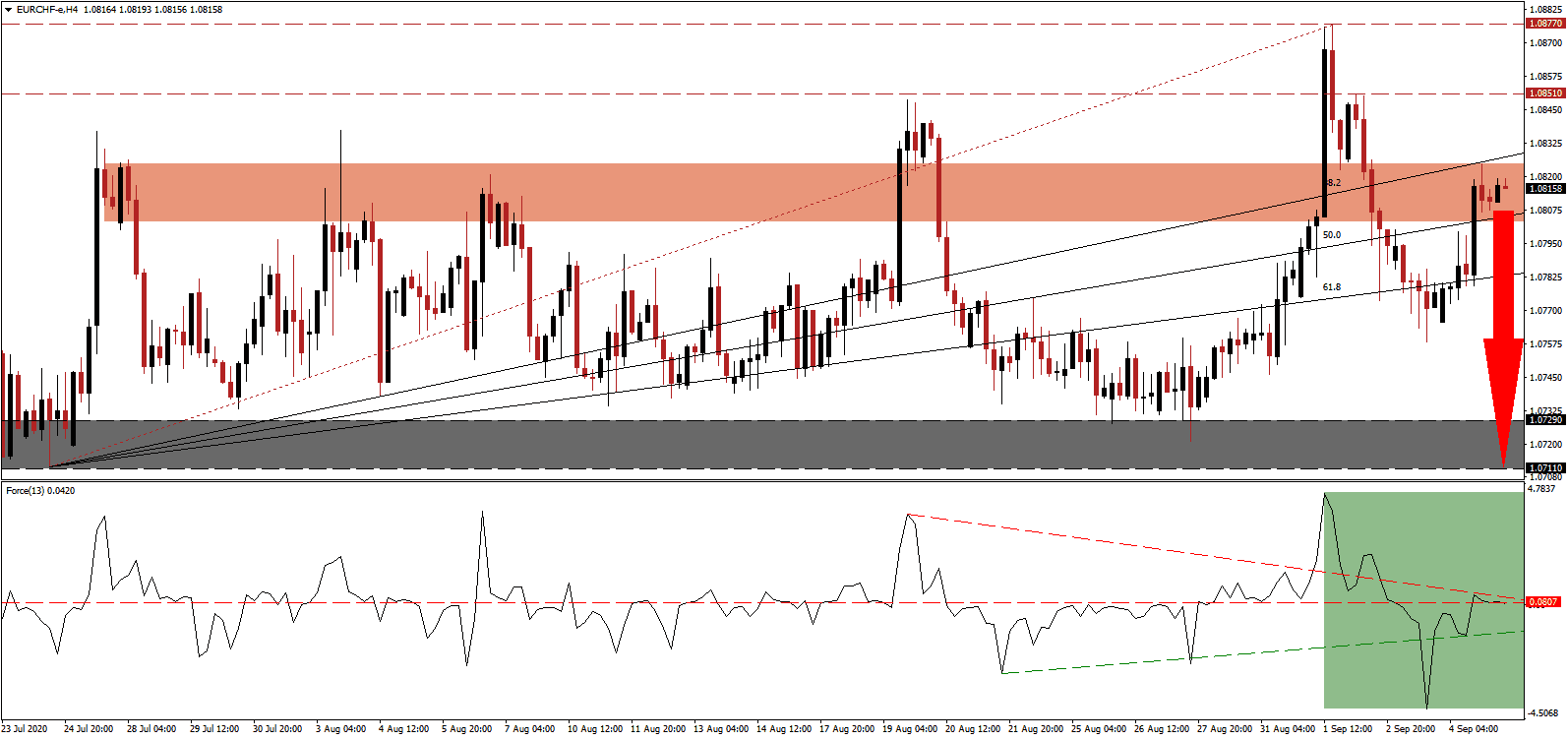

Health authorities gained a better understanding of the virus, and the government remains committed to ensuring the safety of its citizens. It closed a transit loophole allowing travelers from a high-risk county to enter Switzerland via transit through a low-risk country. The EUR/CHF advanced into its short-term resistance zone, from where fading bullish momentum is favored to lead to a correction.

The Force Index, a next-generation technical indicator, briefly eclipsed its horizontal resistance level before being rejected by its descending resistance level, as marked by the green rectangle. It is now expected to reverse the recovery off of a multi-week low and correct below its ascending support level. Once this technical indicator slides below the 0 center-line, bears will regain majority control over the EUR/CHF.

While the Swiss export-based economy is heavily dependent on global trade, the Covid-19 pandemic caused limited delays to major infrastructure programs. Switzerland is notorious for its tunnel building frenzy, opening the newest addition to its network on September 4th, 2020. The CHF 3.6 billion, 15.3 kilometers Mount Ceneri tunnel was officially inaugurated, joining the Gotthard and Lötschberg tunnels for a total cost of CHF22.8billion. The EUR/CHF is well-positioned to complete a breakdown below its short-term resistance zone located between 1.0803 and 1.0825, as identified by the red rectangle.

Despite the Covid-19 pandemic and ongoing travel restrictions or limitations, demand for second homes and holiday rentals is on the rise. According to real estate professionals, the uptrend primarily benefits smaller tourist destinations. Of particular interest are detached villas, where demand surged by as much as 25%. Fears over a second wave of the pandemic are pushing Swiss outside of crowded city centers and into smaller towns with more green space. A collapse in the EUR/CHF below its ascending 50.0 Fibonacci Retracement Fan Support Level will clear the path for an accelerated sell-off into its support zone located between 1.0711 and 1.0729, as marked by the grey rectangle.

EUR/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.0815

Take Profit @ 1.0710

Stop Loss @ 1.0840

Downside Potential: 105 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 4.20

In case the Force Index advances past its descending resistance level, the EUR/CHF could seek more upside. Given ongoing economic weakness out of the Eurozone and the potential of more stimulus by the European Central Bank (ECB), Forex traders should sell any temporary price spike. The upside potential remains confined to its intra-day high of 1.0914, from where a previous uptrend ended.

EUR/CHF Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 1.0870

Take Profit @ 1.0910

Stop Loss @ 1.0840

Upside Potential: 40 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 1.33