The market is very likely to continue the overall trend because this has nothing to do with the economy, just the fact that the Federal Reserve is flooding the market with currency. That generally works against the value of a currency, and we are seeing that in spades when it comes to the greenback against most currencies, not just the Euro.

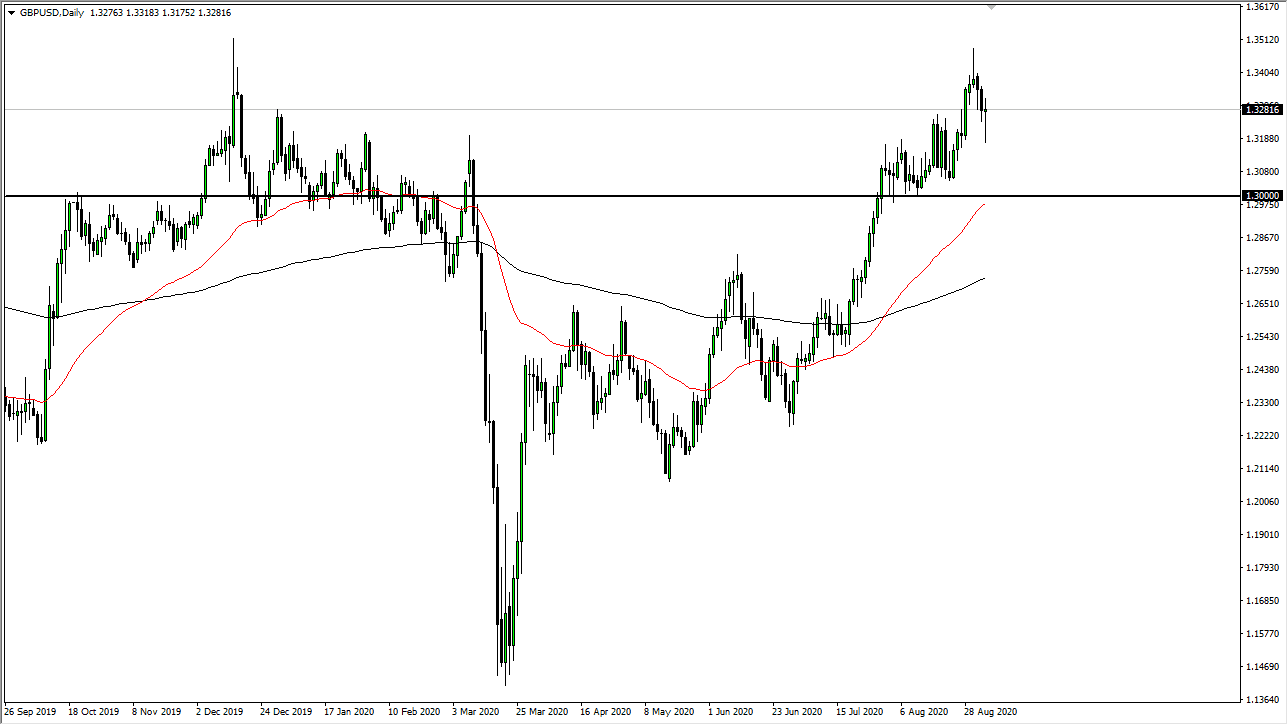

Looking at the candlestick for the trading session on Friday, you can see that we have formed a massive hammer, which is a very bullish sign. Hammers are acknowledged by a lot of technical traders out there so it will attract a lot of attention. It should be noted that the 1.32 level offered quite a bit of support, and the market bounced 80 pips from the bottom after the jobs number came out. With that being the case, it looks like we are ready to go much higher, but we probably have to build up enough momentum to finally break above the 1.35 handle, a large, round, psychologically significant figure. Breaking above there should open up the flood gates to the next move higher, perhaps as high as 1.40 given enough time.

In the meantime, I like the idea of buying dips as it offers value in a very obvious and significant uptrend. The market is one that cannot be sold, at least not until we break down below the 1.30 level at the very least. I even believe that the 1.2750 level is likely to offer significant support as well, as the 200 day EMA is sitting right there. The market should continue to find plenty of buyers in that area, assuming that we even get down there. All things being equal, I do not have any interest in shorting this market and therefore I think that this is a “long only” type of scenario. To the upside, I believe that it is going to take a significant amount of momentum to finally break above the 1.35 handle. The US dollar continues to be the main driver of all currency pairs, so I do not think this has anything to do with the British pound.