There is no doubt that the continued failure of trade negotiations between the European Union and Britain is an important factor for the continued pressure on the Pound in the currency market for years since the country voted to leave the bloc. Therefore, we always recommend selling the sterling from every ascending level. In the last two weeks, the most prominent performance was what we always expect, as the GBP/USD pair collapsed from its 2020 highs at the 1.3482 resistance to the 1.2762 support at the end of the week's trading before the close around the level of 1.2796. The pair still has a chance for more losses if the two Brexit sides stick to their current positions, which paves the way for the No-Deal Brexit by the end of this year 2020, which will be disastrous for everyone.

The new UK bill creates a mechanism and precedent by which the terms of the new EU Treaty and Northern Ireland Protocol can be overwritten, “clarified”, or rejected. Brussels was angered, along with the condemnation from some political figures and parts of the comments from Britain. Brussels' interpretation of the terms of the withdrawal agreement alarmed London and paved the way for a domestic and international political clash that threatened to disrupt trade talks with the European Union. The trade talks must end in time for any agreement to be ratified before December 31, 2020.

The European Union has called on the British government to drop or amend the bill and threaten to take legal action and a trade war, which may be little more than a new name for the

No-Deal” Brexit ". In general, the collapse of the relationship with the European Union and the sharp exit from the transitional period, which preserved all the advantages of membership except for some until December 31, 2020, will not only require the two sides to trade under the tariff of the most favorable country according to the World Trade Organization, as it can also be seen that Brussels is proactively trying to harm the British economy through changes in laws and regulations designed to compel European financial firms and other international financial firms to reduce their presence in London. The European Union’s attempts to undermine London have failed so far, but that does not mean that they will not succeed in the end to some extent, nor has it prevented the British Pound from worrying about the path of relations between them.

According to analysts, the Bank of America team says the markets have been "extremely satisfied" in assuming that "common sense will prevail" and will ultimately prevent an economic and political rift between the UK and the European Union before the end of the Brexit transition period ends on December 31, which imposed itself in mid-October as a deadline for reaching a free trade agreement. They noted that since the referendum, there has been a deterioration in the “liquidity conditions” that are closely related to the general level of trading activity within the sterling exchange rates and market participants' perceptions of the risks that come with dealing in the British pound.

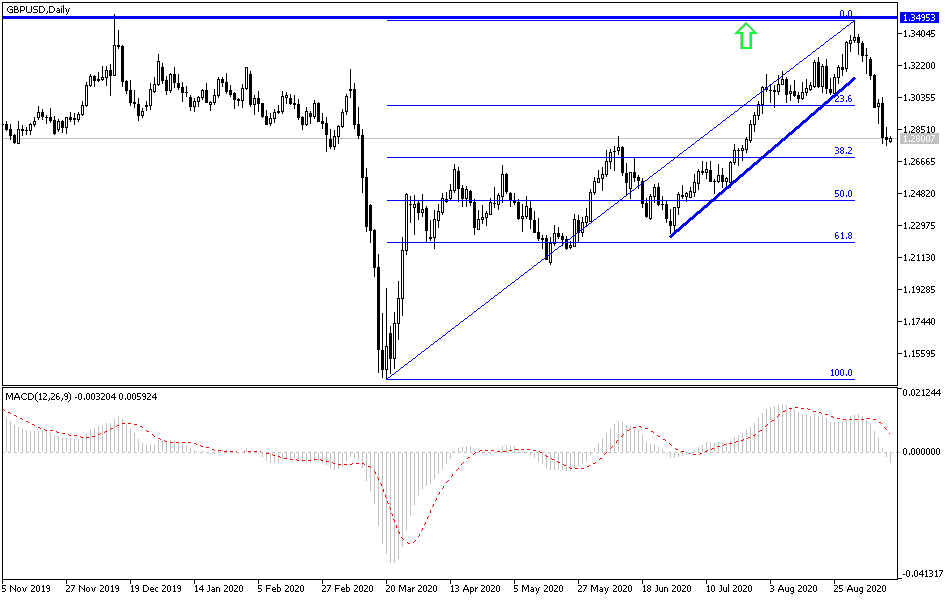

According to the technical analysis of the pair: The daily GBP/USD chart below confirms the strength of breaking the uptrend and turning the direction downward, and as we expected, the pair's selling increased since it abandoned the 1.3000 psychological support. The control of the bears over performance is still continuing despite technical indicators to reaching oversold areas, as the concern about the future of Brexit is still devastating for the pound against the rest of the other major currencies. The closest support levels for the pair are currently at 1.2755, 1.2680, and 1.2600, respectively. There will be no opportunity for the bulls to control the performance without returning to the 1.3250 resistance. The pair does not expect any important and influential economic data today, whether from Britain or the United States. The pair will only interact to the market’s reaction with the failure of the last round of Brexit negotiations and the path of global stock markets.