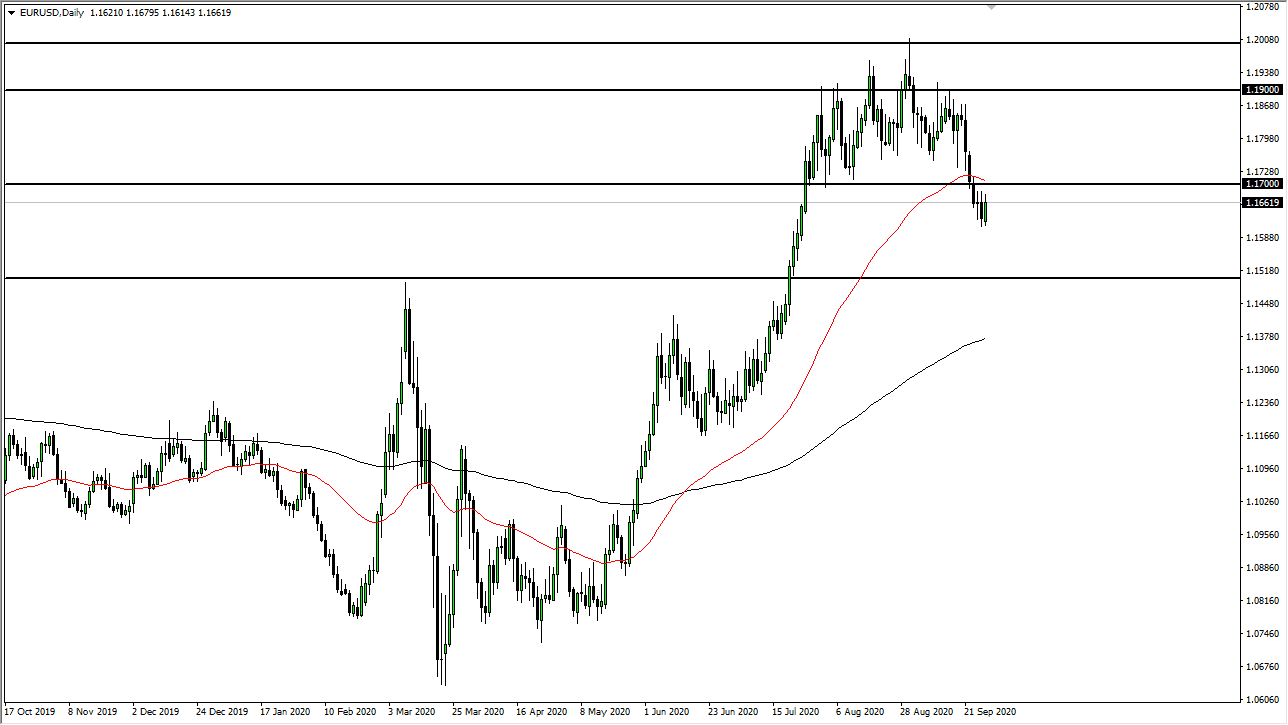

The Euro initially tried to rally during the trading session on Monday but gave back some of the gains towards the top of the range as the price looks to be a little bit gun shy when it comes to the 1.17 level. The pair had recently broken through a significant support barrier in the form of 1.17, and of course the 50 day EMA which sits right in the same area. Granted, this pair is still technically in an uptrend but obviously there are a lot of concerns when it comes to the Euro out there, as we have seen over the last week or so.

The Federal Reserve has basically stated that it has gone as far as it can when it comes to liquidity measures, and there are a lot of concerns when it comes to risk assets around the world. With the presidential election coming in just a handful of weeks, it is also going to have a lot of concern in the markets, so it is possible that might be yet another catalyst for people to look for safety. It is a bit counterintuitive, but the worst things get in the United States the more likely we are to see US dollar strength. This will be especially true because of the Treasury markets attracting more inflows.

To the upside, if we were to break above the 50 day EMA then we could have a run towards the 1.1750 level. After that, the market is very likely to go looking towards the 1.1850 level where I would see a strong possibility of even more pressure, because we have already broken down from that level. All things being equal, I think it is much more likely that we go looking towards 1.1 file level though, as this has been a major structural break down and of course the 1.15 level will attract a certain amount of attention.

Further concerns abound when it comes to the European Union due to the coronavirus figures in the fact that a lot of European governments are openly discussing further lockdowns. The market participants continue to see a lot of negativity coming out of the European Union, so it does make quite a bit of sense that it is only a matter of time before we break down even further.