Contrary to last week’s performance, the GBP/USD currency pair started this week’s trading amid positive performance. It has moved towards the 1.2929 resistance from the 1.2750 support at the beginning of the session and stabilized around the 1.2860 at the time of writing. The Pound gained positive momentum against the rest of major currencies as a policymaker at the Bank of England played down the possibility of impending negative interest rates, and investors awaited the Brexit trade talks due to resume this week. Bank of England Deputy Governor Dave Ramsden said the slowdown in economic activity was less severe than initially expected in May. Accordingly, the British central bank expects that the country's GDP will recover steadily, despite the existence of real doubts and risks.

Strong data from China helped offset the escalating tensions between Beijing and Washington. Data from the National Bureau of Statistics showed that China's industrial profits grew for the fourth consecutive month in August.

The last official round of trade talks between the UK and the European Union kicked off ahead of next month's summit. Some progress has been reported, but the attempt to draft the text of an agreement still appears a long way off. Meanwhile, domestic issues remain prominent. First, Parliament may seek to seize more power from the British government in the face of pandemic response. Second, BoE member Tinero appears to have increased the likelihood of passing negative rates even though Governor Bailey appeared to have underestimated their value last week. The latest opinion polls put the Labour Party ahead of the Conservatives for the first time since Labour chose a new leader (Starmer) nearly six months ago.

From the US side, the highlight of this week is the September US employment report at the end of the week. This evening's presidential debate will draw attention even though the number of voters who declare themselves hesitant and the number of those who say they may be affected by the debate are nearing its historic lows, according to some polls. On the financial front, some observers believe that US Treasury Secretary Mnuchin and Speaker Pelosi could reach an agreement at the last minute. However, the odds appear to be in favor of a move after the election. Meanwhile, PredictIt.Org participants collectively see there is an 85% chance of confirming Supreme Court candidate Barrett before the presidential election.

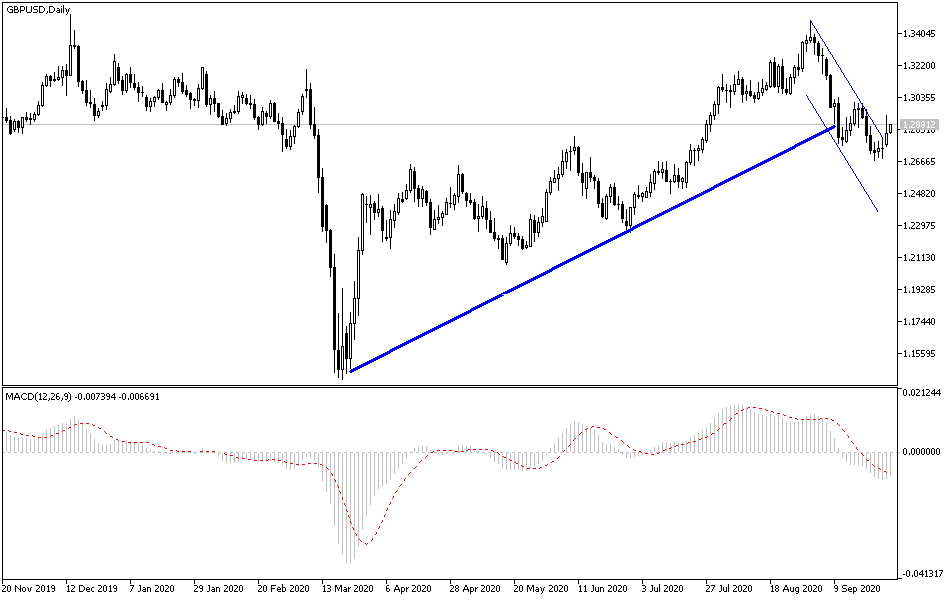

According to the technical analysis of the pair: On the GBP/USD daily chart, it seems clear that there is an attempt to break the descending channel, and that attempt will not succeed without the pair stabilizing above the 1.3000 resistance. I still expect more volatility and instability to the pair’s performance this week, as it will be subject to statements from both sides of Brexit about the performance of the ongoing negotiations before the final announcement on Friday. Stability below 1.2800 support will increase the bearish momentum to move towards lower levels. The closest ones are currently 1.2775, 1.2690, and 1.2600, respectively.

As for the economic calendar data today: From Britain, the money supply, mortgage approvals, and net lending to individuals will be announced. During the American session, the American consumer confidence will be announced. Then statements by several monetary policy officials from the US Central Bank.