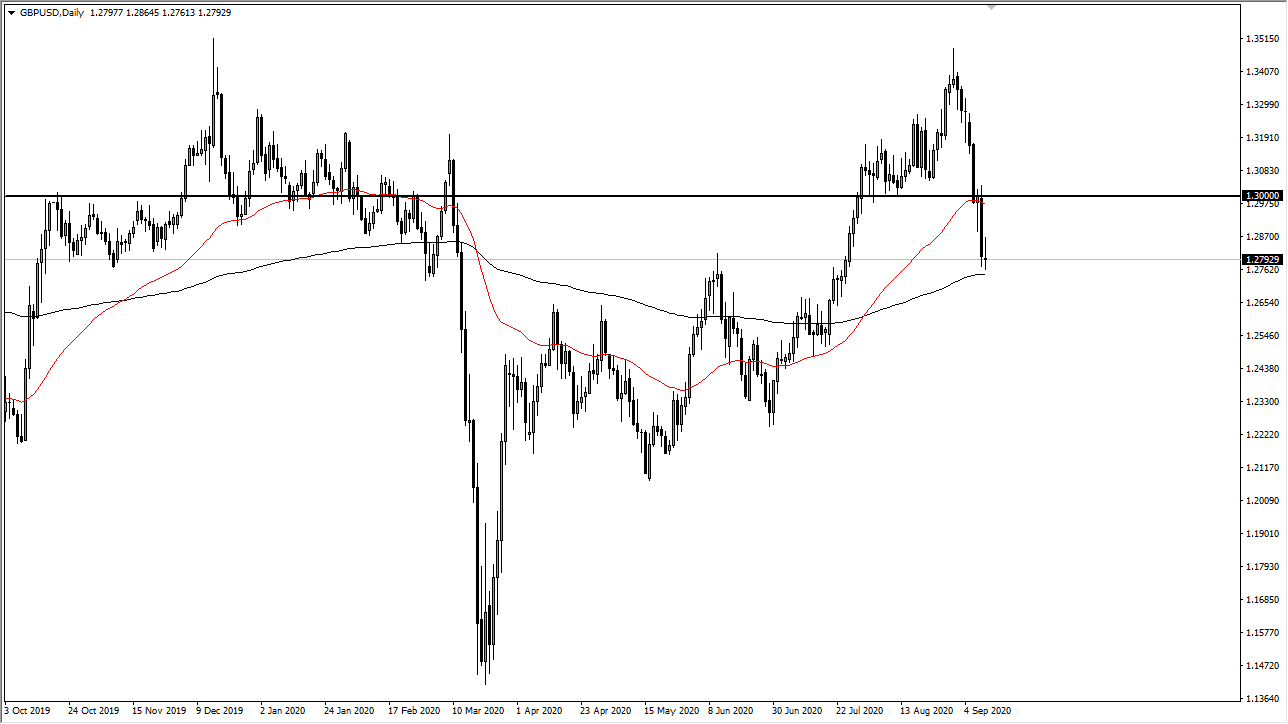

The British pound has looked horrible over the last several sessions as we are back to trading on the latest rumor or tweet based upon whatever nonsense is going on with Brexit at that particular moment. This is going to be a very difficult market to trade, but it must be said that the Friday candlestick looks horrible. The 200 day EMA sits just below, so that could offer significant support. Furthermore, if we were to break above the top of the candlestick on Friday, then it would turn this candlestick into an “inverted hammer.”

By breaking below the 200 day EMA, longer-term traders will probably continue to sell the British pound, perhaps reaching down towards the 1.25 handle. That level will attract a lot of attention as it is a large, round, psychologically significant figure, and the trading public, on the whole, will be paying attention to this. Because of this, we could see a bounce from there as well. Regardless, even though there are a lot of concerns when it comes to the British pound due to Brexit, the reality is that we are short-term oversold so I would not be surprised at all to see a bounce.

As far as trading this market is concerned, you really should not be doing so right now. However, if you feel the need to do so then you should use smaller than usual trade positions as you may find yourself suddenly 200 pips down based upon some rumor. That is a very difficult set of circumstances to trade in, and I have seen a lot of retail traders get wiped out by Brexit in the past, and based upon what we have seen over the last several sessions, it looks like more will be liquidated relatively soon as well. In fact, I think about the only thing you can count on in the British pound right now is that it is going to be extraordinarily erratic. Quite a few professional traders that I know do not even bother looking at it at this point, because it is trading on its own again, as of last week. It does not matter if the US dollar is rising against everything, it may not be against the British pound. Obviously, the inverse can be true as well.