Since the beginning of this week’s trading, the EUR/USD has been in an upward correctional range, which pushed it towards the 1.1900 resistance. Amid cautious moves, it retreated to the 1.1845 support at the time of writing, ahead of the US Federal Reserve's monetary policy decisions and the statements of its Governor Jerome Powell. Euro’s gains stalled even after the stunning results of the German ZEW survey for September, a measure widely observed as better than expected sentiment towards the Eurozone economy, and accordingly, the ZEW index, which measures optimism about the six-month outlook for the Eurozone economy, rose from a reading of 64. To a reading of 73.9 in September, and expectations were for a decline to 63. Meanwhile, the German ZEW index jumped from 71.5 to 77.4, which was surprising as expectations were for a decline to a reading of 69.7.

ZEW, or the Leibniz Center for European Economic Research, also reported that investors and institutional analysts have become less pessimistic about the current economic situation in both the Eurozone and Germany this month. Commenting on this, Klaus Festsen, chief Eurozone economist at Pantheon Macroeconomics, says, “The increase in the headline ZEW forecast has pushed the metric to its highest level since 1999, in line with the increase in the Sentix survey. This is good news for the economy, but it contrasts with the fluctuating economic surveys and the continuous increase of the virus outbreak”. He added,“ It is quite reasonable to attribute the high investor sentiment to the prevailing belief in setting policy, although this now seems a bit far off given last week’s signal from European Central Bank that more stimulus will not come, at least not in the near future.

Opinion polls conducted by the Institute on a large scale for investors and institutional analysts have risen strongly for the sixth month in a row, and have continued to recover even in the face of the second Coronavirus wave that swept the continent and prompted tighter restrictions on activity in some parts.

The Euro rose alongside the Chinese yuan after it was raised at the opening session of the week amid renewed speculation that the Coronavirus vaccine may not be far-fetched, despite the fact that the EUR/USD was not able to hold for a long time above 1.19. Chinese industrial production and retail sales numbers released Tuesday night were stronger than expected, as retail sales rose 0.5% in August, the first increase for 2020. Chinese retail sales continued to decline even after the country bounced back from the coronavirus epidemic. The end of which was overshadowed by the spread of infection to other parts of the world.

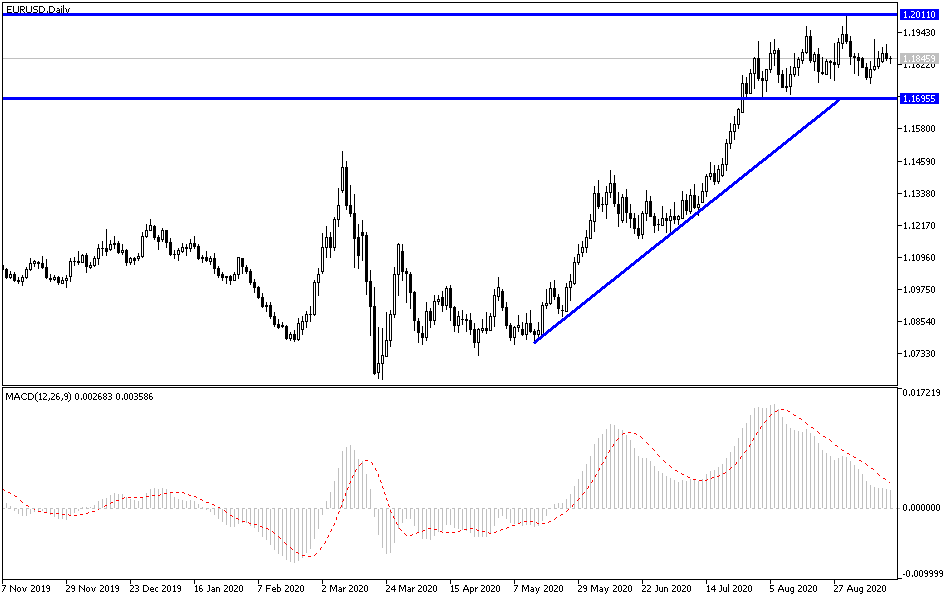

According to the technical analysis of the pair: The success of the EUR/USD currency pair-instability above the 1.1900 resistance will support stronger control of the bulls and may pave the way to test the 1.2000 psychological resistance again, from which there has been more talk about the strength of the Euro and the extent of damage from that to the European economy, which depends on Exports. In return, moves to break the general trend will succeed and sell-offs will increase if the pair crosses the 1.1752 support again.

Regarding the economic calendar data today: The beginning will be with the announcement of the Eurozone’s Trade Balance figures. From the United States, retail sales figures, the interest rate decision from the Federal Reserve Bank, its policy statement, and the statements of the bank’s governor, Jerome Powell, will be announced.