Today's signals for the GBP/USD

- Risk 0.75%

- Trades must be taken before 17:00 London time today.

Sell Trading Ideas:

- Sell position after bearish price action reversal on the H1 timeframe immediately upon the next touch of 1.2725 or 1.2660, respectively.

- Stop losses at one point above the local swing high.

- Move your stop loss to break even when the trade is in 25 pips of profit.

- Take 50% of the position as profit when the trade is in 25 pips of profit and allow the remainder of the position to run.

Buy trading ideas:

- Buying position after the bullish price action reversal on the H1 timeframe, immediately after the next touch of 1.2850 or 1.2920.

- Place stop losses at one point below the local swing low.

- Move your stop loss to break even when the trade is in 25 pips of profit.

- Take 50% of the position as profit when the trade is in 25 pips of profit and allow the remainder of the position to run.

The best way to define a "price action reversal" is for an hourly candle, such as a pin, doji, outside or even a vertical candle, to close higher. You can take advantage of these levels or areas by observing the price action that occurs at these levels.

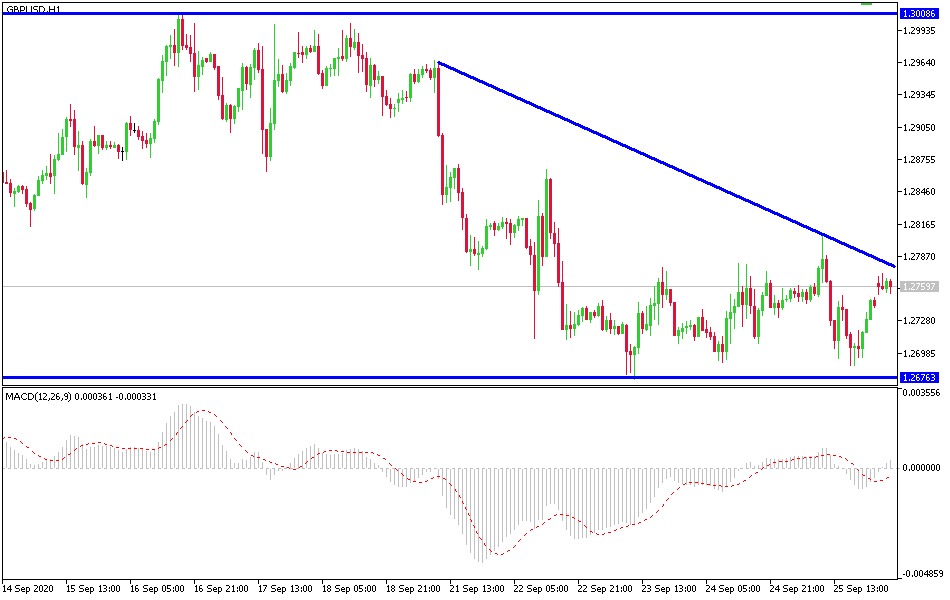

GBP/USD Analysis

As I mentioned a lot, Brexit has always been the most influencing factor on the future and movements of the pound in the forex exchange market versus the rest of other major currencies since 2016, but with the advent of the worrying 2020 year in global financial markets, the pressure factors increased on the pound. Besides Brexit, there was a global economic weakness. Due to the outbreak of the deadly Corona epidemic and recently the hint by the Bank of England to the possibility of passing negative interest rates as one of the tools to stimulate the British economy in the face of the pandemic effects. Combined, these factors were a catalyst for the bears to quickly push GBP/USD towards the 1.2675 support during last week's trading, the pair's lowest level in two months before the beginning of the week’s trading, around the 1.2760 level.

The selling wave of the pair will not end as long as the mentioned factors persist. The US currency recovered recently, as investors demanded it as a safe haven, which contributed greatly to the recent losses of the pair, while the Conservative government led by Boris Johnson has imposed new restrictions to contain the new outbreak of the epidemic.

When will the British pound resume its rising?

There will be no real and effective bounce for the pound against the rest of the currencies in the coming days without a possible positive shift in Brexit trade talks and reaching a final agreement. Brexit talks will continue in the coming days, starting on Tuesday and culminating on Friday with the chief negotiator meeting. A controversial and so-called equal opportunity agenda will dominate this week's talks, while the two sides will have only two weeks to reach an agreement from that point before the deadline of October 15, 2020.

On another level, the market focus is likely to shift towards the first three televised election debates in the United States, in which US President Donald Trump and opposition candidate Joe Biden from the Democratic Party appear, and investors are looking to see if the remainder of Biden's comfortable lead on the ballot can stay on during his discussion with Donald Trump.

The prevailing view in the market is that a Biden presidency will be bad for the dollar, partly due to the expectation that democratic administration will favor bigger government and more onerous regulations that usually stifle business, as well as more spending.

Technically: the GBP/USD currency pair is still in the range of a descending channel since the pair abandoned the 1.3000 psychological support - currently psychological resistance - the current bear's domination may push the pair towards stronger support levels. The 1.2500 support would be a legitimate target on the daily chart. In the near term, the selling operations pushed the technical indicators into oversold areas, and the opportunity is now awaiting an upward rebound.

The pair IS not expecting any economic data or important events during today's trading.