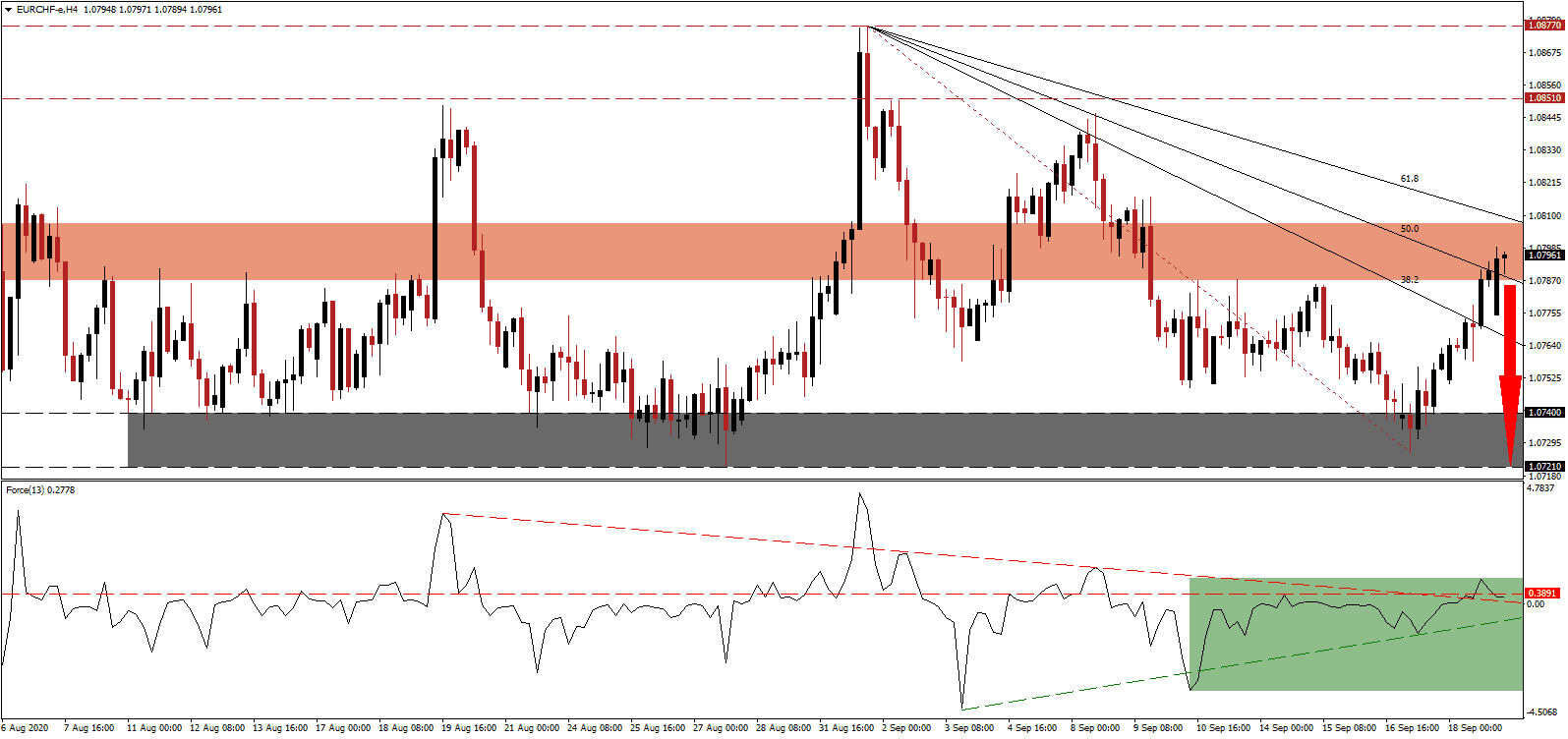

Switzerland witnessed a gradual increase in new Covid-19 infection since mid-June when it started to open its land borders and eased restrictions. The pattern repeats itself throughout the world, and the wealthy Alpine nation remains in a superior position compared to its neighbors. With a second wave of the virus expected to join the seasonal influenza virus, how the Swiss government responds will dictate the strength of the current post-COVID-19 recovery. The EUR/CHF pushed into its short-term resistance zone, but upside exhaustion set in, risking a profit-taking sell-off.

The Force Index, a next-generation technical indicator, briefly eclipsed its horizontal resistance level before retreating, as marked by the green rectangle. It is now on course to move below its descending resistance level, serving as short-term support. Bearish pressures should suffice to take this technical indicator below its ascending support level and farther into negative territory, granting bears complete control over the EUR/CHF.

Credit Suisse predicts 2020 GDP to contract just 4.0% in 2020, placing the economy well-ahead of other developed countries. The Swiss banking conglomerate, rumored to be in merger talks with rival UBS, is among the optimistic but did note that the momentum will slow down in the fourth quarter. A complete recovery to 2019 level is not forecast until the end of 2021. After the EUR/CHF moved into its short-term resistance zone between 1.0787 and 1.0807, as marked by the grey rectangle, breakdown pressures started to increase.

Swiss immigration for 2021 is forecast to reach the lowest level since 2007 following the introduction of a now-controversial bill granting freedom of movement of persons. The unemployment rate is also expected to increase from a relatively low 3.3% to 3.9% over the next nine months. Exports of pharmaceuticals and chemicals cushioned the economic fallout of the pandemic. A breakdown in the EUR/CHF below its descending 50.0 Fibonacci Retracement Fan Support Level will clear the path into its support zone located between 1.0721 and 1.0740, as identified by the grey rectangle.

EUR/CHF Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.0795

Take Profit @ 1.0720

Stop Loss @ 1.0815

Downside Potential: 75 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 3.75

Should the Force Index accelerate to the upside, guided higher by its ascending support level, the EUR/CHF may attempt a breakout. Safe-haven demand for the Swiss Franc, despite well-known market manipulation by the Swiss National Bank, continues to expand as Covid-19 cases rise. Forex traders should sell any advance from present levels with the upside potential reduced to its resistance zone between 1.0851 and 1.0877.

EUR/CHF Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 1.0830

Take Profit @ 1.0850

Stop Loss @ 1.0815

Upside Potential: 20 pips

Downside Risk: 15 pips

Risk/Reward Ratio: 1.33