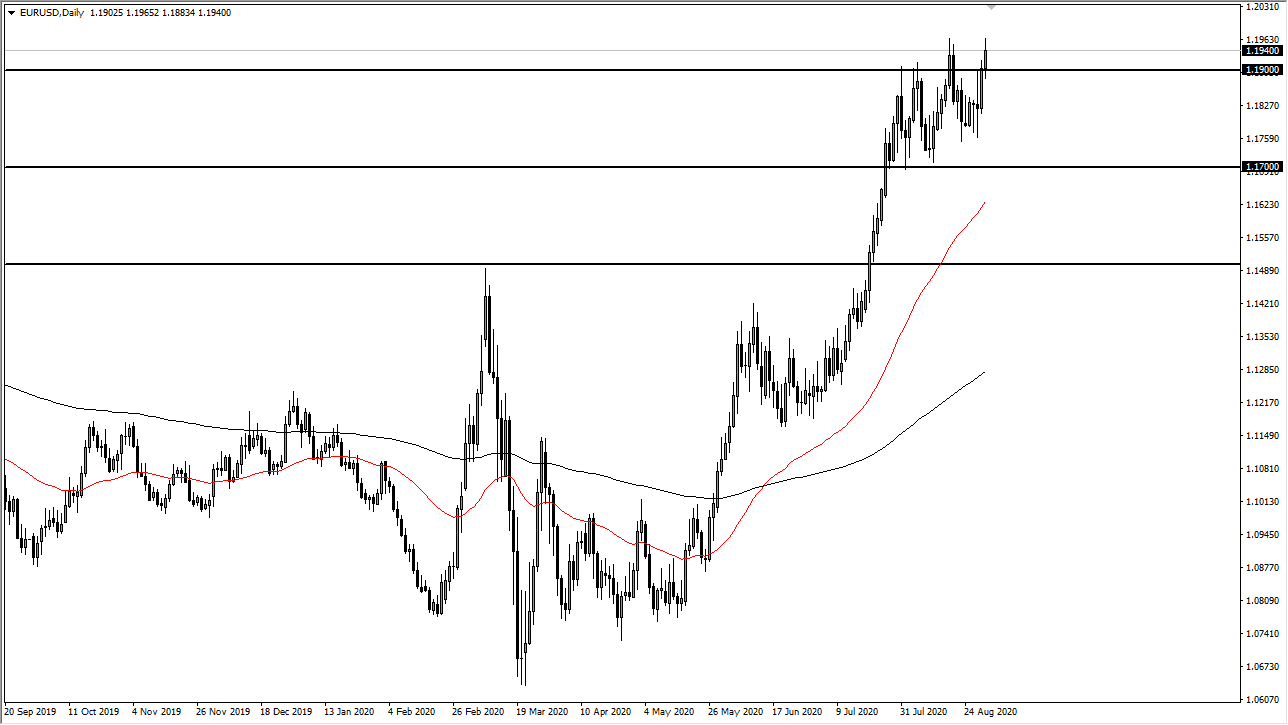

The Euro rallied again during the trading session on Monday but has pulled back from the highs as we continue to see a lot of noise between here and the 1.20 level. This is a massive barrier and it can take a lot of effort to get through, and therefore do not be overly surprised if it takes multiple attempts to get above there. The market is likely to continue to see a lot of noise in general, but I do feel that the Euro will eventually break out. Nonetheless, the fact that we could not break out during the day on Monday just the same thing.

One thing to keep in mind is that the jobs number in the United States comes out on Friday, so the later we get into the week, the more that people are going to be focusing on that. That being said, any type of move lower to signify US dollar strength will probably get squashed by the time that session is over because the Federal Reserve has already made clear what it is they plan on doing. Therefore, any reaction that suggests that they are going to tighten monetary policy will start to get sold into once the professionals get involved.

To the downside, I believe that there is a significant amount of support near the 1.1750 level, perhaps even the 1.18 level. The market has been “tilting to the upside”, which is always a sign that there is plenty of buying pressure underneath. I think at this point we will probably see a bit of a pullback, followed by more buying on the day. That has been the case for some time, so I think it makes sense that we will continue this, especially as the real news this week comes on Friday, and not in the short term.

Whenever we can break above the 1.20 level, then it allows the market to go looking towards the 1.25 handle, which is my longer-term target. That does not mean that we get there overnight, but I do think that is eventually where this pair ends up. Ultimately, it looks as if we are forming some type of up-trending channel, which mirrors a lot of the indices that I follow as well which is quite interesting.