Gold markets have rallied a bit during the trading session on Monday to kick off the week, as we have seen precious metals have a fairly strong day. Ultimately, this is a market that I think continues to see a lot of noise, because there are a lot of different things out there that are moving markets in general. The first thing to pay attention to is the US dollar, so if it starts to lose strength, we could see the gold market rally a bit. For what it is worth, the Monday session started to see US dollar strength late in the day, and gold did pull back just a bit.

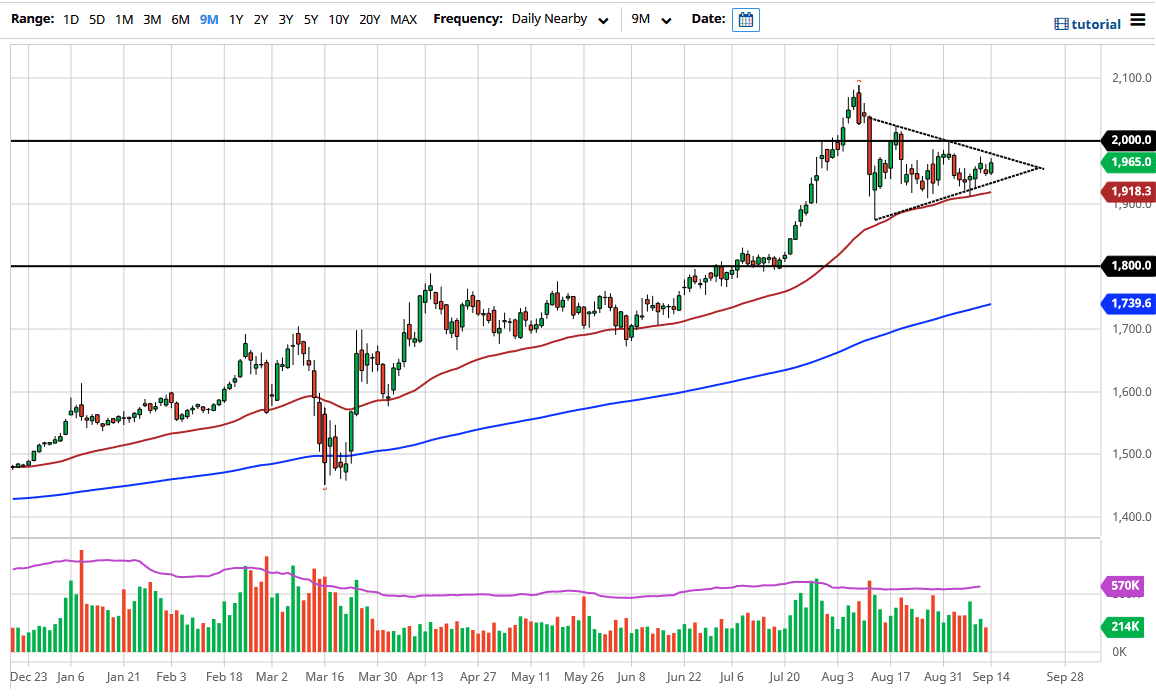

The market is forming a bit of a symmetrical triangle, and that is a consolidation area that is worth paying attention to. However, even if we do break to the upside and clear the triangle, the market would more than likely go looking towards the $2000 level. The $2000 level is a large, round, psychologically significant figure, and we have seen a lot of selling in that pressure-filled area a couple of times. This is why I believe that breaking above the $2000 level will probably be the signal that we are going much higher in more of a longer-term leg up in the market.

To the downside, there is an uptrend line and the 50 day EMA that comes into play. At this point, any type of bounce should be thought of as a buying opportunity, but even if we break down below here there is the $1900 level that should come into play, as it has been supportive in the past that it is a large, round, psychologically significant figure. After that, the market will more than likely see a lot of support at the $1800 level, which was the scene of a major breakout. I would actually start buying gold as rapidly as possible in that area unless something fundamentally changes. Gold is going to be used to protect wealth against fiat currencies, although we may see a little bit of weakness in the short term due to the US dollar strengthening in the short term. We are still very much in an uptrend, so that is without a doubt the most important thing to pay attention to. I think $2000 is going to continue to be a major barrier, but once it is behind the market, it should have a much easier way forward.