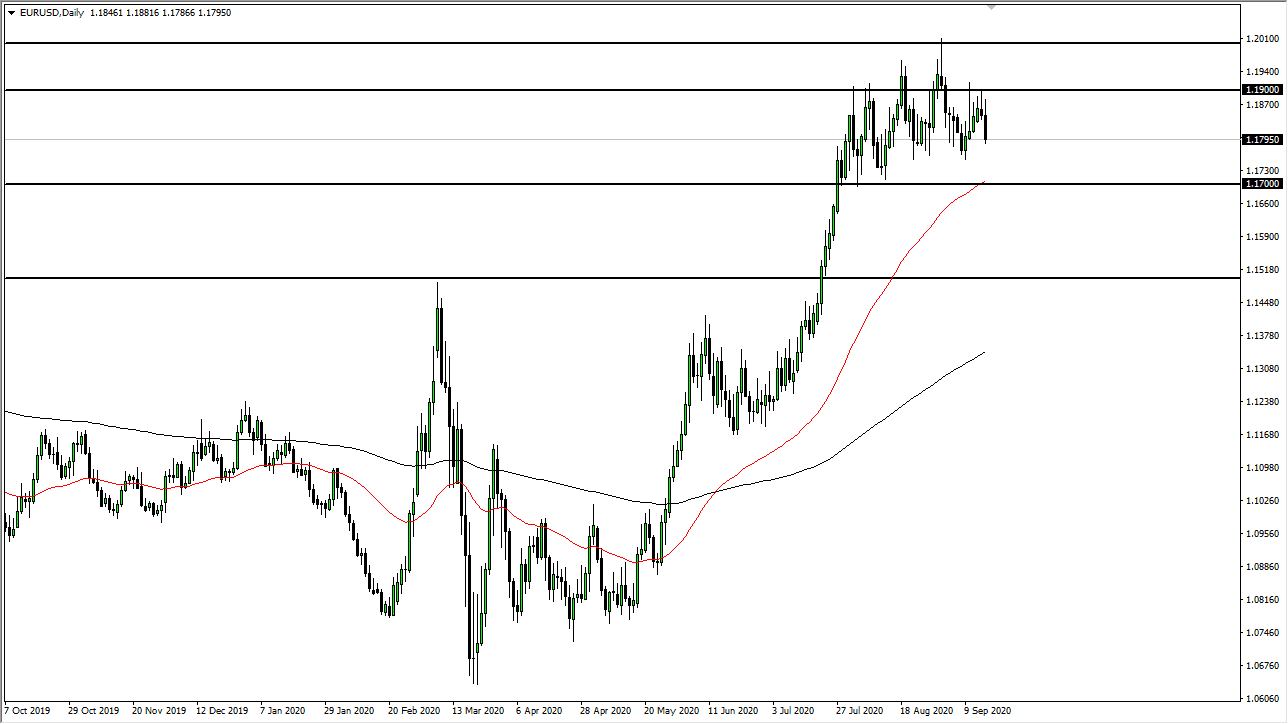

The Euro continues to look very heavy above, as the 1.19 level has offered a significant amount of resistance. The Wednesday session featured the Federal Reserve meeting and press conference, so that will have had traders paying quite a bit of attention to the questions in the press conference. At this point, it does not look like the Federal Reserve wants to rock the boat, but we have seen a lot of concerns when it comes to the economy in general, and the Euro has not looked very healthy, even before the meeting. You cannot pin this one on the Federal Reserve, because the markets started to roll over several days ago. Paragraph to the upside, it looks as if there is a massive barrier between the 1.19 level and the 1.20 level, so it is worth paying attention to. If the market cannot seem to get its act together and rally through that region, this could be the beginning of something bigger.

Needless to say, the day on Wednesday was rather volatile but at the end of the day it is obvious that the overall attitude of the market has been bullish until recently. The US dollar is worth paying attention to because it has such a major influence on other assets out there. For example, Gold markets look a little bit suspicious at the same time. If the market does not like what the Federal Reserve is doing, they will certainly throw a tantrum, and that could send more money into the Treasury market, which would drive up the value of the US dollar.

To the upside, if we can finally break above the 1.20 level it is very likely that the Euro will go looking towards 1.25 handle. As things stand, that is essentially my long-term target, but I am the first to admit that would take a significant amount of momentum building. In other words, we would need some type of catalyst. Right now, we just do not have it, and a lot of traders are starting to wonder about the European Union as the coronavirus numbers continue to get worse there, while they are flattening out in the United States. With this, I remain very skeptical of the Euro in the short term and believe that fading short-term rallies should continue to work.