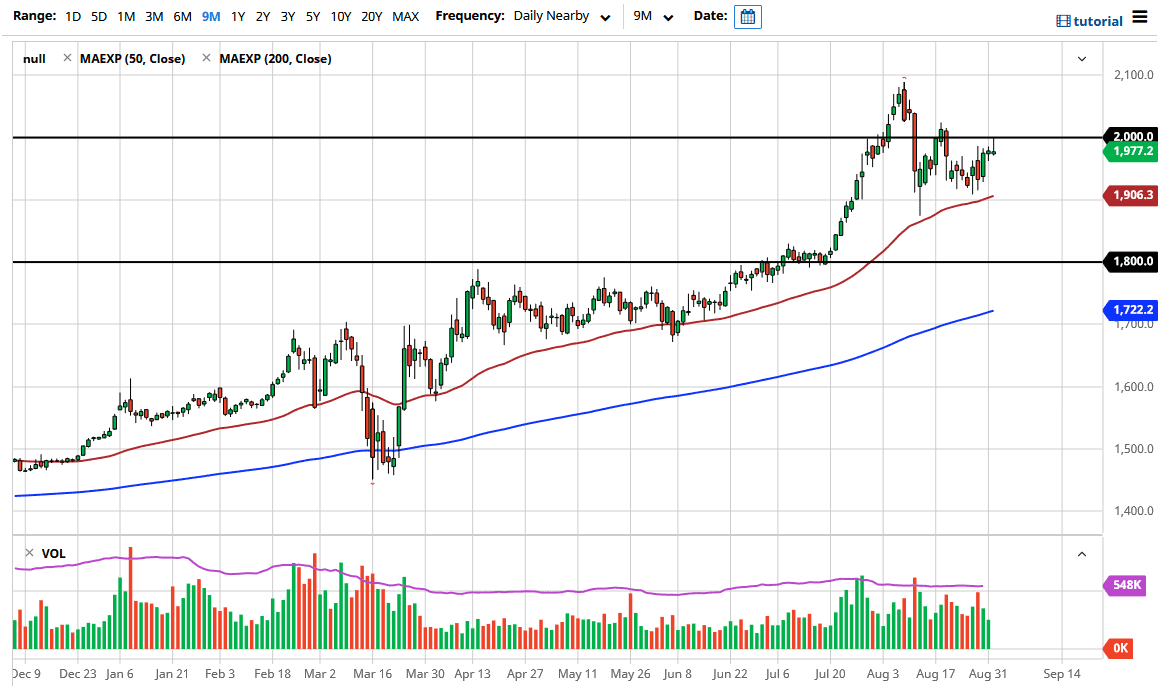

The gold markets initially tried to rally during the trading session on Tuesday but found the $2000 level to be a bit too resistive to continue and break out. The fact that we turned around and fell as hard as we did suggests that it is going to take a couple of attempts to clear the $2000 level finally. Once we do, that would be a very bullish sign and should send this market looking for the 2100 level given enough time. In the meantime, I do think that we are very likely to see a bit of back-and-forth, mainly because we had formed a hammer-like candlestick during the previous session, showing a major conflict of momentum.

The market breaking down below the lows of the Monday candlestick opens up the possibility of reaching down towards the $1950 level, and then eventually the $1900 level. We also have the 50 day EMA sitting at the $1906 level, and I think that will be something that people pay a lot of attention to. Ultimately, this is about the US dollar which did recover quite nicely during the trading session in New York, so that is part of what we have to pay attention to, as if the US dollar rallies, it will certainly work against the value of gold.

Nonetheless, the fundamental situation has not changed, and the Federal Reserve is likely to continue loosening monetary policy into the foreseeable future. If that is going to be the case, then gold eventually finds buyers and it will break out to the upside. I expect a lot of volatility, mainly because we have not only massive liquidity coming out of the Federal Reserve but we also have the job number on Friday so the later we get into the week, the more likely we are to see this market flex its muscles in both directions. If we were to break down below the $1900 level, then I would wait until we get closer to the $1800 level where I would be even more aggressively bullish. We are in a long-term cyclical trend to the upside in gold, but clearly, we are struggling in the short term. The question really does not come down to whether or not traders want to buy gold, it is all about the US dollar and what happens in the Forex markets going forward.