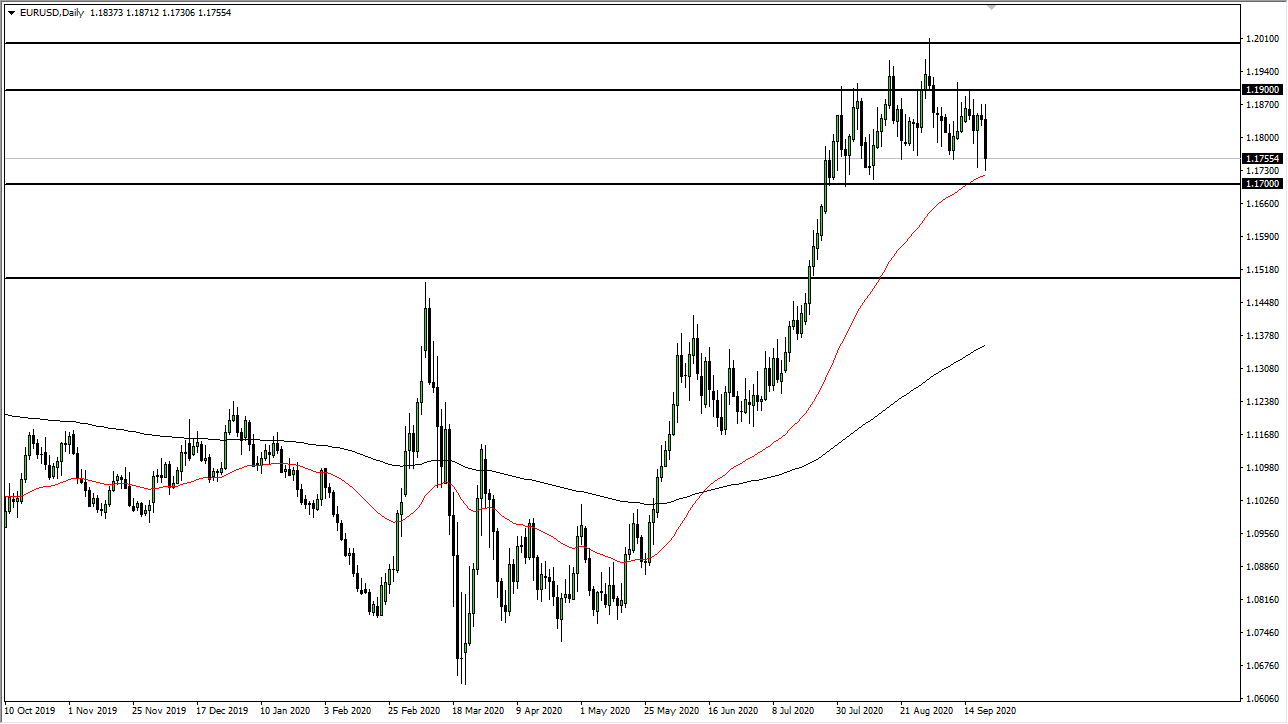

The Euro initially tried to rally during the trading session on Monday but gave back the gains and crashed towards the 1.17 level. We have been going back and forth between the 1.17 level underneath and the 1.19 level above. Because of this, the market is likely to see a lot of back-and-forth trading, but it must be said that unlike several of the other previous candlesticks, we are actually closing quite a bit closer to the 1.17 level. This only solidifies my opinion that short-term rally should be sold, as the Euro is now starting to face the reality of the European Union slowing down and the coronavirus numbers picking up as an even heavier weight around the neck.

The 50 day EMA is sitting just below and solidifies the 1.17 handle, so a break down below there would be a very negative sign as well. At that point, the market is likely to go looking towards the 1.15 level underneath which is a large, round, psychologically significant figure and an area that has been broken out of multiple times. The short-term charts will probably lead the way and it is likely that you can simply look at like 30, 15, and 5-minute charts.

As far as buying is concerned, I would be very cautious about doing so until we get some type of supportive daily candlestick, and even then, I have to look at the total situation. Ultimately, this is a market that is forming a huge topping pattern, and I think it is only a matter of time before it works itself out. However, if we were to clear the 1.20 level then we would be looking at the next leg higher, perhaps sending this market much higher, maybe reaching towards the 1.25 handle.

This is all about the US dollar currently though, so as long as the EU is soft, there are concerns out there when it comes to the risk appetite around the world, it does make sense that the greenback would strengthen in general. I think we are going to continue to see a lot of choppiness, but we are rounding the top right now and that suggests that we have further negativity ahead of us, especially as the volatility is a major problem.