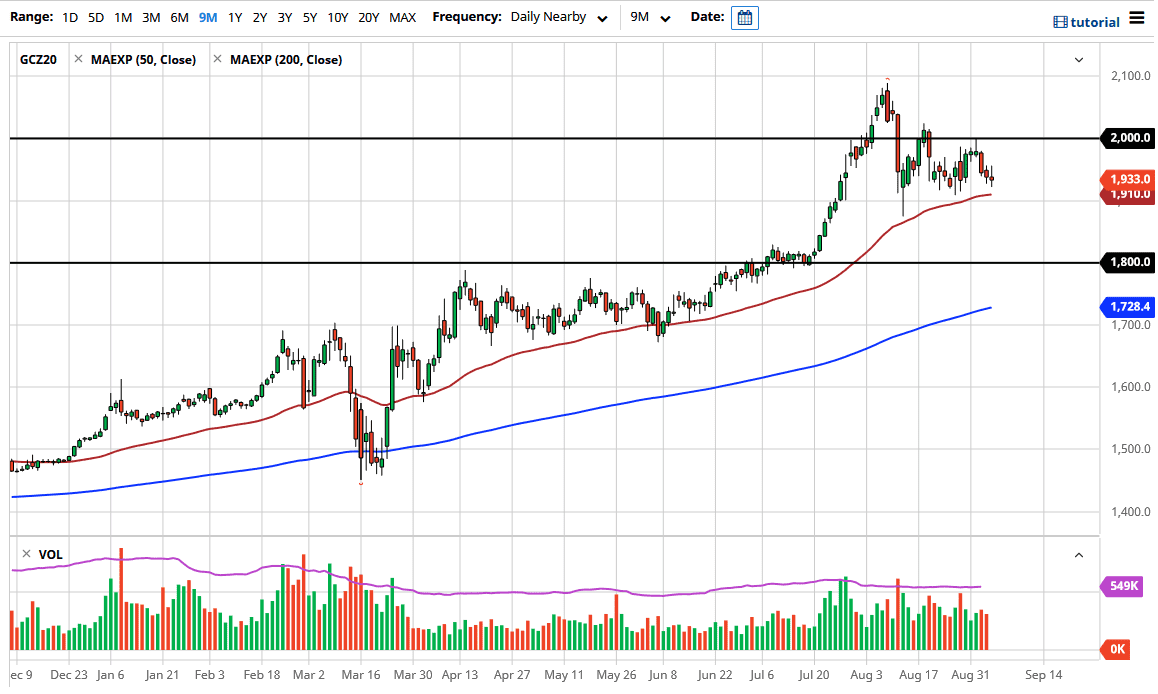

Gold markets went back and forth during the trading session on Friday, as you would expect. After all, the gold markets are highly sensitive to the US dollar and we have the jobs number coming out that moved the markets quite drastically. That being said, the market ended up forming a bit of a neutral candlestick, sitting just above the 50 day EMA. The 50 day EMA sits above the $1900 level, which is going to be very supportive.

The $1900 level is a large, round, psychologically significant figure, and a place where we have seen buyers in the past. I like the idea of buying some type of bounce from that level and looking at gold as being “cheap” in this general vicinity. However, the market breaks down below the $1900 level then I will “reset” and go looking towards the $1800 level underneath which was structural resistance in the past. Now that we are above that, it is likely that we see a lot of support in that general vicinity. I do like gold in general, because central banks around the world continue to flood the markets with liquidity and the US dollar has been beaten up. However, the US dollar is oversold so the question now is whether or not it strengthens and drives a price of gold lower, only to offer a nice buying opportunity?

If the market turns around and reaches towards the $2000 level, it should be massively resistant and if we can clear that area on a daily candlestick, then it is likely that we could go looking towards the $2100 level. The $2100 level would offer resistance based upon the fact that the recent high was put in there. If we can break above the $2100 level, then it is likely that the market goes even higher, perhaps reaching towards the $2500 level which is my longer-term call. As far as selling is concerned, I have no interest in doing so until we break down below the $1800 level, something that would take quite a bit of downward pressure. In general, this is a market that I think as plenty of crosscurrents, which is the US dollar, central bank printing, fear around the world when it comes to investing, and geopolitical tension between the United States and China.