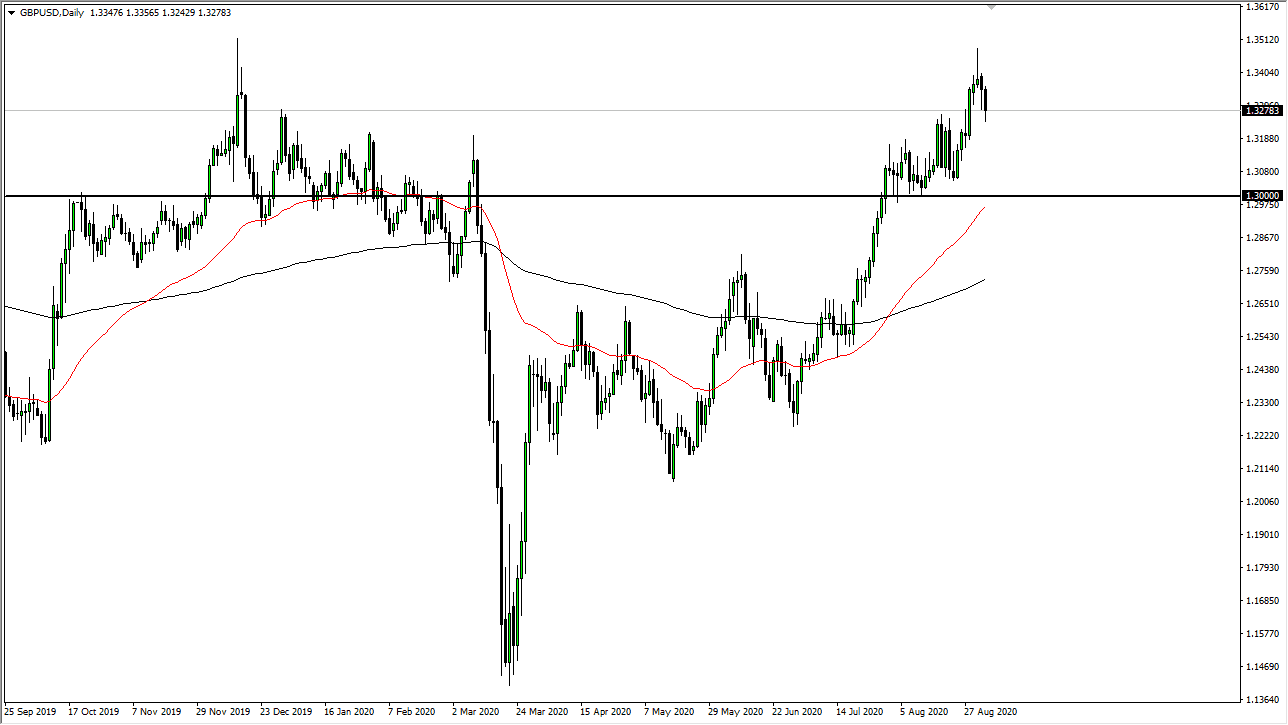

Ultimately, this is a market that has been very bullish for some time and the fact that we broke down should not be a huge surprise as a lot of people will be worried about taking too much risk on ahead of the US jobs number. That being said, after we get the jobs number it could be a complete reversal. I expect a lot of volatility during the trading session on Friday, but ultimately, we are still in an uptrend so one should not be overly concerned whether or not that has changed. At this point, it is a simple decision as to whether or not we have found enough support underneath to continue going higher, or if we are going to have to go a bit lower in order to find enough support.

Regardless, you will notice that I did not mention shorting the British pound. This is because it is only a matter of time before the uptrend continues unless something changes rather drastically. For me, the decision point is at the 1.30 level, so as long as we stay above there it is difficult to short this market. I would rather ride the trend than try to fight against it, which is a great way to lose money. That being said, I think it is only a matter of time before the buyers return so it is a matter of being patient. The main reason that I will not take a trade now though is simply because I know how much noise and volatility can be brought into the markets during that announcement.

The 50 day EMA is sitting just below the 1.30 level, so I think it is only a matter of time before traders would be interested in that area as well. The Federal Reserve continues to work against the value of the greenback it seems like the markets are willing to go right along with that. Ultimately, this remains a “buy on the dips” type of scenario so that is what I am going to do. Sometimes we get paid to wait, and this is one of those times currently as far as I can tell