Today's signals for EUR/USD

- Risk 0.75%

- Trades must be taken between 08:00 and 17:00 London time today only.

Sell Trading Ideas:

- Sell position after bearish price action reversal on the H1 timeframe immediately upon the next touch of 1.1610 or 1.1570, respectively.

- Stop losses at one point above the local swing high.

- Move your stop loss to break even when the trade is in 20 pips of profit.

- Take 50% of the position as profit when the trade is in 20 pips of profit and allow the remainder of the position to run.

Buy trading ideas:

- Buying position after the bullish price action reversal on the H1 timeframe, immediately after the next touch of 1.1680 or 1.1740.

- Place stop losses at one point below the local swing low.

- Move your stop loss to break even when the trade is in 20 pips of profit.

- Take 50% of the position as profit when the trade is in 20 pips of profit and allow the remainder of the position to run.

The best way to define a "price action reversal" is for an hourly candle, such as a pin, doji, outside or even a vertical candle, to close higher. You can take advantage of these levels or areas by observing the price action that occurs at these levels.

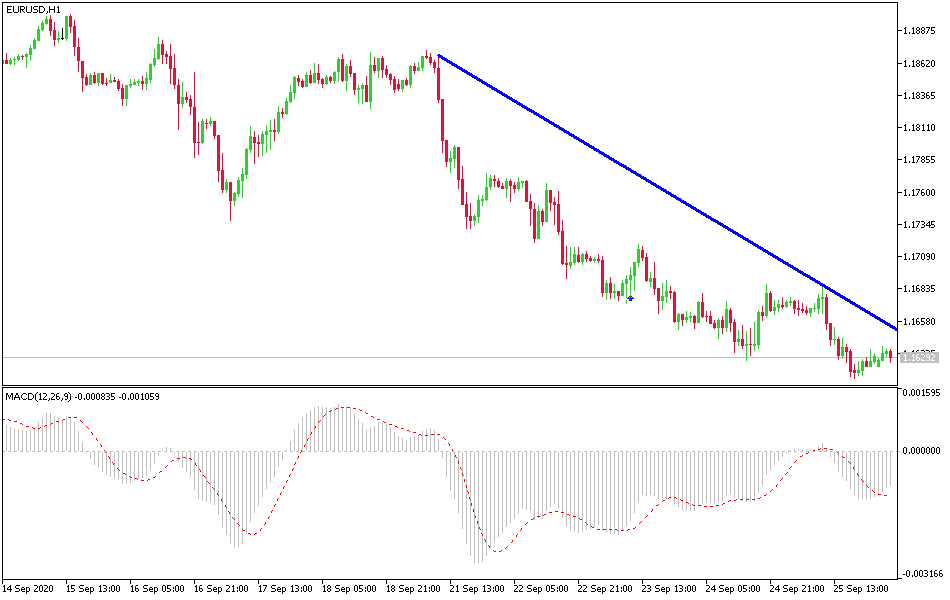

EUR/USD analysis

During last week’s trading, the bears dominated the EUR/USD performance, as the pair plummeted to the 1.1612 support, its lowest level in more than two months. The European continent is facing the specter of a new, more powerful Coronavirus outbreak. European governments, despite their economic and social suffering from the first COVID-19 wave, did not wait long, as happened at the first wave, and took precautionary measures to contain the virus outbreak, and the most prominent measures were from France, Spain, and the United Kingdom. This situation forced investors to buy the US dollar strongly as a safe haven, this demand pushed the pair to stronger support levels, which will be highlighted by technical indicators, which began to give oversold signs.

The Euro will continue to suffer from fears of the second Coronavirus wave in Europe and more concerns about the emerging economic recovery there. As downside pressure continues on the pair, DXY continues to benefit from buyers looking for safer havens. Investors concluded from the US Federal Reserve Governor’s testimony and even the Treasury Secretary that the US economy still needed more stimulus plans, and blamed Congress for the stalling of the stimulus. According to Powell's assurance, US interest rates will remain at their historical low levels near zero until at least 2023. The bank recently revised its target for US inflation to fit developments that Coronavirus imposed on the global economy.

Technically, based on the pair's performance on the chart, it is likely that the 20-day moving average will close below the 50-day simple moving average, and a bearish cross might confirm the momentum of the EUR/USD downtrend. This is a short-term optimism, despite the 2-week Relative Strength Index which is currently below the 30-level indicating that the EUR/USD pair is currently overbought.

Returning to the Euro’s level in relation to the European Central Bank policy, Philip Lane, chief economist, made it clear last week that they had impending inflation. The base case was found in the factors of the bank officials’ expectations for the next few years. This will support the recovery of the services industry and add upward pressure on inflation in the services sector. This week, inflation data for September will have an impact on the EUR, with data due on Tuesday and Wednesday from Germany, France, and the Eurozone. In Germany, the annual/headline inflation rate is likely to remain at zero, while the Eurozone in the HICP scale may remain at -0.2% making sure that the European Central Bank policy remains accommodative.

Regarding the Euro, the focus this week will be on the first remarks by European Central Bank Governor Christine Lagarde. Regarding the US dollar, the economic calendar has no influential economic data or events today.