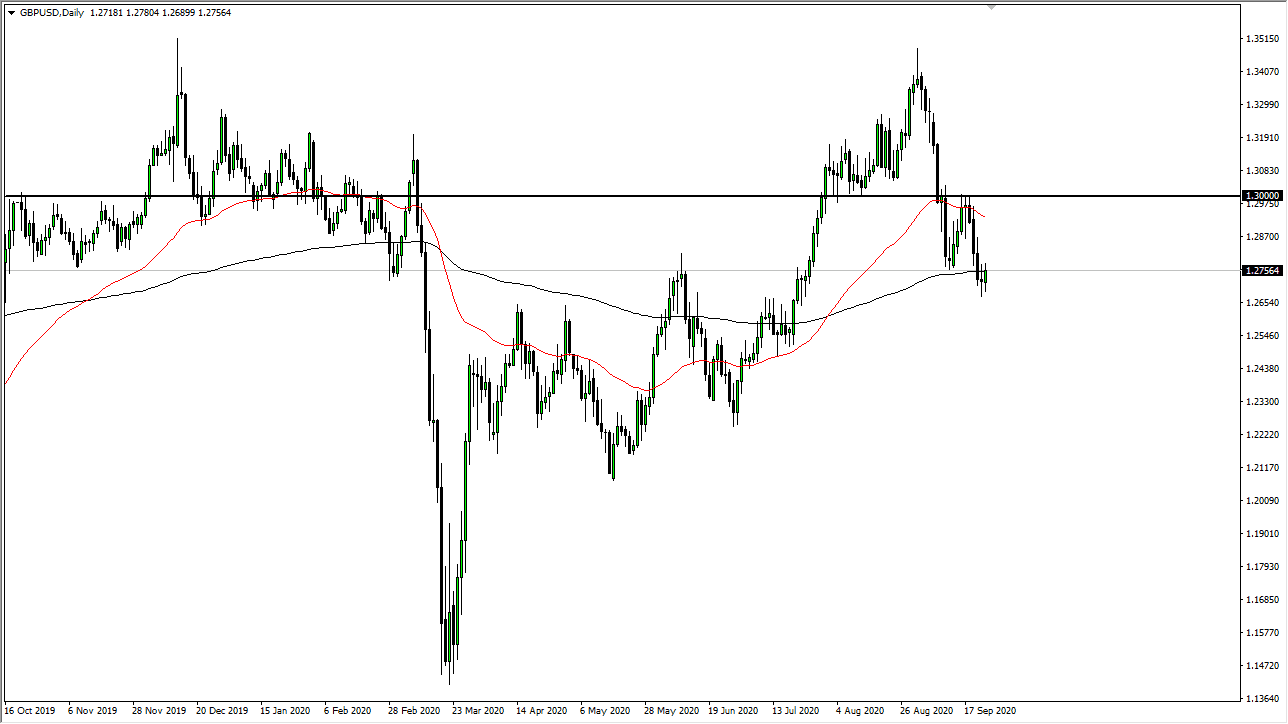

This is a market that is dancing around the 200 day EMA that a lot of traders will pay attention to. If we can break down below the bottom of the candlestick from the Wednesday session, then it opens up the “trapdoor” to lower levels, most specifically the 1.25 handle which I think is going to be the longer-term target. In the meantime, a bounce is most certainly possible, so keep that in mind.

Looking at the chart, we have had a recent bounce but broke down below the recent low to make a “lower low.” Because of this, I think we are going to continue to “sawtooth lower”, meaning that we will bounce occasionally but sell into it and grind lower. This makes quite a bit of sense considering that the United Kingdom is likely to close down its economy, and of course the strengthening coronavirus figures will continue to cause major issues there. That certainly is not going to be good for the British pound, so rallies should be thought of as buying opportunities for the US dollar.

All things being equal I believe that the market continues to favor the greenback, and the oversold condition of the US dollar is finally becoming somewhat unwound that. When you look at the US Dollar Index, we have bounced from a major trend line and have even broken out from a certain amount of consolidation. For this pair, I have no interest in buying it anytime soon, at least not until we break above the 1.30 level, and even then, it would have to be on a daily close. The trend has decidedly shifted lower, and at this point it makes sense that we go looking towards that bigger level. The candlestick later in the day is starting to look less and less desirable, so I do think that there are plenty of sellers above waiting to jump in and punish Sterling. Brexit headlines of course can come in and wreak havoc occasionally so keep your position size reasonable.