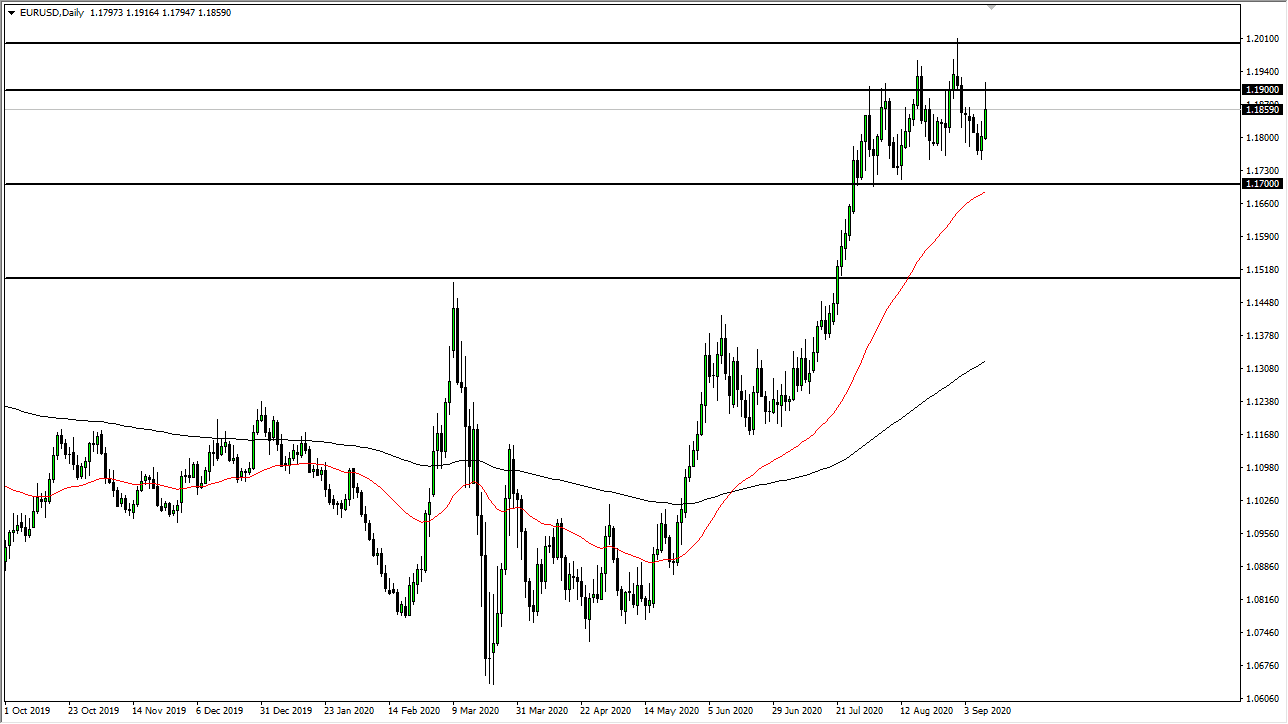

The Euro rallied significantly during the trading session on Thursday, especially as the ECB press conference started. Having said that, we gave back a significant amount of the gains and that of course is a very negative sign in general. The 1.19 level continues to be very resistive, and that extends up to the 1.20 level. In fact, the fact that we pulled back the way we did on Thursday suggests that we are running out of steam.The market could very well make a move towards the 1.17 level underneath, which is an area that has been supported. Furthermore, it is supported by the 50 day EMA, which is a technical signal.

If the market does break down below the 50 day EMA, then it is likely that we go lower and reach towards the 1.15 handle. The 1.15 level was previous resistance, and it should now be support. Market memory will be strong in this pair, but I think that as we head into the weekend, there probably will not be that big of a move as a lot of people will not want to put on a ton of risk over what could be a long weekend and of course with all of this noise it is likely that we will continue to see a lot of people concerned about the Brexit situation, which obviously has an effect on the Euro itself. All things being equal, I think that we are starting to see cracks in the ice when it comes to the Euro, so I am starting to give serious thought to the downside. However, on Friday I am not willing to switch everything and therefore I think you are probably better off sitting on the sidelines and waiting to see how the day plays out. Member, if we do break down from here, there are multiple levels on the way lower, but you should have plenty of time to take advantage of that.

As far as buying is concerned, I am not interested in doing so in the short term, at least not until we break above the 1.20 level on a daily close. If that happens, then it is likely that we go to the 1.25 handle, which is my longer-term target given enough time, but we are starting to see a lot of fear out there when it comes to the overall global economy, and that of course does not bode well for the Euro in relation to trading against the greenback.