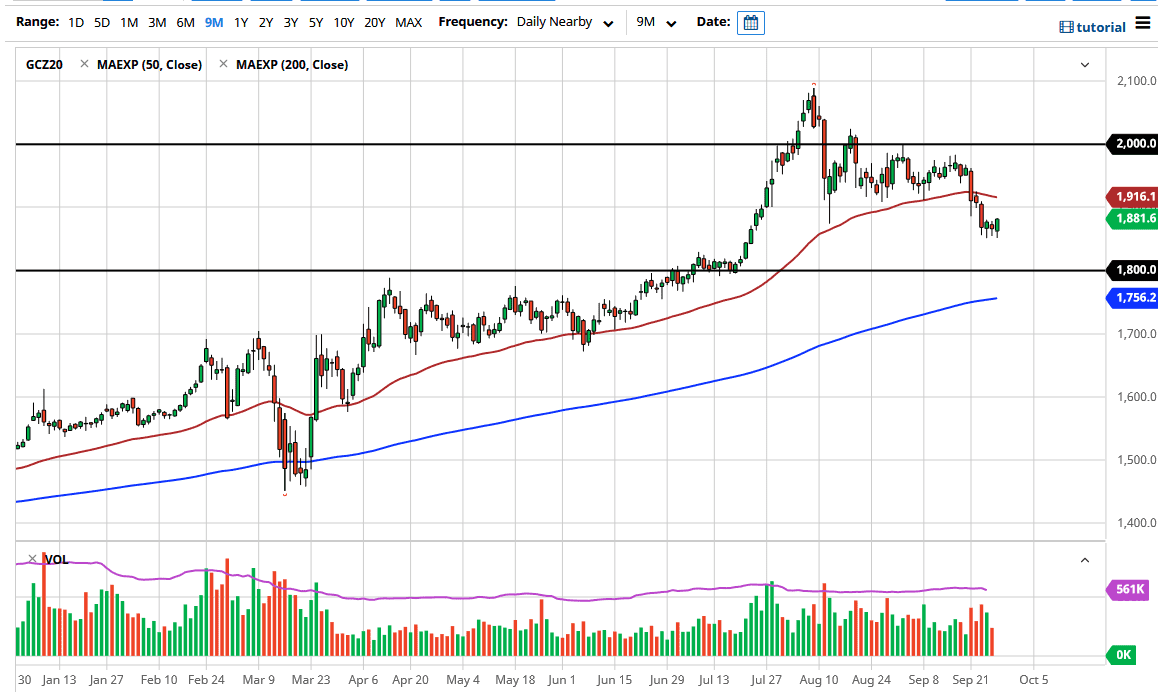

I do recognize that we are not at a major support level, so although I am bullish of gold from the longer-term, I do not necessarily know if I believe that this is where we are going to see the market turn around for good. The size of the candlestick is impressive in relation to the previous one, so it certainly seems as if we could move towards the $1900 level, possibly even the 50 day EMA which is at $1916 in the short term. Whether or not we can break above there is a completely different story, but it is worth noting that the US dollar is not exactly falling apart, so you do not necessarily have that tailwind that would be helpful.

That being said, it is not as if there is not a significant amount of concern out there when it comes to risk appetite, so that could propel gold higher as well. All things being equal, it is interesting to see that the gold market has proven itself to be somewhat resilient, so I do believe that it is only a matter of time before we rally again, but I think it makes a much more compelling argument down at the $1800 level, so I am much more interested in buying a dip that I trying to jump in with both feet and get aggressive here.

Having said all of that, the US Dollar Index breaks down rather significantly, then I might be compelled to start buying gold more aggressively. In the meantime, I suspect that we probably get plenty of short-term buying opportunities on dips, so there is no need to rush into this market. I think that the $1900 level will start a significant amount of psychological and structural resistance that the market may pull back from. Regardless, I have no interest in shorting gold so it is not necessarily a matter of whether or not I would be a seller, it has more to do with whether or not I am long or if I am sitting on the sidelines at that moment. I have no interest in shorting gold anytime soon, as I believe it is in a secular bull market.