The British pound rallied rather significantly during the day on Monday, breaking the back of the inverted hammer that was formed on Friday. While this in and of itself is a very bullish sign, in this particular scenario it is a bit difficult to get overly bullish of the British pound because there are so many clowns out there that are more than likely going to cause some kind of problem.

What I mean by this is that there are plenty of politicians that have their fingers in the pie at the moment. The British Parliament is getting ready to vote on whether or not Boris Johnson can go ahead with potential moves to break out above a deal with the European Union. Although part of it is possibly illegal from an international law standpoint, the question is whether or not the UK Parliament will vote to go along with it, and whether or not the European Union will soothe the United Kingdom? Recently, the EU has suggested that it may do that, although in the end, it is a bit difficult to imagine who really benefits from this situation.

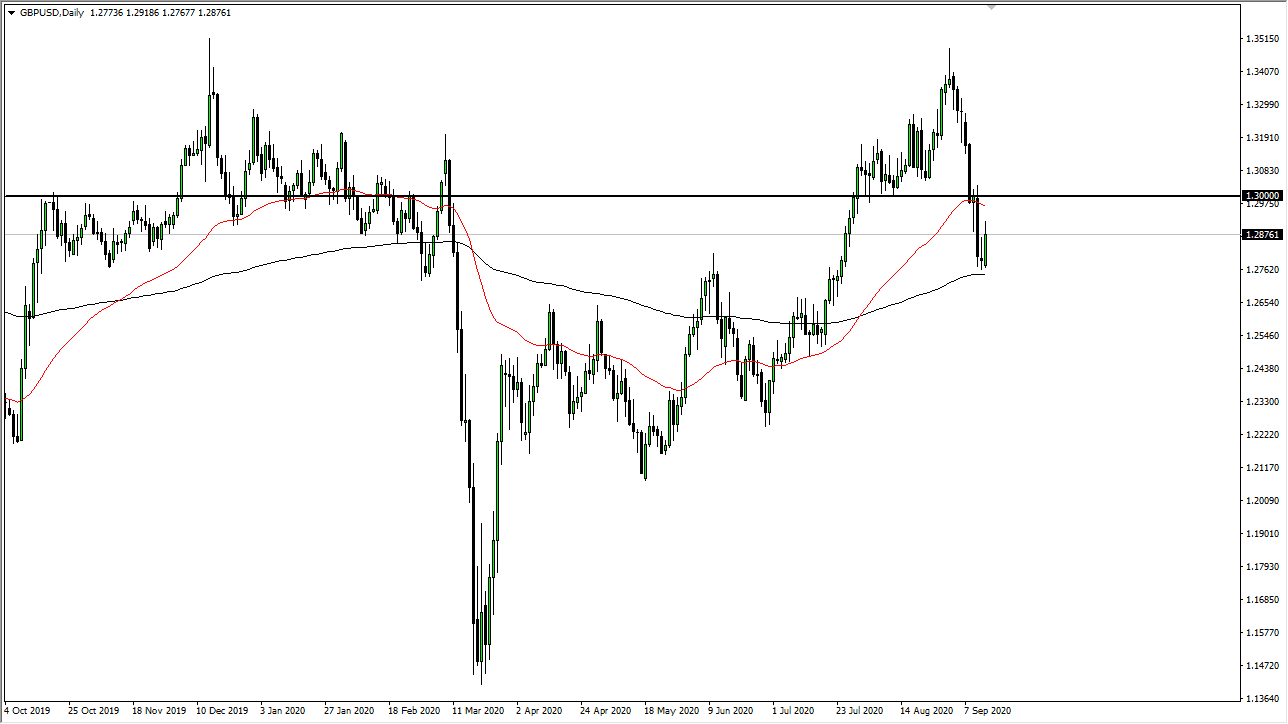

From a technical analysis standpoint, we have bounced from the 200 day EMA so that helps from a bullish perspective, and breaking above the top of that inverted hammer is also a bullish sign. Under normal circumstances, I would be buying the British pound hand over fist at this point, but unfortunately, somebody somewhere will say something that moves this pair 200 pips before you know it. That is the way this pair trades with the entire Brexit fiasco, which has been nice not to think about for quite some time. This has been going on for years, and still, here we are. I think at this point the overall consensus in the United Kingdom is that they are better off just simply leaving without any type of trade agreement because the European Union is sickly at best. It is because of this that I do not trust rallies in this pair, and it is worth noting that the Euro cannot seem to hang on to gains either, which may in fact point towards at least short-term US dollar strength. I think that fading rallies that show signs of weakness may continue to be the way in this pair, at least until we can convincingly break above the 1.30 handle above.