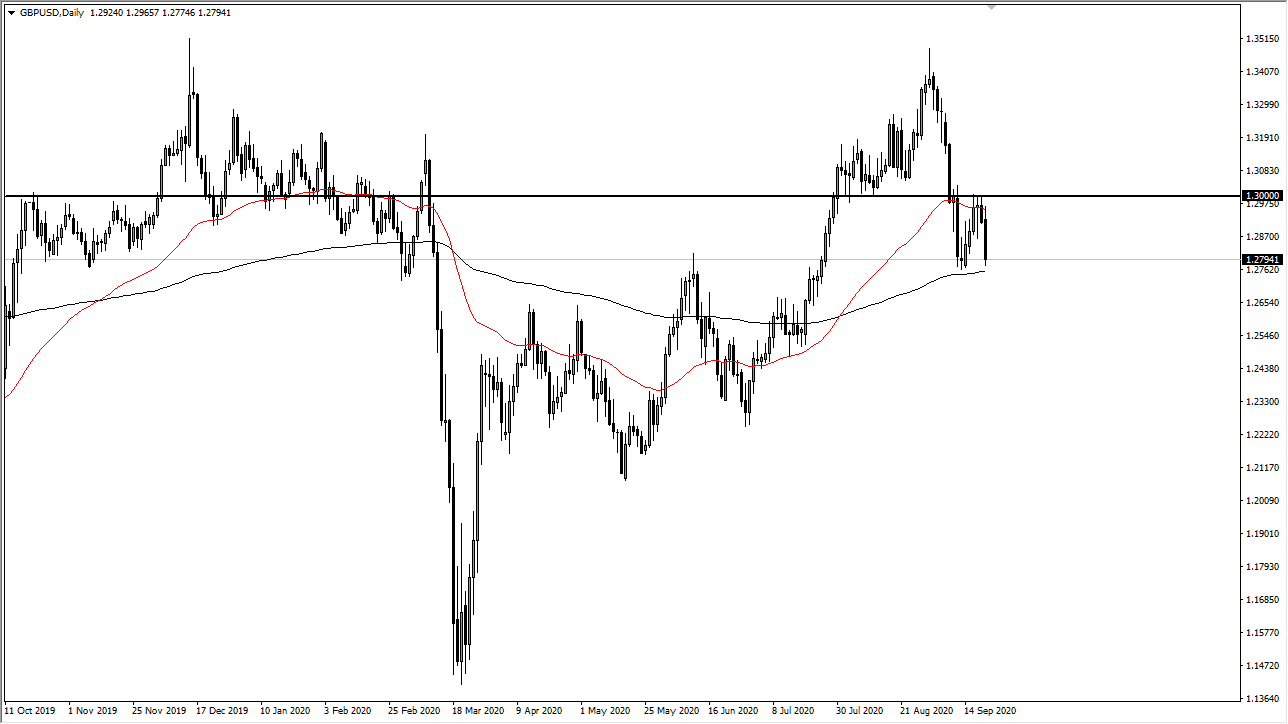

The British pound initially tried to rally during the trading session on Monday but gave back the gains at the 50 day EMA. The market then sliced all the way down to the 1.28 handle, which is also where the 200 day EMA sits. If we break down below the 200 day EMA, then the market is likely to unwind down to the 1.25 handle which is the next large, round, psychologically significant figure and where we have seen a previous impulse higher.

The candlestick for the trading session suggests that we are going to continue to see downward pressure, and with Brexit out there still hanging over the head of the British pound and the British economy, it does make sense that we are going to struggle with this pair. Furthermore, there is also the likelihood of the British pound getting hit due to the fact that the United Kingdom is very well going to be locked down. If that is the case, that can only be bad for the Pound, and therefore it is likely that the pair continues going lower. The bounce from the 200 day EMA suggests that we are going to see a bit of a fight here, and this does not make much of a surprise, considering that the candlestick was a bit extended at the moment. However, it also looks very likely that we will continue to fade short-term rallies, so if you have the proclivity to trade shorter-term charts, you should continue to get multiple opportunities.

As far as buying is concerned, it is very difficult to imagine a scenario in which I would be doing so right now, but I suppose the easiest trade to take to the long side would be if we get a daily close above the 1.3050 level, something that would probably take a couple of days to occur, so therefore I am not even looking at it right now. I think at this point all we need is some type of negative headline to push this pair lower, as it seems to be following everything else out there when it comes to the US dollar and risk appetite in general. Expect volatility but after the extreme negativity we have seen of the last couple of weeks, it is obvious that the momentum is still to the downside in general.