For the third day in a row, the EUR/USD currency pair continues the possibility of an upward correction, gains of the retracement have stopped around the 1.1748 resistance, where it is stable around in the beginning of today’s trading, waiting for an economic calendar full of very important and influential data. The last bounce came after the pair collapsed during last week’s trading to the 1.1612 support, its lowest level in more than two months. Despite this, the Euro is considered one of the best-performing currencies in 2020, but the period of outperformance that made the single European currency topped the leader board may have come to an end with the European Central Bank lining up to warn of their discomfort with the currency's strength in the forex market.

Therefore, a series of verbal interventions regarding the currency's appreciation combined with fears of a faltering Eurozone economy to create the impression that the European Central Bank will increase its support at some point in the coming weeks, which may halt the possibility of the Euro's rise. For her part, Christine Lagarde, President of the European Central Bank, said at a hearing of the Economic and Monetary Affairs Committee of the European Parliament that the Euro was a concern and that "it is clear that the external value of the Euro has an effect on inflation."

Lagarde also indicated that measures that may hinder the rise of the Euro while strengthening the economy may be imminent. Providing an ethical framework for further intervention, the quantitative easing could see expansion again: “We are still feeling the impact of the coronavirus pandemic across the Eurozone,” Lagarde stated. Businesses are struggling, people are losing their jobs, and prospects of the future remain uncertain. “While economic activity recovered in the Eurozone during the third quarter, the recovery remains incomplete, uncertain, and erratic.” The public health crisis will continue to affect economic activity and pose significant downside risks to the economic outlook.

“In the current environment of high uncertainty, the Board of Directors will carefully evaluate all information received, including developments in the exchange rate, and regarding their implications for inflation expectations in the medium term,” Lagarde concluded. “The Board remains ready to amend all information from its instruments, as appropriate, to ensure that inflation moves towards its target in a sustainable manner, in line with its commitment.”

As is known in the foreign exchange markets, when the central bank embarks on a new path of monetary easing (lowering prices, enhancing quantitative easing), the currency it issues depreciates.

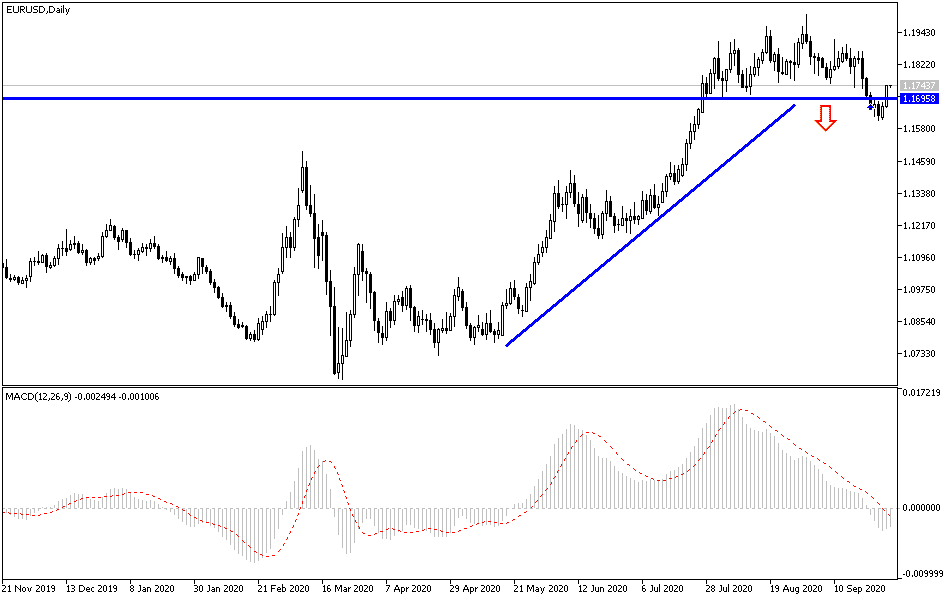

According to the technical analysis of the pair: There is no change in my technical view of the EUR/USD performance on the daily chart. The bears' dominance will continue as long as it remains below the 1.1800 level. Continued investor appetite for safe havens will not be in favor of a rebound to the upside, and therefore the support levels at 1.1690, 1.1600, and 1.1545 may be the next bears’ targets. The pair will change the bearish direction if the bulls succeed in breaking the 1.2000 psychological resistance. I still prefer to sell the pair from every upper level.

As for the economic calendar data today: Regarding the Euro, retail sales and unemployment figures will be announced from Germany. From France, the country's consumer spending and inflation figure will be announced. Then statements by the governor of the European Central Bank, Lagarde. Regarding the US dollar, the ADP survey will be announced for the change in non-farm payroll numbers, then the US GDP growth rate, the Chicago PMI reading, pending home sales, and crude oil inventories numbers.