The downward momentum is still dominating the EUR/USD performance at the beginning of an important week as markets await US jobs numbers. The bears stopped the pair around the 1.1613 support, the lowest in more than two months, waiting for any new results. The closing last week was its worst weekly performance since last April. Concern over the strength of the Coronavirus outbreak in European countries continues to impede the upward rebound after recent sales, as more restrictions to contain the outbreak mean more pressure on the Eurozone economy and thus on the single European currency against the rest of other major currencies, especially the dollar. The currency pair is trading inside a steep descending triangle amid increasing downward pressure.

On the economic side, by the end of the week, the US durable goods orders numbers for August were released, which missed expectations of 1.5% with a slight change of 0.4%. On the other hand, the non-defense capital goods performance of aircraft outperformed expectations by 0.5% with the announcement of a change of 1.8%. Durable goods orders excluding transportation missed expectations by 1.2%, recording 0.4%, while durable goods orders excluding defense beat expectations by 0.1% with a rate of 0.7%.

The Euro fell while the dollar recovered sharply last week as risk appetite faltered among investors, which led to a decline in global stock markets and increased selling in light of the continuing tensions between the United States and China, and the continued absence of American financial support for families. The ambiguity is over whether the Fed will fulfill its recent commitment to keep interest rates at zero for a while even after inflation rises above the 2% target. Among other factors affecting the Euro are the growing concerns about the Coronavirus containment in the Eurozone, and indications that the expectations of the Eurozone recovery were exaggerated and hurt confidence in the ability of the single European currency to achieve additional returns after the European Central Bank complained about the Euro’s strength earlier in September.

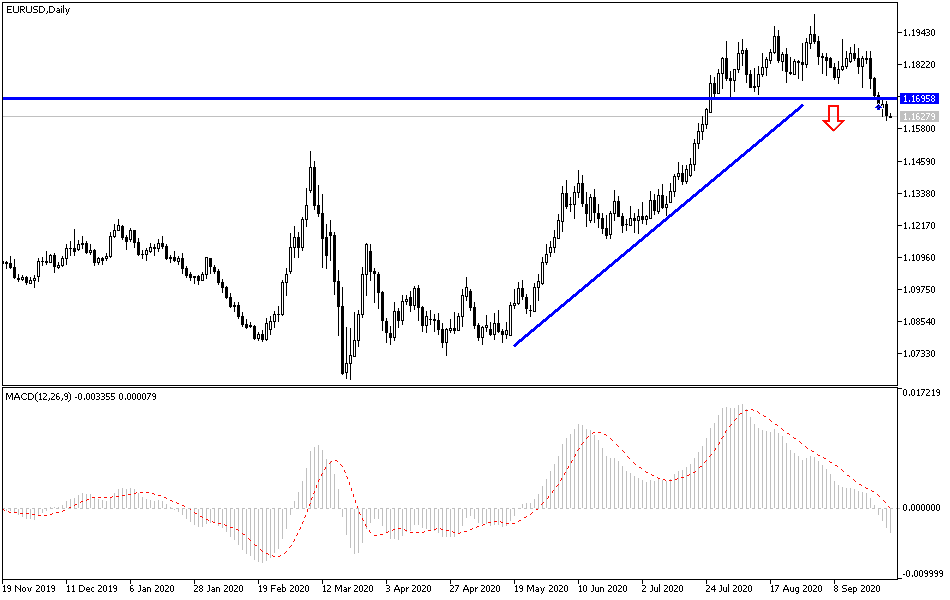

According to the technical analysis of the pair: In the near term and according to the hourly chart performance, the EUR/USD currency pair appears to be trading within a sharp descending triangle. This indicates significant downside pressure in the short term in market sentiment. Accordingly, bulls will target the short-term rebound gains around 1.1665 or higher at 1.1705. On the other hand, bears will look to extend the current lows around 1.1600 or below at 1.1550. On the longer term and based on the performance on the daily chart, it appears that the EUR/USD has made a bearish breakout from a sharp upward channel. This indicates the bears attempt to control the pair from the bulls' grip.

Accordingly, bulls will target long-term gains around 1.1747 or higher at 1.1878. On the other hand, the bears will look for profits at around 38.20% and 50% Fibonacci levels at 1.1490 and 1.1329 respectively.

Today, the pair will react to statements by European Central Bank Governor Christine Lagarde. There are no important US economic releases today.