global risk appetite and sudden changes which hinder the investment climate. Speculators may want to consider selling the DAX Index today, but they should do this with limit orders and not blindly participate. Support levels may be tested throughout the next two days. Yes, a bullish market could certainly emerge with a swift movement upwards, but it appears that we are about to experience more selling short term which will see support levels challenged.

Traders should be cautious today. If you choose to sell into the negative tide which does seems to be strong, you should use take profit orders also. Grab your profits when you can and do not become too greedy, because if the DAX Index does trade negatively, you can assume there will be some reversals higher which can eliminate your profitable positions quickly. In other words, when you see profits in your account, do not suddenly bet that you are about to accumulate a fortune on one trade. It can be done, but it is a speculative proposition which can see your winnings wiped out in a flash.

DAX Index Short Term Outlook:

Current Resistance: 12600.000

Current Support: 12450.000

High Target: 12750.000

Low Target: 12340.000